Precap from SPAC Track

The Precap newsletter: SPAC Track’s morning recap of the action in the SPAC world for premium subscribers. (March 17, 2022)

The Stats:

Pre-Market Movers:

MTAL +3.3%, TBCP +2.5%, TWNT -4.7%, DWAC -1.4%, CFVI -1.3%

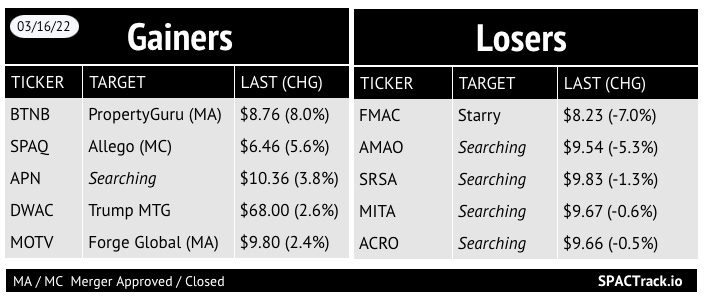

Yesterday’s Movers and Volume Leaders:

The Deals:

1) Metals Acquisition Corp. (MTAL) & CSA Copper Mine (Glencore subsidiary)

Merger Partner Description:

CSA is a producing, high-grade, long-life, underground copper mine located in the Tier 1 mining jurisdiction of western New South Wales, Australia. CSA has been in operation since 1967 and has a strong ESG track record.

Purchase price of:

$1.1B, of which Glencore will subscribe for $50m of equity; plus

a 1.5% copper net smelter royalty to Glencore,

News:

Neuberger Berman Raises $1.95 Billion to Co-Sponsor SPACs (WSJ)

Asset manager Neuberger Berman has collected $1.95 billion for a debut fund to sponsor special-purpose acquisition companies, or SPACs, alongside CC Capital Partners, a private investment firm formed and led by ex- Blackstone Inc. dealmaker Chinh Chu.

An affiliate of Koch Industries anchors the vehicle, called Neuberger Berman Opportunistic Capital Solutions Fund, a spokesman for the company confirmed. The fund had an initial target of $1.5 billion, a February 2020 regulatory filing shows.

Neuberger and CC Capital agreed in 2020 to form a series of SPACs with the new fund acting as a co-sponsor with CC Capital. SPACs—also known as blank-check companies—begin as shell organizations formed to raise capital through an initial public offering to invest in private businesses and bring them public in what is often called a reverse merger.

Chinh Chu, the chief executive and a director of all three SPACs formed under the agreement so far, is the founder and senior managing partner of CC Capital, which he started after leaving Blackstone in 2015. Over about 25 years at Blackstone, he rose to senior managing director and led investments across multiple sectors. Since then, CC Capital’s website says he has led several earlier SPACs, including the ones that brought public snack food company Utz Brands and insurer FGL Holdings.

Updates:

Spartan Acquisition Corp. III (SPAQ) and Allego announce the closing of the business combination. Will begin trading as ALLG today

The transaction raised appx $161M in gross proceeds, including a $150M PIPE, indicating a potential estimated ~98% redemption rate

First Reserve Sustainable Growth Corp. (FRSG) and EO Charging mutually agree to terminate their merger due to unfavorable market conditions

“FRSG intends to continue to pursue the consummation of a business combination with an appropriate target”

IPOs:

1) Goldenstone Acquisition Limited Announces Pricing of $50 Million Initial Public Offering (GDST-U)

New SPACs (S-1s):

No new S-1s

Registration Withdrawal

Silverman Acquisition Corp I (SACQ)

ACI Corp. III (ACCC), Atlas Crest Investment Corp. IV (ACIV)

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

S-1 filings:

BRC Inc. (Black Rifle Coffee Company) (BRCC)

S-4 Activity:

S-4 filings:

Edoc Acquisition Corp. (ADOC) & Calidi Biotherapeutics

S-4/A:

ACE Convergence Acquisition Corp (ACEV) & Tempo Automation

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

SPAC Track Pro Updates:

New Data Points and Filters have been added to the Pro Screener as of 3/16:

Data Points in the Default View and SPAC Details View:

NAV (Trust per share) from proxy filing, Date of filing used for Trust per Share, Link to relevant filing

Data Points in the SPAC Details View:

Upcoming extension vote date, extension vote link, extension vote redemption date, extension vote ex. redemption date

New De-SPAC Filters:

Completed in 2022, Redemption Levels (<50%, 50%+, 75%+, 90%+), Post-closing S-1 effective

**Please note that all of the Pro data points on the Pro Screener along with which table “view” and download eligibility can be found here: spactrack.io/screener-instructions

Thanks for reading,