Precap from SPAC Track

The Precap newsletter: SPAC Track’s morning recap of the action in the SPAC world for premium subscribers. (Feb 15, 2022)

FYI: All the Pro data points on the Pro Screener along with which table “view” and export eligibility can be found here: spactrack.io/screener-instructions

The Stats:

Pre-Market Movers:

CFVI +3.1%, GGPI +1.63%, HUGS +1.1%

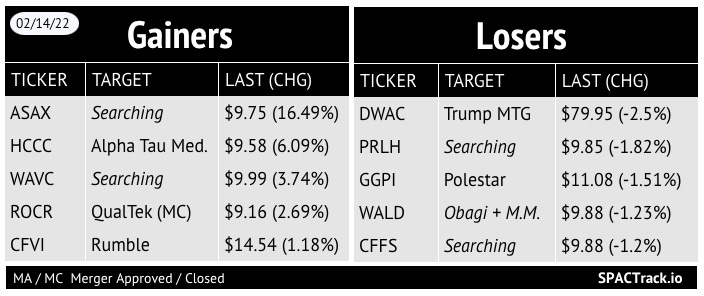

Yesterday’s Movers and Volume Leaders:

The Deals:

Monday afternoon deal:

1) Software Acquisition Group Inc. III (SWAG) & Nogin

Merger Partner Description:

Nogin delivers Commerce as a Service to leading brands in the fashion, CPG, beauty, health, and wellness industries. The Company's Intelligent Commerce product is a full-stack eCommerce platform that includes R&D, sales optimization, and machine learning, along with artificial intelligence-driven marketing and fulfillment. Known for helping global brands keep pace with big retail and drive predictable profitability, Nogin partners with clients to take the eCommerce operation, team, and data from the ground up—typically in less than 90 days.

Valuation: $646M EV

No PIPE

News:

Warburg and Barry Sternlicht Partnering on Jumbo, 3-Way SPAC Deal

Buyout firm Warburg Pincus and property billionaire Barry Sternlicht are partnering up in a rare, three-way, blank-check deal worth about $20 billion to take a security services firm public. In another unusual twist, Warburg Pincus already owns the target.

Three special purpose acquisition companies -- two backed by Warburg Pincus, and one backed by Sternlicht -- are in talks to merge with Allied Universal, according to people familiar with the matter, in what would be the first SPAC deal involving more than one of the popular investment vehicles.

Warburg Pincus Capital Corp I-A (WPCA), Warburg Pincus Capital Corp I-B (WPCB) and a SPAC affiliate of JAWS Estates Capital LLC, Sternlicht’s family office, are discussing raising a so-called private investment in public equity, or PIPE, to support a transaction with Allied Universal, the people said. A deal, which has been in negotiations for months, hasn’t been finalized, and terms could change or talks could fall apart. The people asked not to be identified because the discussions aren’t public.

A representative for Warburg Pincus declined to comment. A representative for Sternlicht didn’t immediately respond to a request for comment.

The deal illustrates how SPAC dealmakers are getting increasingly creative as the merger vehicles begin falling out of favor after booming in popularity for the past two years. A number of SPAC deals have fallen apart in recent months while other companies that went public via blank-check deals have plunged in value.

This deal would create a pathway to an exit for Warburg Pincus’s investment in Allied Universal, which describes itself as having the largest security force in North America. Warburg Pincus in 2015 agreed to take a majority stake in Universal Services of America, and later combined it with AlliedBarton Security Services.

