Precap from SPAC Track

The Precap newsletter: SPAC Track’s morning recap of the action in the SPAC world for premium subscribers. (May 23, 2022)

The Stats:

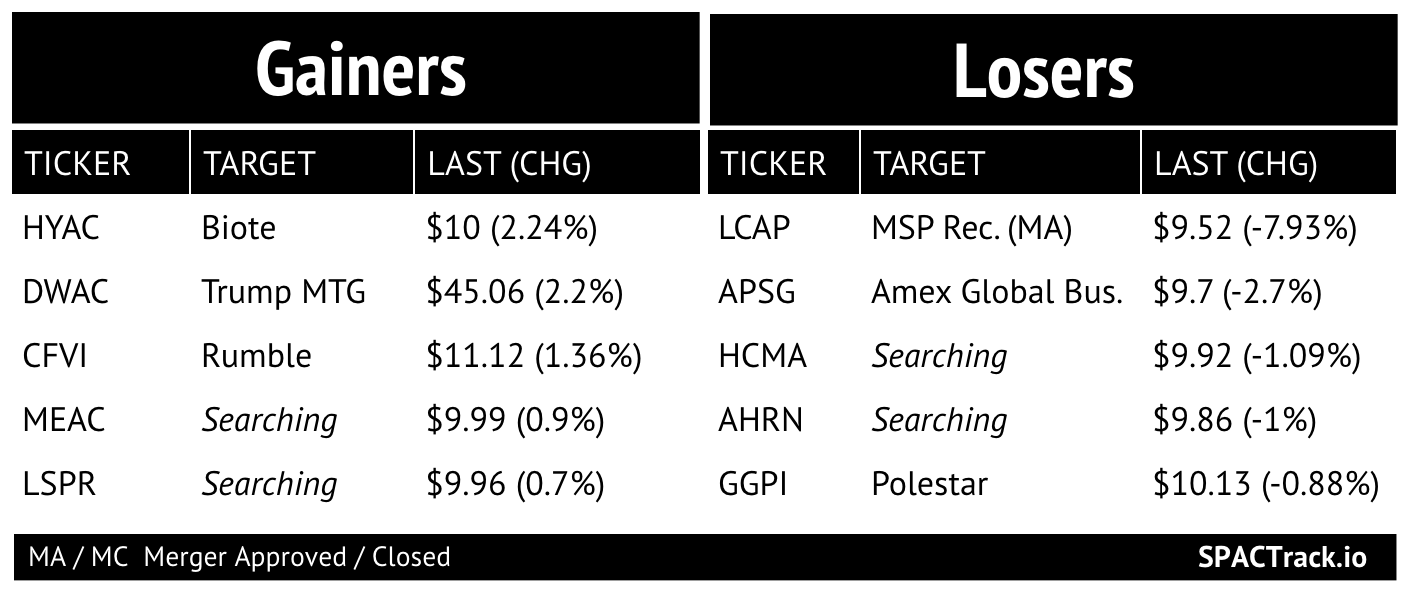

Pre-Market Movers:

APSG +1%, CFVI -1.1%

Previous Session Movers & Volume Leaders:

The Deals:

No new deals

News:

eToro targeting $1 billion funding round after SPAC stalls (Calcalist)

Calcalist has learned that while it continues to work to complete the SPAC merger, eToro is also in advanced stages of completing a massive private funding round of between $800 million and $1 billion. However, the valuation of the company in the round is set to only be around $5-6 billion.

eToro’s move is a testament to the current situation in the market in which investors are back in the driving seat, and while they are willing to invest massive sums, they will only do so at far lower valuations compared to recent years. Nevertheless, should this round be completed, it will be the biggest ever private funding series for an Israeli tech company.

According to the original agreement, the SPAC merger was supposed to result in $300 million-worth of secondary deals that were set to enter the pockets of shareholders rather than the company’s account. The potential upcoming funding round is also set to include secondary deals valued in the hundreds of millions.

The Betsy Cohen-backed blank-check company FinTech Acquisition Corp V which was set to merge with eToro already announced back in January that the fintech company’s valuation has been cut by over 15% to $8.8 billion.

The SPAC said in a regulatory filing at the time that the companies will not be able to meet the required closing conditions for the deal by Decr 31 and hence had extended the deadline to June 30, 2022.

Since signing the agreement with the SPAC back in March 2021, eToro’s related costs already reached $75 million in 2021, mostly due to payments to accountants, lawyers, bankers, etc. This is a significant expense that already hurt the company's profitability last year and was among the factors that saw it suffer a loss in the third quarter.

