Precap from SPAC Track

The Precap newsletter: SPAC Track’s morning recap of the action in the SPAC world for premium subscribers. (May 18, 2022)

The Stats:

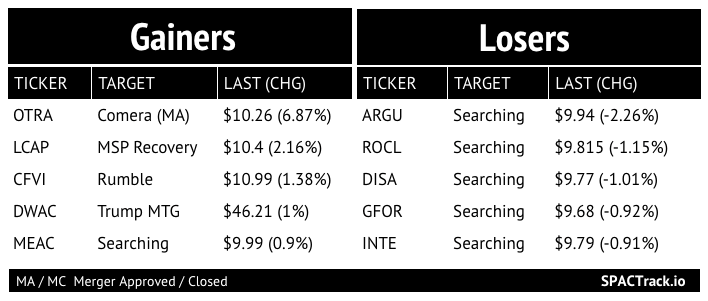

Pre-Market Movers:

OTRA -5.6%, AGCB -1.3%, NAAC +3.1%, THCA +2.9%

Previous Session Movers & Volume Leaders:

The Deals (1):

1) Tuscan Holdings Corp. II (THCA) & Surf Air Mobility (warrants +59.5% pre-market)

Surf Air Mobility is a Los Angeles-based electric aviation and air travel company reinventing flying through the power of electrification. The company will bring electrified aircraft to market at scale in order to substantially reduce the cost and environmental impact of flying. The management team has deep experience and expertise across aviation, electrification, and consumer technology. Surf Air Mobility is the parent company of Surf Air Inc, and has entered into a definitive agreement to merge with Southern Airways Corporation.

Valuation: $1.42B Pro-forma Enterprise Value

“The transaction is expected to provide up to $467 million in gross cash proceeds to SAM, including committed capital from strategic and financial investors including iHeartMedia, and Partners For Growth, and an equity line from Global Emerging Markets (GEM), as well as THCA’s cash in trust” (~$27M remaining estimated in trust)

News:

Turkish Bike-Riding App Marti to List in New York Via SPAC (Bloomberg)

Turkey’s electric scooter and bike-sharing app Marti is preparing to go public in New York through a merger with a blank-check company, according to people with knowledge of the matter.

Marti Ileri Teknoloji AS will merge with a special purpose acquisition company -- Galata Acquisition Corp. (GLTA) -- that raised $125 million in a listing on the New York Stock Exchange last year, said the people who asked not to be named because the plan is confidential. The deal is expected to finalize this year, the people said.

Carousell, L Catterton SPAC Merger Talks End Amid Rout (Bloomberg)

Updates:

OTR Acquisition Corp. (OTRA) “expects that as of immediately prior to the closing of the Business Combination, there will be between 452,987 and 1,428,587” public SPAC shares remaining following the redemption withdrawal window, which closed yesterday

Merger vote set:

Tuatara Capital Acquisition Corporation (TCAC) & Springbig (6/9)

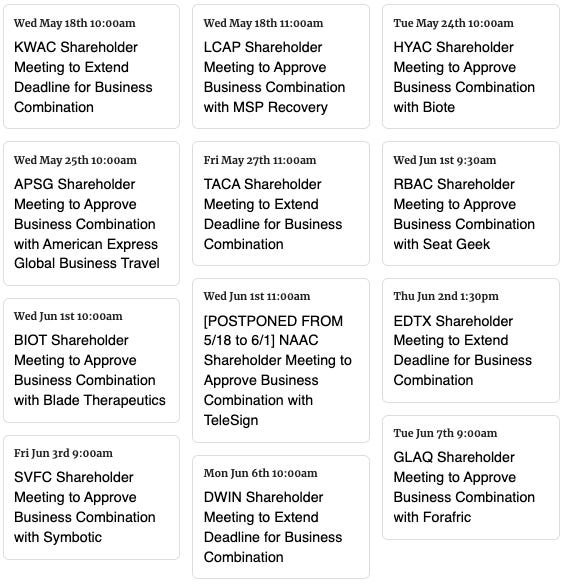

North Atlantic Acquisition Corporation (NAAC) postpones the shareholder meeting to approve its merger with Telesign from May 18 to June 1.

New SPACs (S-1s):

No new S-1s

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

No activity

S-4 Activity:

S-4/A:

Ackrell SPAC Partners I Co (ACKIT) & Blackstone Products (2nd amendment)

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

SPAC Track Pro Notes:

Please note that a list of all the data points available on the Pro Screener with download eligibility can be found here: spactrack.io/screener-instructions

Thanks for reading,