SPACs getting dragged through the MUDS

The Nightcap newsletter: SPAC Track’s nightly recap of the action in the SPAC world. (August 19, 2021)

Good evening!

Thanks for reading the Nightcap by SPAC Track. You can always discover and track all of the SPACs at spactrack.net.

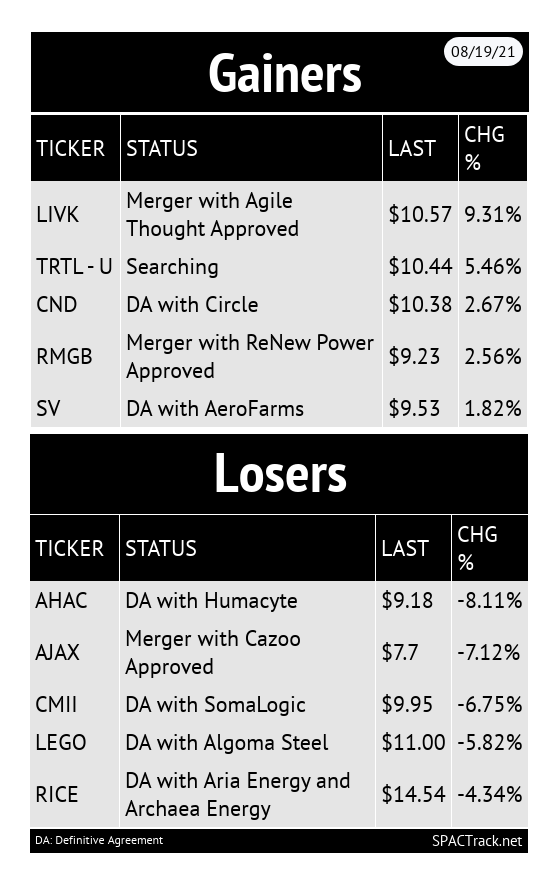

The Stats:

If you haven’t subscribed to this Free nightly newsletter, you can do so below.

The Deals:

None today.

News:

MLB will end 70-year deal with trading card company Topps (CNBC)

Major League Baseball will abandon Topps as its partner for trading cards, ending a relationship that’s been in place since 1952.

Fanatics, the company that makes sports apparel, is expected to get the trading card deal instead, according to two people familiar with the matter. Fanatics and MLB declined to comment.

MLB renewed its deal with Topps in 2018, and the existing deal ends in 2025. The MLB Players Association deal also aligns with the league, so its deal would end, too.

In the agreement with Topps, MLB gets a royalty on products sold with its intellectual property. Baseball departing is a blow to Topps as the powerhouse announced it would go public last April. The trading cards company entered a SPAC merger with Mudrick Capital Acquisition Corp. II (MUDS: $10.11), which is listed on the Nasdaq, valuing Topps at $1.3 billion.

Topps was a public company before being taken private following a $385 million deal in 2007. The company was founded in 1938 and became well known for its distribution of trading cards, including the 1952 Mickey Mantle card which sold for $5.2 million last January. With MLB out, Topps is left with licensing deals with leagues including Major League Soccer and the National Hockey League.

Meanwhile, MLB will turn to Fanatics in some capacity to produce physical trading cards. Fanatics plans to start a new trading card company and will give equity in the company to MLB and the MLB Players Association.

MLB already owns equity in Fanatics, and it recently give its NFT rights to Fanatics-owned Candy Digital. In addition, Fanatics already owns all of MLB’s e-commerce rights, and wants to grow its business outside of sports merchandising, including sports betting.

New S-1s (5):

1) Broad Capital Acquisition Corp (BRAC)

$100M, 1 right (1/10 sh)

Focus: High growth technology and tech-enabled businesses

2) BurTech Acquisition Corp. (BRKH)

$250M, 1/2 warrant

Focus: Retail, lifestyle, hospitality, technology, or real estate

3) Accretion Acquisition Corp. (ENER)

$150M, 1 right (1/10 sh), 1/2 warrant

Focus: Energy value chain, including energy tech

4) Future Health ESG Corp. (FHLT)

$200M, 1/2 warrant

Focus: Smart health technology

5) WinVest Acquisition Corp. (WINV)

$100M, 1 right (1/15th sh), 1 warrant (2 warrants per 1 share)

Focus: Financial services industry, with a particular focus on financial media, brokerage, banking, investing, and wealth management

Directors:

Lawrence Kramer (Founder, Former Chairman & CEO of Marketwatch.com)

Advisors:

Lee Barba (Former CEO of thinkorswim)

David Siegel (CEO of Meetup and Former CEO of Investopedia)

Upcoming Dates:

This Week’s Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

Fri, August 20

Merger Meetings:

Spring Valley Acquisition Corp. (SV: $9.53) & AeroFarms

Vector Acquisition Corp (VACQ: $10.01) & Rocket Lab

Unit Splits:

Thunder Bridge Capital Partners IV (THCP-U: $9.90)

Shelter Acquisition Corp I (SHQA-U: $9.93)

Thanks for reading,