Precap from SPAC Track

The Precap newsletter: SPAC Track’s morning recap of the action in the SPAC world for premium subscribers. (March 22, 2022)

The Stats:

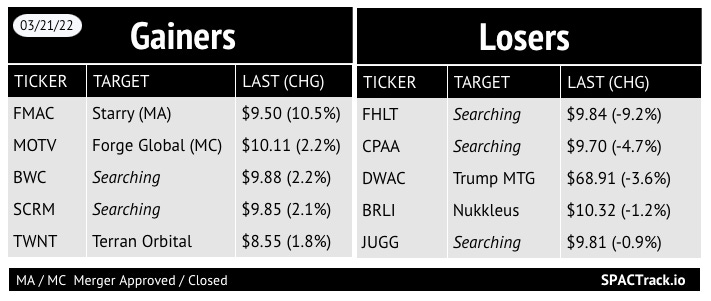

Pre-Market Movers:

THCP +2%, CFVI -1.1%

Yesterday’s Movers and Volume Leaders:

The Deals (1):

1) Thunder Bridge Capital Partners IV, Inc. (THCP) & Coincheck, Inc. (subsidiary of Monex Group)

Merger Partner Description:

Coincheck, Inc. operates “Coincheck”, a digital asset trading service with the highest number of app downloads in Japan* for three consecutive years, and over 1.5 million verified accounts**.

With the mission of “making the exchange of new values, more accessible”, the company continues to develop new products and services based on emerging technologies and advanced security, giving users comfort and familiarity with the “exchange of new values” that is enabled by digital assets and blockchain.

** Period: From January 2019 to December 2021

Valuation: $1.25B transaction value

No PIPE

News:

FTX Invests $100M in Banking App Dave (DAVE), Forms Partnership for Crypto Payments (CoinDesk)

Koch Industries, Built on Oil, Bets Big on U.S. Batteries (WSJ)

Updates:

Motive Capital Corp (MOTV) and Forge Global announce the completion of the business combination. Will begin trading as FRGE today

The transaction raised appx. $215.6M in gross proceeds

Ackrell SPAC Partners I Co. (ACKIT) deposits $0.10 per share, extending its deadline to 6/23/22

New SPACs (S-1s):

No new S-1s

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

No activity

S-4 Activity:

S-4/A:

Adit EdTech Acquisition Corp. (ADEX) & Griid Infrastructure (1st amendment)

Apollo Strategic Growth Capital (APSG) & American Express Global Business Travel (2nd amendment)

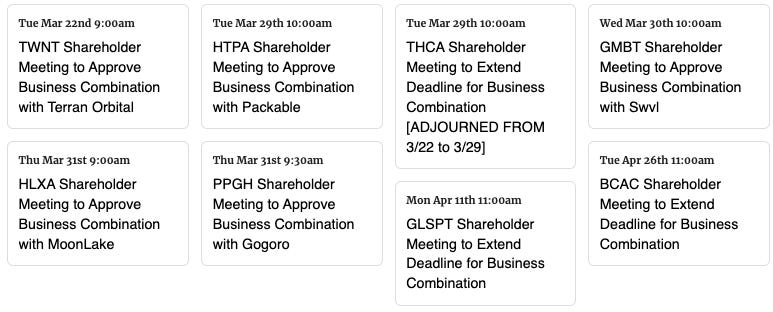

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

SPAC Track Pro Updates:

New Data Points and Filters have been added to the Pro Screener as of 3/16:

Data Points in the Default View and SPAC Details View:

NAV (Trust per share) from proxy filing, Date of filing used for Trust per Share, Link to relevant filing

Data Points in the SPAC Details View:

Upcoming extension vote date, extension vote link, extension vote redemption date, extension vote ex. redemption date

New De-SPAC Filters:

Completed in 2022, Redemption Levels (<50%, 50%+, 75%+, 90%+), Post-closing S-1 effective

**Please note that a list of all the data points available on the Pro Screener with download eligibility can be found here: spactrack.io/screener-instructions

Thanks for reading,