SPAC Track's Weekly Review

A weekly newsletter recapping the past week's SPAC activity (Jan 31, 2022)

Reminder:

As a reminder, the Nightcap nightly newsletter is now the Precap — a SPAC newsletter sent in the morning before the market opens each day to our Pro subscribers only.

Sign up for SPAC Track Pro and for the next 2 days get 25% off of the first month or the first year of the annual subscription with the coupon: ‘25PRECAP2022’ (Expires EOD Feb 1st).

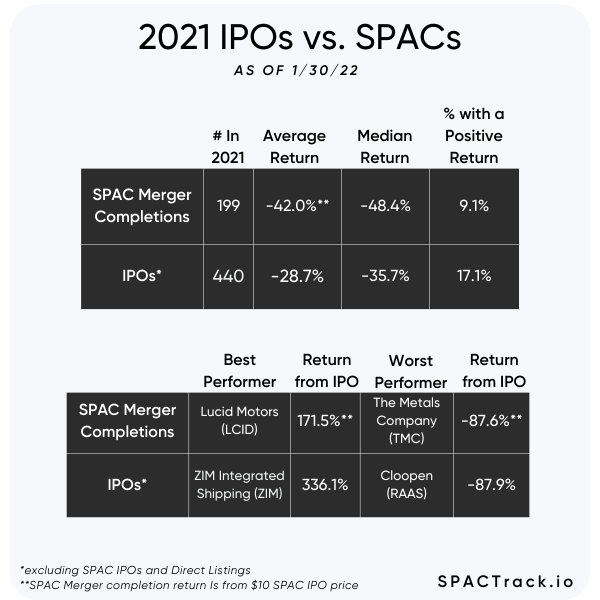

The Listing Wars:

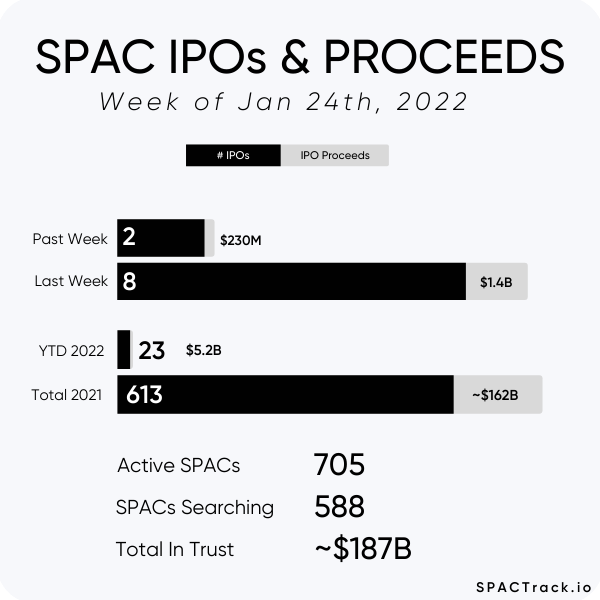

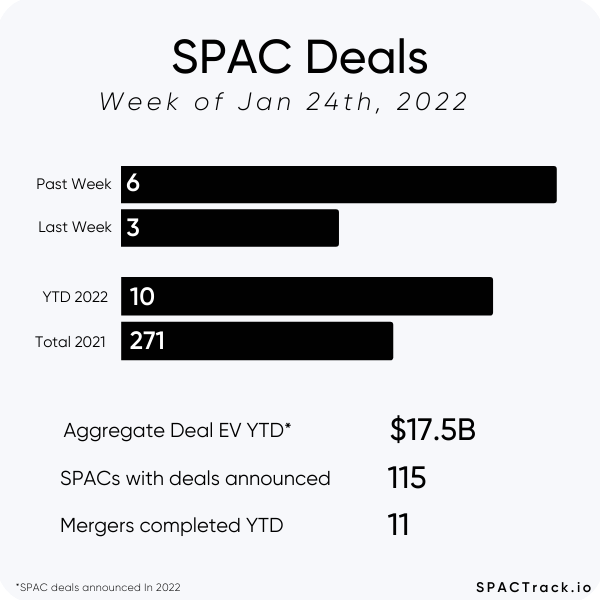

The Weekly Review:

The Deals from the Past Week (6):

1) Sports Ventures Acquisition Corp. (AKIC) & DNEG

Merger Partner Description:

DNEG is one of the world’s leading visual effects (VFX) and animation companies for the creation of feature film, television, and multiplatform content. DNEG employs nearly 7,000 people with worldwide offices and studios across North America (Los Angeles, Montréal, Toronto and Vancouver), Europe (London) and Asia (Bangalore, Chandigarh, Chennai and Mumbai).

Valuation: $1.7B EV

2) Arisz Acquisition Corp. (ARIZ) & BitFuFu

Merger Partner Description:

BitFuFu is a fast-growing digital asset mining service and world-leading cloud-mining service provider. BitFuFu has been invested by, and is the only cloud-mining strategic partner of Bitmain to date, a world-leading cryptocurrency mining hardware manufacturer.

Valuation: $1.5B EV

3) Social Capital Suvretta Holdings Corp. I (DNAA: no warrants) & Akili Interactive

Merger Partner Description:

Akili is pioneering the development of game-changing technologies to usher in a new era of cognitive medicine. Focused on delivering cutting-edge digital diagnostics, treatments and monitors for cognitive impairments across disease and disorders, Akili is combining scientific and clinical rigor with the ingenuity of the tech and entertainment industries and challenging the status quo of medicine. Akili’s treatments are designed to directly activate the networks in the brain responsible for cognitive function and have been rigorously tested in extensive clinical studies, including prospective randomized, controlled trials. Driven by Akili’s belief that effective medicine can also be fun and engaging, Akili’s products are delivered through captivating action video game experiences.

