Romeo finds a suitor in Nikola

Web3, another scooter deal, and Nikola goes shopping in this edition of the Morning Recap, the pre-market recap for SPAC Track Pro subscribers.

Good Morning,

We have a double merger Monday with scooters and Web3 taking center stage. Also, in De-SPAC merger news, two from the 2020 vintage get together as Nikola [$NKLA] announced an acquisition of battery maker Romeo Power [$RMO] at $0.74 per share or down about 95% from its SPAC valuation. Romeo completed its SPAC merger in December of 2020.

Previous Session Stats

Gainers & Losers

Volume Leaders

News & De-SPAC Updates

Nikola [$NKLA] enters into an agreement to acquire Romeo Power [$RMO] “To Bring Battery Pack Engineering and Production In-House” in an all-stock transaction that values RMO at $0.74 per share or $144M (a ~34% premium to RMO’s July 29 closing price) (PR)

Playtech Scraps Caliente Interactive SPAC Merger Plan- Sky News reported back in December of last year that Tekkorp Digital [$TEKK] was in advanced talks to merge with Caliente in a $2.5B deal

The Deals

1) Galata [$GLTA] & Marti

Founded in 2018, Marti is Turkey’s leading mobility app, operating a fleet of over 46,000 e-mopeds, e-bikes, and e-scooters, serviced by proprietary software systems and IoT infrastructure.

Valuation: $532M Pro-forma Enterprise Value

2) Social Leverage I [$SLAC] & W3BCLOUD

Founded in 2018, W3BCLOUD provides storage and compute infrastructure to power Web3’s decentralized economy. With today’s transaction, W3BCLOUD aims to accelerate its investment in its platform to drive adoption by the blockchain developer community. Additionally, the company expects to benefit from emerging Web3 use cases such as Web3-enabled gaming, NFTs, DeFi, and the Metaverse, to further reinforce its position as a leading Web3 infrastructure provider and diversify revenue.

Valuation: $1.25B Pro-forma Enterprise Value

SPAC Updates

Liquidations

New Liquidation: RedBall [$RBAC], effective 8/11 with a $10.02 liquidation price (PR)

Merger Votes / Completions

Completion: Brookline Capital (BCAC) & Apexigen [$APGN]

The transaction raised gross proceeds of $19M including $4.5M from the trust account and $14.5M of the expected $15M PIPE

Ticker change to APGN today

Deal Updates

As part of the merger with Tempo Automation, ACE Convergence [$ACEV], was to use the proceeds to acquire Compass AC Holdings (Advanced Circuits) and Whizz Systems. ACEV received a termination letter from the parent company of Compass. ACEV, Tempo Automation, and Whizz, however, are continuing to pursue the merger and expect to consummate the merger in Q3 (SEC)

PIPE Down: Mountain Crest III [$MCAE] and SME Investment Group terminated SME’s $250M PIPE commitment in connection with MCAE’s merger with ETAO International (SEC)

Extensions

LMF Acquisition Opportunities [$LMAO] elects to extend its deadline from 7/29 to 10/29 by depositing $0.10 per public share into trust (PR)

Registrations

New S-1s

No new S-1s

Registration Withdrawals

Catcha Investment Corp 2.0 (CHAB)

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

Key Filings

SPAC S-4 Activity

S-4/A

Cohn Robbins [$CRHC] & Allwyn Entertainment

*Latest S-4 filings are found in the “Deal Details” view under the column “S-4 Link”

De-SPAC/ Post-Merger S-1s

S-1

FaZe Holdings [$FAZE]

S-1/A

Eve Holding [$EVEX]

Effective

*including PIPE resale registrations where applicable — latest post-merger S-1 filings are found in the “De-SPAC" view under the column “Post-Close S-1”

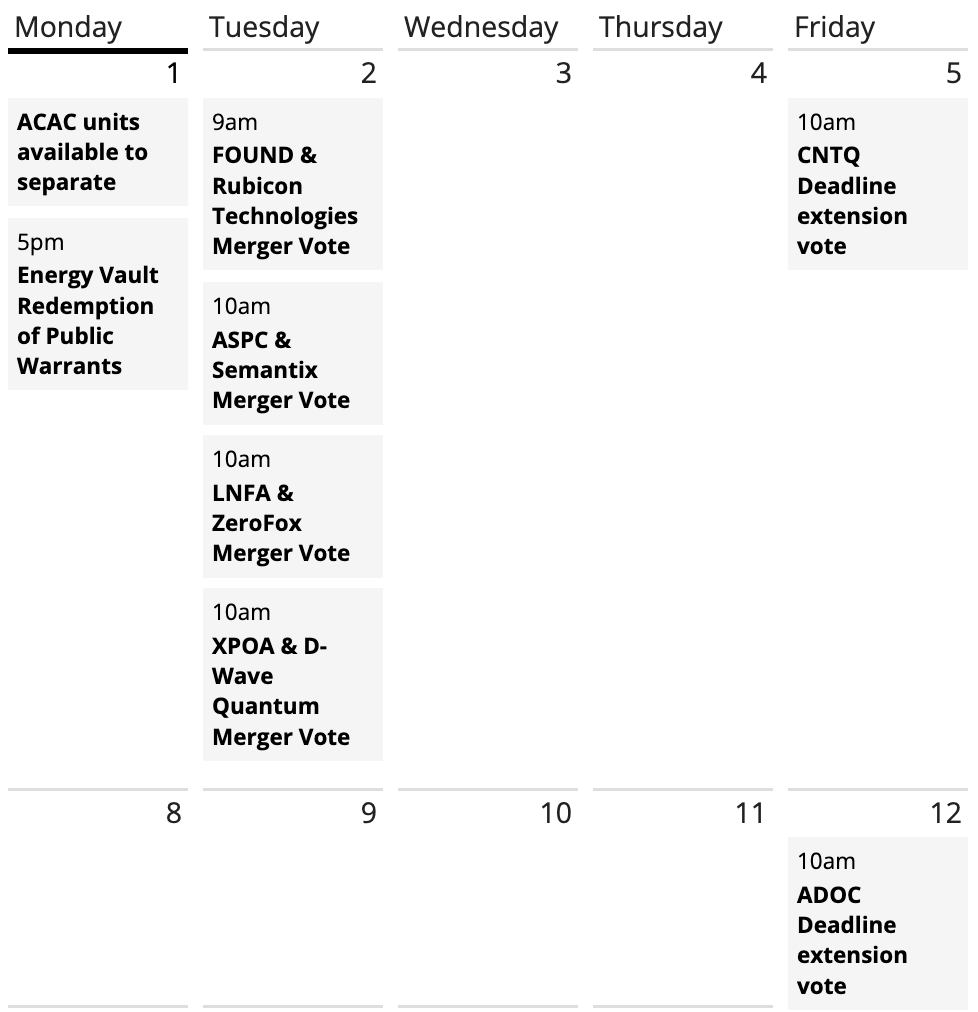

Upcoming Dates:

Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar with proxy links here.

SPAC Track Pro:

Please note that a list of all the data points available on the Pro Screener with download eligibility can be found here: spactrack.io/data-catalog

Thanks for reading,

The team at SPAC Track (spactrack.io)