SPACs not giving up on EVs and Bridgetown still in the hunt

Pre-market recap of the action in the SPAC world for SPAC Track's premium subscribers. (July 13, 2022)

The Stats:

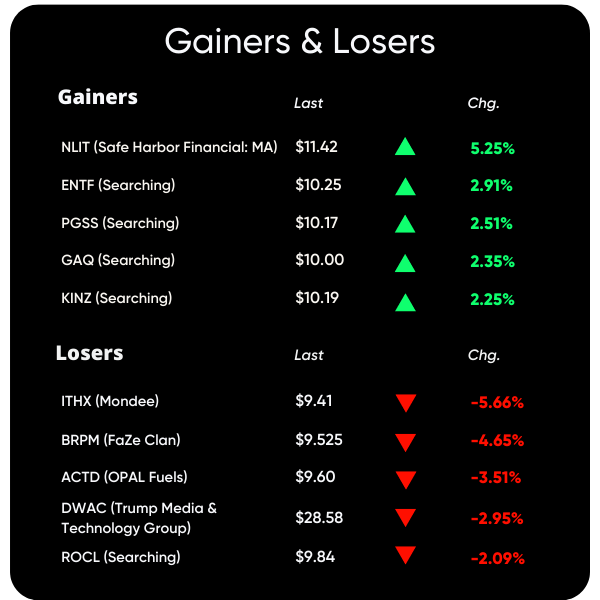

Pre-Market Movers*:

Active Moves (1%+): DMAQ +5.0%, NLIT +5.0%, // BRPM -5.0%, DWAC -3.8%,

Some De-SPAC Moves (10%+): IS +48.9% // BOXD +10.4%

*at the time of this writing

Previous Session Movers & Volume Leaders:

The Deals:

1) Deep Medicine Acquisition Corp. (DMAQ) & Chijet Motor Company

The primary business of Chijet is the development, manufacture, sales and service of traditional fuel vehicles and electric vehicles. State-of-the-art manufacturing systems and stable supply chain management enable the company to provide consumers with products of high performance at reasonable prices. The factory in Yantai, China, will be dedicated to EV production, and the company’s headquarters will be also located at the planned Yantai factory. Chijet has a management team of industry veterans with decades of experience in engineering and design, management, financing, industrial production and financial management.

Valuation: “Implied enterprise value to Chijet’s operating companies of $2.55B in the aggregate”

News:

Thiel-Backed SPAC Weighs $2.5 Billion Circles.Life Deal (Bloomberg)

Bridgetown Holdings Ltd. (BTWN), the US-listed blank-check company backed by billionaires Peter Thiel and Richard Li, is considering a potential merger with digital telecom services provider Circles.Life, according to people familiar with the matter.

The special purpose acquisition company is holding early talks with Singapore-based Circles.Life to explore a transaction, the people said, asking not to be identified because the matter is private. Bridgetown could seek a valuation for the combined entity of about $1.5 billion to $2.5 billion, the people said.

Considerations are preliminary and there’s no guarantee an agreement could be reached, the people said. Bridgetown could also look at other targets for a merger, while Circles.Life could opt to pursue other transactions, they added.

Founded in 2016, Circles.Life offers digital mobile services including voice, data, roaming and international calls, according to its website. The company reached 5% market share in Singapore in 2019 and also has operations in Taiwan, Australia, Indonesia and Japan. Warburg Pincus LLC made a “substantial investment” in Circles.Life in 2020, without disclosing the financial terms.

Updates:

Global Synergy Acquisition Corp. (GSAQ) announced that it will liquidate on 7/26 at a liquidation price of appx $10.01 per share

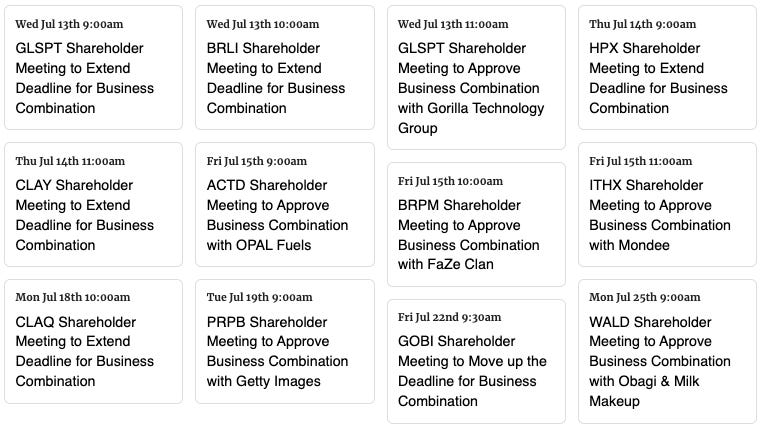

Merger Vote Set:

—> CHW Acquisition Corp (CHWA) & Wag Labs (7/28)

Industrial Human Capital, Inc. (AXH) announced that two directors have resigned, and that “the Directors of the Company initiated discussions regarding the approaching deadline to complete the initial business combination and the possible need to seek a vote of the Company’s stockholders to approve an amendment to the Company’s charter extending the time period in which to complete an initial business combination and to take such other actions as may be necessary in connection with such extension.”

—> ShiftPixy (PIXY), AXH’s sponsor, has withdrawn 3 SPACs it planned to launch, and PIXY stock has dropped roughly 76% year-to-date

ACE Convergence Acquisition Corp. (ACEV) shareholders approved the deadline extension from 7/13 to 10/13

—> 4,256,979 shares were redeemed or appx 51.9% of the remaining public shares

New SPACs (S-1s):

No new S-1s

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

S-1:

S-4 Activity:

S-4/A:

DPCM Capital, Inc. (XPOA) & D-Wave (5th amendment)

Effective:

CHW Acquisition Corp (CHWA) & Wag Labs

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

SPAC Track Pro Notes:

Please note that a list of all the data points available on the Pro Screener with download eligibility can be found here: spactrack.io/screener-instructions

Thanks for reading,