Some De-SPACs rise and Some De-SPACs fall, but 'tis the first earnings reports and not the projections that tell us which way they will go

The Nightcap newsletter: SPAC Track’s nightly recap of the action in the SPAC world. (August 10, 2021)

Good evening!

Thanks for reading the Nightcap by SPAC Track. You can always discover and track all of the SPACs at spactrack.net.

Tonight’s newsletter is sponsored by Founder Shield.

SPAC transaction volume has already surpassed 2020’s total, and regulators have taken notice. With increased scrutiny from the SEC, effective risk management has never been more important for SPACs and their sponsors. How should SPACs approach risk management and insurance in 2021 and beyond? Find out in Founder Shield’s SPAC Risk Management Guide.

The Stats:

If you find that this newsletter keeps you informed of all things SPAC, please consider sharing it with a friend or colleague and suggest they subscribe!

The Deals:

1) Astrea Acquisition Corp. (ASAX: $9.81) & HotelPlanner + Reservations.com

Reimagining the Hotel Booking Experience: HotelPlanner and Reservations.com Enter Three-Way Merger with Astrea Acquisition Corp. to Become a Public Company Listed on NASDAQ (Press Release)

Merger Partner Description:

HotelPlanner

HotelPlanner is a leading travel technology company that combines proprietary artificial intelligence capabilities with a 24/7 global gig-based reservations and customer service network. HotelPlanner travel agents can customize all traveler hotel & accommodation needs from a single platform while providing localized advice. HotelPlanner is one of the leading providers of individual, group and corporate travel bookings, specializing in unique “Closed User Group” discounted rates offered in unpublished private sale environments. Founded in 2004, HotelPlanner has enduring partnerships with many of the world’s largest OTAs, well-known hotel chains, individual hotels, online wedding providers, ancillary lodging providers, corporations, professional and amateur sports teams and franchises, universities and government agencies.

Reservations.com

Reservations.com is an award-winning online travel company on a mission to bring the human-touch back to travel. Founded in 2014 with a focus on helping consumers create memorable travel experiences, Reservations.com has experienced rapid growth. Reservations.com's user-friendly website offers unparalleled visibility into hotels, including: descriptions, pricing information, and reviews of nearly 500,000 properties globally.

Valuation: $567.1M EV

PIPE: No PIPE

HotelPlanner Investor Presentation

2) Environmental Impact Acquisition Corp. (ENVI: $9.80) & GreenLight Biosciences

GreenLight Biosciences Announces Business Agreement With Environmental Impact Acquisition Corp. to Become Publicly Traded Company, Allowing It to Better Harness Its Breakthrough Platform to Develop and Produce RNA for Human Therapies and Agriculture (Press Release)

Merger Partner Description:

GreenLight Biosciences is an integrated life sciences company with a breakthrough biomanufacturing platform for discovering, developing, scaling, and commercializing ribonucleic acid (RNA) solutions at volume for a diverse product pipeline across agriculture and human health. Applications include vaccine development, pandemic preparation, crop management, and plant protection. The GreenLight team values diversity, inclusion, and equality and uses collaboration to remain scientifically imaginative and passionately focused on making a difference in the world.

Valuation: $1.23B EV

PIPE: $105M including investments from S2G Ventures, Cormorant Asset Management, Morningside Venture Investments, Hudson Bay Capital, BNP Paribas Ecosystem Restoration Fund, The Jeremy and Hannelore Grantham Environmental Trust, Continental Grain Company, Pura Vida Investments LLC, Xeraya Capital, and MLS Fund II/Spruce

GreenLight Biosciences Investor Presentation

Deal News:

Wilbur Ross’s SPAC Is in Talks to Merge With GaN Systems (Bloomberg—behind paywall)

GaN Systems, which specializes in gallium-nitride technology for products such as semiconductors and transistors, is in talks to go public through Wilbur Ross’s Ross Acquisition Corp. II (ROSS: $9.76), according to people with knowledge of the matter.

As a deal hasn’t been finalized, terms could change or talks could fall apart.

“My policy is not to comment on rumored acquisitions,” Ross said in an interview. “At such time as the SPAC has a definitive agreement with any target, I would be happy to discuss the details.”

A representative for GaN said the company’s policy is also not to comment on rumors or speculation.

“Yesterday’s silicon has reached its limits,” and power systems based on gallium nitride can replace that technology at a lower cost and with one-quarter the power loss, GaN says on its website.

The company, led by Chief Executive Officer Jim Witham, has counted Taipei-based Delta Electronics Inc., BMW Group’s venture arm BMW i Ventures, BDC Capital and Chrysalix Venture Capital among its investors.

Other News:

Vivendi sells a 7.1% stake of UMG to Pershing Square for $2.8 billion (Reuters)

Billionaire hedge fund manager William Ackman on Tuesday bought 7.1% of Universal Music Group from French conglomerate Vivendi (VIV.PA) and pledged to keep buying after his original plan to acquire a 10% stake in the record label for his blank-check company [Pershing Square Tontine Holdings (PSTH: $20.21)] collapsed.

Vivendi said the transaction was valued at $2.8 billion, based on an enterprise value of 35 billion euros ($41.01 billion) for 100% of UMG's share capital.

Ackman still has the right to buy up to 2.9% more in UMG by Sept. 9, Vivendi said.

For Ackman, this marks the first part of a promise to make good on his pledge to buy a sizable stake in UMG after the complex SPAC deal he put together crumbled last month amid scrutiny from U.S. regulators.