Valuation: $600M pre-money equity value / $516M pre-money EV

4) Mountain Crest Acquisition Corp. III (MCAE: no warrants) & ETAO International Group

Merger Partner Description:

ETAO International Group ("ETAO") aims to be a leading digital healthcare group providing telemedicine, hospital care, primary care, pharmacy and health insurance covering all life stages of patients. "ETAO" brand means "Best Medical Way" with transformative medical care and unparalleled service.

Valuation: $2.5B EV

PIPE: $250M PIPE from China SME Investment Group

Investor Presentation pending

5) Breeze Holdings Acquisition Corp. (BREZ) & D-Orbit

Merger Partner Description:

D-Orbit is a market leader in the space logistics and transportation services industry with a track record of space-proven technologies and successful missions.

Valuation: $1.28B EV

6) Abri SPAC I, Inc. (ASPA) & Apifiny Group

Merger Partner Description:

Apifiny is a global cross-exchange digital asset trading network for institutions. The company’s vision is to create one, global trading marketplace for digital assets. Apifiny aims to deliver institutional-grade performance to digital asset traders through seamless connection with global digital asset exchanges and infrastructure providers. With one account and one API, Apifiny Connect gives institutional traders the flexibility to trade directly on global centralized exchanges at a discounted cost.

Valuation: $530M EV

News from the Past Week:

Kin Insurance and Omnichannel Acquisition Corp. (OCA) Mutually Agree to Terminate Business Combination Agreement “as a result of current unfavorable market conditions”

Kin Insurance gets new funding after spurning its SPAC (Axios)

Wynn Reportedly Shopping Wynn Interactive Unit at Fire Sale Price of $500 Million (Casino.org)

Globis Acquisition Corp. (GLAQ) files investor presentation for its merger with Forafric

TradeUP Global Corporation (TUGC) decreases the merger consideration for SAITECH from $228M to $188M due “in part based on recent events in Kazakhstan”

Merger Votes/ Completions/ Extensions from the Past Week:

Merger Votes Set:

Astrea Acquisition Corp. (ASAX) & HotelPlanner and Reservations.com: 2/15

Growth Capital Acquisition Corp. (GCAC) & Cepton Technologies: 2/9

Completions:

Sports Entertainment Acquisition Corporation (SEAH) completed its merger with Super Group, has changed its name to SGHC Limited, and started trading as SGHC

Trebia Acquisition Corp. (TREB) completed its merger with System1 and started trading as SST

CF Acquisition Corp. V (CFV) completed its merger Satellogic and started trading as SATL today

The transaction raised appx $262M with ~23.1M shares redeemed or an estimated ~93% of the public SPAC shares

Yellowstone Acquisition Company Corp. (YSAC) completed its merger Sky Harbour and started trading as SKYH

~12.1M shares were redeemed or an estimated ~87% of the public SPAC shares

Extensions:

SCVX Corp (SCVX) shareholders approved the deadline extension from Jan 28 to July 28 with ~19.2M shares redeemed or an estimated ~84% of the public SPAC shares. SCVX now has ~$38M left in trust

Lionheart Acquisition Corp. II (LCAP) shareholders approved the deadline extension from Feb 18 to August 18 with ~10.9M shares redeemed or an estimated ~48% of the public SPAC shares

ACE Convergence Acquisition Corp. (ACEV) shareholders approved the deadline extension from Jan 30 to July 13 with ~14.8M shares redeemed or an estimated ~64% of the public SPAC shares

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

Weekly De-SPAC S-1s (including PIPE resale registrations*):

S-1 filings:

CompoSecure (CMPO) (Tuesday)

Virgin Orbit (VORB) (Tuesday)

S-1/A filings:

Microvast (MVST) (Friday)

Pardes Biosciences (PRDS) (Friday)

Fathom Digital Manufacturing (FATH) (Thursday)

S-1 Effective:

Today:

Ermenegildo Zegna (ZGN)

Fathom Digital Manufacturing (FATH)

Vertical Aerospace (EVTL) (Friday)

Science 37 (SNCE) (Wednesday)

BuzzFeed (BZFD) (Tuesday)

Altus Power (AMPS) (Monday)

*When applicable

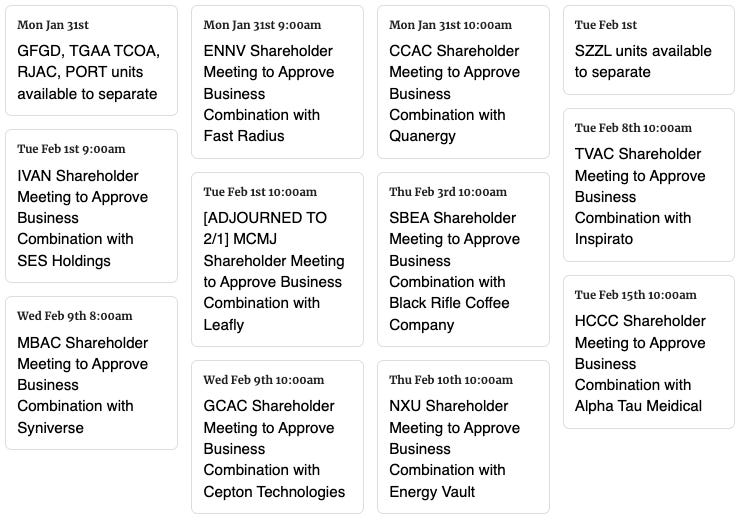

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions, Earnings, and Expected Ticker Changes

See the full calendar here.

Thanks for reading,