Precap from SPAC Track

The Precap newsletter: SPAC Track’s morning recap of the action in the SPAC world for premium subscribers. (March 24, 2022)

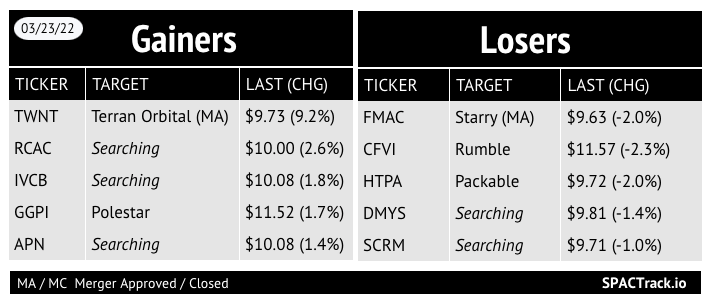

The Stats:

Pre-Market Movers:

HTPA -2.3%, TWNT +2.3%

Yesterday’s Movers and Volume Leaders:

The Deals (1):

Yesterday afternoon deal:

1) Avista Public Acquisition Corp. II (AHPA) & OmniAb (subsidiary of Ligand) (warrants +60% pre-market)

Merger Partner Description:

The OmniAb discovery platform provides pharmaceutical industry partners with access to diverse antibody repertoires and high-throughput screening technologies to enable discovery of next-generation therapeutics. At the heart of the OmniAb platform is the Biological Intelligence (BI) of our proprietary transgenic animals, including OmniRat, OmniChicken and OmniMouse, which have been genetically modified to generate antibodies with human sequences to facilitate development of human therapeutic candidates. OmniFlic (transgenic rat) and OmniClic (transgenic chicken) address industry needs for bispecific antibody applications though a common light chain approach, and OmniTaur features unique structural attributes of cow antibodies for complex targets. OmniAb animals comprise the most diverse host systems available in the industry and they are optimally leveraged through computational antigen design and immunization methods, paired with high-throughput microfluidic-based single B cell screening and deep computational analysis of next-generation sequencing datasets to identify fully human antibodies with superior performance and developability characteristics. An established core competency focused on ion channels and transporters further differentiates our technology and creates opportunities to further leverage across modalities, including antibody-drug conjugates and others. The OmniAb suite of technologies and differentiating computational capabilities and BI features are combined to offer a highly efficient and customizable end-to-end solution for the growing discovery needs of the global pharmaceutical industry.

Valuation: $1.5B EV

PIPE & Additional Financing: $15M & $100M redemption backstop from Avista, and a $15M contribution from Ligand

Updates:

Brilliant Acquisition Corporation (BRLI) shareholders approved the extension proposal, pushing the deadline to 7/23

633k shares were redeemed, leaving $41.5M in trust

$0.16 per share was deposited, increasing the trust per share to $10.46

IPOs*:

1) RF Acquisition Corp. Announces Pricing of $100 Million Initial Public Offering (RFAC-U)

*Announced pricing at the time of this writing

New SPACs (S-1s):

No new S-1s

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

S-1:

Rigetti Computing (RGTI)

Super Group (SGHC) Limited (SGHC)

S-4 Activity:

S-4/A:

SVF Investment Corp. 3 (SVFC) & Symbotic (1st amendment)

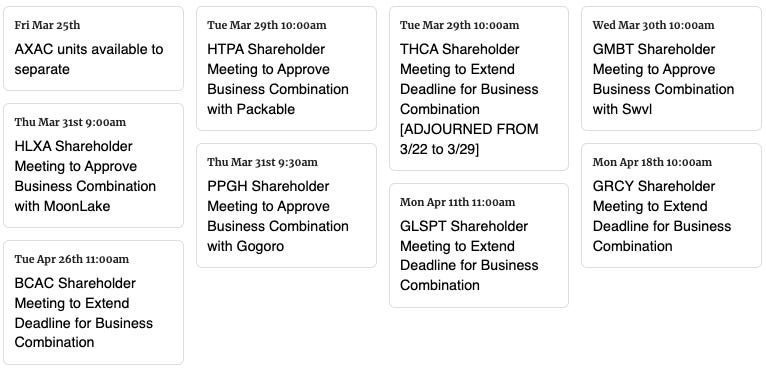

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

Notes:

New Data Points and Filters have been added to the Pro Screener as of 3/16. A list of all the data points available on the Pro Screener with download eligibility can be found here: spactrack.io/screener-instructions

Thanks for reading,