Also see:

eToro SPAC merger likely to be canceled (Globes)

Trump’s commerce secretary Ross plots £700m merger with UK’s Atom Bank [Ross Acquisition Corp II (ROSS)] (Sky News)

Updates:

Lionheart Acquisition Corporation III (LCAP) announces the closing is expected for today, May 23rd, and the warrant ratio details:

holders will receive one share of Class A Common Stock traded under “MSPR” and the right to receive New Warrants in an amount equal to the product of (a) the number of Continuing Shares held multiplied by (b) 118.109463483458 (the “New Warrant Ratio”), to be issued as soon as practicable following the Closing, which is currently estimated to be 10 days following the Closing

the warrants will trade as MSPRZ

Gores Holdings VIII, Inc. (GIIX) and Footprint amend the merger agreement to among other things, reduce the PIPE to $285.55M to account for the Class C Financing raised by Footprint — $25M from Koch and the changing of “Closing Parent Cash” from to $150M to $175M

Tiga Acquisition Corp. (TINV) extends deadline to 11/27/22 by depositing funds from private placement warrant sale to the sponsor into trust

New SPACs (S-1s):

1) SK Growth Opportunities Corporation (SKGR)

$200M, 1/2 Warrant

Focus: Tech addressing ESG-related issues

Sponsor: SK

Directors:

John Boenhner (Former Speaker of the U.S. House of Representatives), Michael Noonen (Director of SES.ai)

Underwriter: Deutsche Bank Securities

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

Effective:

Alpha Tau Medical (DRTS)

S-4 Activity:

S-4:

Cohn Robbins Holdings Corp. (CRHC) & Allwyn Entertainment

S-4/A:

AEA-Bridges Impact Corp. (IMPX) & LiveWire (2nd amendment)

Gores Guggenheim, Inc. (GGPI) & Polestar (8th amendment)

Effective:

EJF Acquisition Corp. (EJFA) & Pagaya Technologies

Upcoming Dates:

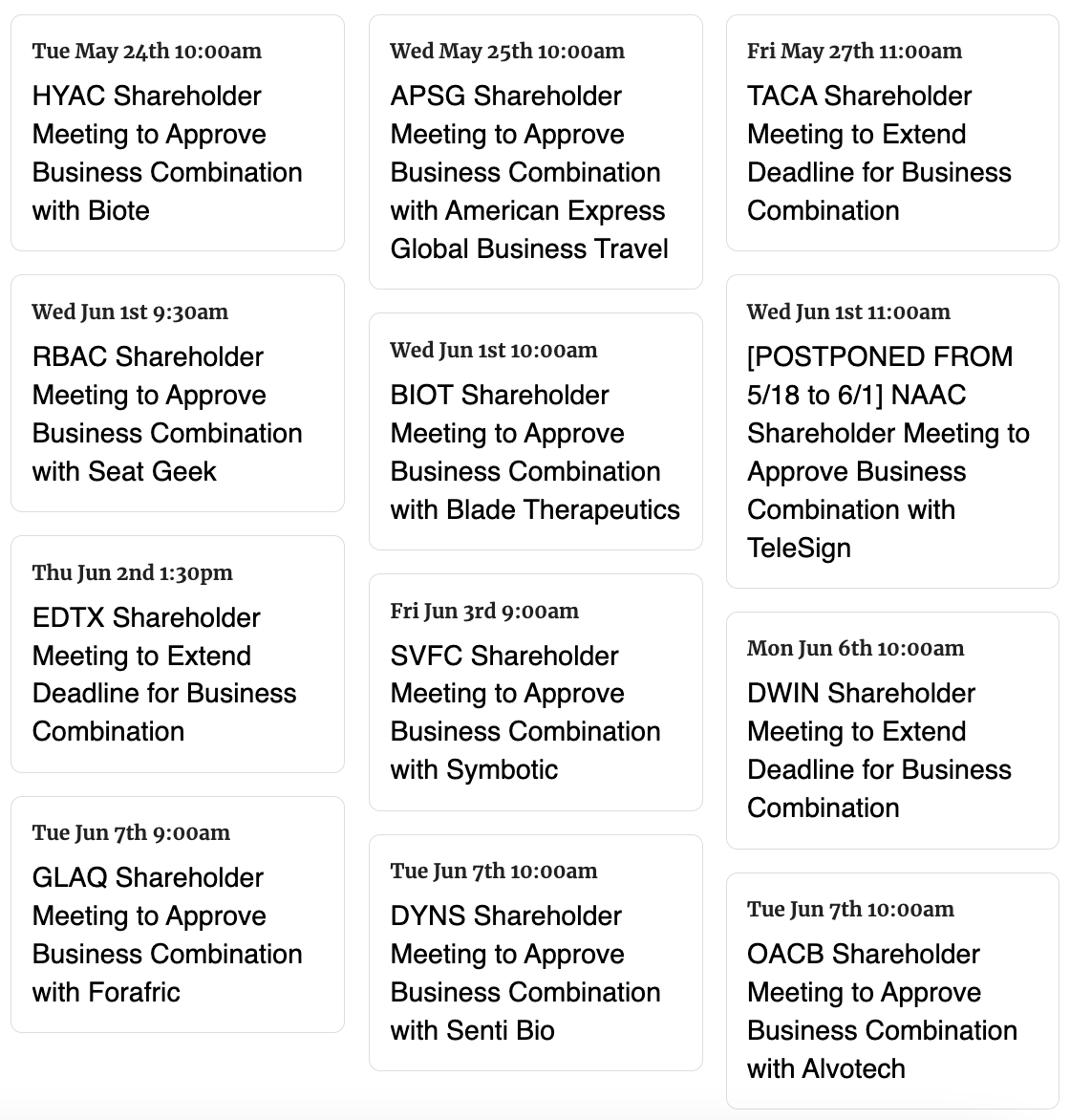

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

SPAC Track Pro Notes:

Please note that a list of all the data points available on the Pro Screener with download eligibility can be found here: spactrack.io/screener-instructions

Thanks for reading,