Ackman has told his own clients that music is the cheapest form of entertainment in the world and a savvy investment because it pays royalties.

His public and private hedge funds run by his firm Pershing Square Capital Management made this investment.

Ackman is currently raising fresh capital from investors to potentially buy more of UMG, according to people familiar with his plans.

Lightning eMotors jumps 89% after entering a $850 million EV partnership with Berkshire Hathaway's Forest River (Markets Insider)

Shares of Lightning eMotors (ZEV: $11.60) rose as much as 89% on Tuesday, hitting their highest level since going public via SPAC, after entering an $850 million partnership deal with a Berkshire Hathaway-backed bus maker.

Lightning eMotors will work with Forest River, the largest shuttle-bus maker in North America, to deliver up to 7,500 zero-emission shuttle buses in the US and Canada starting this year to 2025.

Lightning shares pared from intraday highs and traded roughly 67% higher as of 2:30 p.m. in New York.

The EV maker will build fully electric powertrains at its Loveland, Colorado, facility, and provide charging products and services to Forest River. The powertrain systems will then be shipped to Forest River's factory in Goshen, Indiana, where final assembly will take place for Class 4 and 5 electric passenger buses.

The buses will have batteries that can support ranges on a single charge between 80 miles and 160 miles, the companies said in a joint statement. Forest River runs more than 100 bus dealerships in the US and Canada and the vehicles may be sold and serviced there, with the aim to deliver the new shuttle buses to dealerships by the end of 2021.

Quick News Corner:

Katapult Holdings (KPLT: $4.26 -56.2%) announced Q2 earnings in which the company pulled guidance for the rest of the year.

Given the current macro trends and uncertainty to accurately predict our consumer’s buying behaviors for the remainder of the year, we believe it is best to remove explicit guidance for the remainder of 2021.

BlackSky, Osprey Technology Acquisition Corp.’s (SFTW: $9.99) merger partner, announced it will add six satellites to its constellation through three dedicated missions via Rocket Lab, Vector Acquisition Corporation’s (VACQ: $10.57) merger partner, and launch services provider, Spaceflight Inc.

Consonance-HFW Acquisition Corp. (CHFW: $9.59) & Surrozen shareholders approve the merger

Joby Aviation Announces Closing of Business Combination with Reinvent Technology Partners (RTP: $10.03). Set to trade as JOBY tomorrow.

Li-Cycle Completes Business Combination with Peridot Acquisition Corp. (PDAC: $11.23). Set to trade as LICY tomorrow.

IPOs to Begin Trading Tomorrow (4)*:

1) Chardan NexTech Acquisition 2 Corp. (CNTQ-U)

$110M, 3/4 warrant

Focus: Disruptive Tech

Overfunded Trust ($10.15)

2) TPB Acquisition Corporation I (TPBA-U)

$175M, 1/3 warrant

Focus: To merge a sustainability focused-company in the food, agriculture, biomanufacturing, and life sciences sectors either with The Production Board (the sponsor’s parent company), with one or more of The Production Board’s portfolio companies, or as a standalone transaction

Management:

David Friedberg (Founder & Chairman of Metromile, Founder of The CIimate Corporation)

Directors:

Bharat Vasan (Former COO of August Home)

Dr. Neil Renninger (Co-founder & Co-CEO of Ripple Foods)

Kerry Cooper (Former COO of Rothey’s, Former CMO of Walmart.com)

April Underwood (Director of Zillow)

3) Decarbonization Plus Acquisition Corporation IV (DCRD-U)

$275M, 1/2 warrant

Focus: Decarbonization

Overfunded Trust ($10.10)

4) 10X Capital Venture Acquisition Corp. II (VCXA-U)

$200M, 1/3 warrant

Focus: High-growth Tech

*Priced at the time of this writing

New S-1s:

None today.

Upcoming Dates:

This Week’s Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

Wednesday, August 11

Merger Meetings:

Stable Road Acquisition Corp. (SRAC: $10.47) & Momentus

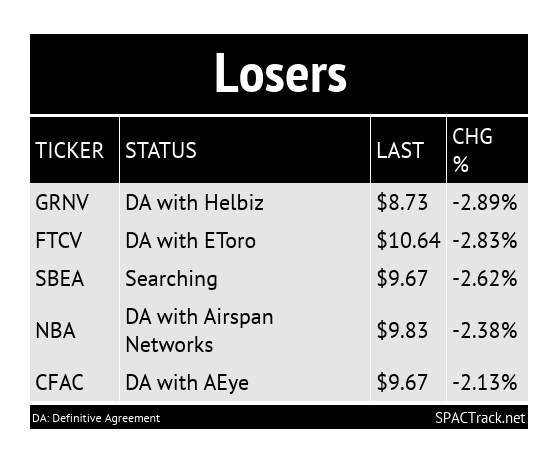

GreenVision Acquisition Corp. (GRNV: $8.73) & Helbiz

New Beginnings Acquisition Corp. (NBA: $9.83) & Airspan Networks

Thursday, August 12

Merger Meetings:

CF Finance Acquisition Corp. III (CFAC: $9.67) & AEye

Blue Water Acquisition Corp. (BLUW: $9.95) & Clarus Therapeutics

Software Acquisition Group Inc. II (SAII: $9.93) & Otonomo

Friday, August 13

Merger Meeting: NavSight Holdings, Inc. (NSH: $9.79) & Spire

Unit Split: Coliseum Acquisition Corp. (MITA-U: $9.83)

If you haven’t subscribed to this free nightly newsletter, you can do so below.

Thanks for reading,