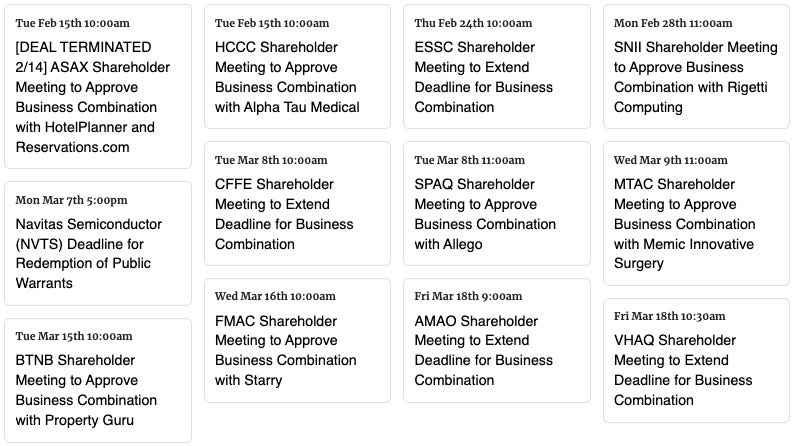

Merger Votes/ Completions:

Inspirato (ISPO) released redemption information from its merger with Thayer Ventures Acquisition Corp (TVAC)

17M shares were redeemed (an estimated ~97% of public shares)

Energy Vault (NRGV) released redemption information from its merger with Novus Capital Corporation II (NXU)

24M shares were redeemed (an estimated ~86% of public shares)

Merger Votes Set:

MedTech Acquisition Corporation (MTAC) & Memic Innovative Surgery (3/9)

Highland Transcend Partners I Corp. (HTPA) & Packable (3/29)

Helix Acquisition Corp. (HLXA) & MoonLake Immunotherapeutics (3/31)

Bridgetown 2 Holdings Limited (BTNB) & PropertyGuru (3/15)

FirstMark Horizon Acquisition Corp. (FMAC) & Starry (3/16)

Tailwind Two Acquisition Corp. (TWNT) & Terran Orbital (3/22)

Extensions:

EDOC Acquisition Corp. (ADOC) shareholders approved the extension to 8/12/22 with 6.3M shares redeemed

Other Updates:

Astrea Acquisition Corp. (ASAX), HotelPlanner and Reservations.com Mutually Agree to Terminate Business Combination Agreement

Jagdeep Singh, Founder & CEO of QuantumScape (QS) resigns from the board of Khosla Ventures Acquisition Co. (KVSA)

IPOs*:

1) Genesis Unicorn Capital Corp. Announces Pricing of $75,000,000 Initial Public Offering (GENQ-U)

2) A SPAC I Acquisition Corp. Announces Pricing of $60 Million Initial Public Offering (GENQ-U)

*Announced pricing as of this writing

New SPACs (S-1s):

No new S-1s

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

S-1 filings:

SES AI (SES)

Energy Vault (NRGV)

Anghami (ANGH)

Effective:

QualTek (QTEK)

GreenLight Biosciences (GRNA)

*When applicable

S-4 Activity:

S-4 filings:

Waldencast Acquisition Corp. (WALD) & Obagi & Milk Makeup

Social Capital Suvretta Holdings Corp. I (DNAA) & Akili Interactive

Dynamics Special Purpose Corp. (DYNS) & Senti Bio

CF Acquisition Corp. VI (CFVI) & Rumble

Software Acquisition Group Inc. III (SWAG) & Nogin

InterPrivate III Financial Partners Inc. (IPVF) & Aspiration

CHP Merger Corp (CHPM) & Accelus

S-4/A filings:

Bright Lights Acquisition Corp. (BLTS) & MANSCAPED (1st amendment)

Archimedes Tech Spac Partners Co (ATSPT) & SoundHound (1st amendment)

Alberton Acquisition Corp (ALAC) & SolarMax Technology (6th amendment)

Duddell Street Acquisition Corp. (DSAC) & FiscalNote (2nd amendment)

FoxWayne Enterprises Acquisition (FOXW) & Aerami Therapeutics (1st amendment)

Effective:

Tailwind Two Acquisition Corp. (TWNT) & Terran Orbital

Motive Capital Corp (MOTV) & Forge Global

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

Thanks for reading,