Stuck in the merger with you

Pre-market recap of the action in the SPAC world for SPAC Track's premium subscribers. (July 18, 2022)

The Stats:

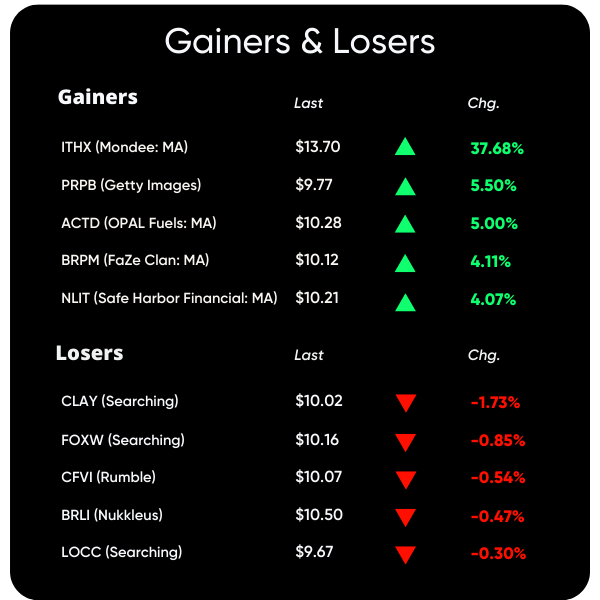

Pre-Market Movers*:

Active Moves (1%+): ITHX +12.9%, ACTD +9.4%, BRPM +8.5%, CLAQ +1.5%, DWAC +1%

Some De-SPAC Moves (10%+): ADN +35.7%, LMDX +15.7%, FSRD +9.9%

*at time of this writing

Previous Session Movers & Volume Leaders:

The Deals:

No new deals

News:

Biote founder calls merger deal a ‘get-rich-quick-scheme’ that’s cost him millions (Dallas Morning News)

The founder of the Irving-based hormone replacement therapy provider has gone to court to prove executives that he hired conspired to push him out of his company.

The founder of an Irving-based hormone optimization company is on a mission to take it back, saying executives he hired to protect it ended up hijacking it and dilg his ownership by nearly $220 million.

Prior to a deal to take Biote (BTMD) public, founder Gary Donovitz said he had a 45.4% ownership stake in a business valued at $737 million. After going public via merger in May, he said he now owns 34.5% of a $339 million business.

Donovotiz, who founded the company in 2012, filed a lawsuit in state court against the CEO he hired to replace him, Terry Weber, as well as the special-purpose acquisition company that took Biote public in May, Haymaker Sponsor III. SPACs look for private companies to take public by merging with them.

Others named in the suit were Mary Elizabeth Conlon, Donovitz’s lawyer on the SPAC transaction who later became Biote’s general counsel; Marc Beer, executive chairman of Biote and chairman of the new company’s board of managers; and Cooley LLP, a law firm that served as counsel to the company but also gave legal advice to Donovitz.

Donovitz claims he wasn’t told the truth about how the SPAC transaction would dilute his ownership. He also accuses Weber and the SPAC sponsors of holding secret meetings to take control of the company, which partners with doctors, training them in hormone replacement therapy using pellets and providing software and marketing materials.

Updates:

Dune Acquisition Corporation (DUNE) received a notice from TradeZero that stated they are terminating the merger as the outside date was 7/12. DUNE then sent a letter to TradeZero stating TradeZero is not able to terminate the merger, because TradeZero’s “breaches of and failure to perform under the Merger Agreement primarily caused or resulted in the failure of the mergers contemplated by the Merger Agreement to be consummated by the Termination Date”

—> “Dune further stated in the Response Letter that it intends to take all necessary steps to protect itself and its investors.”

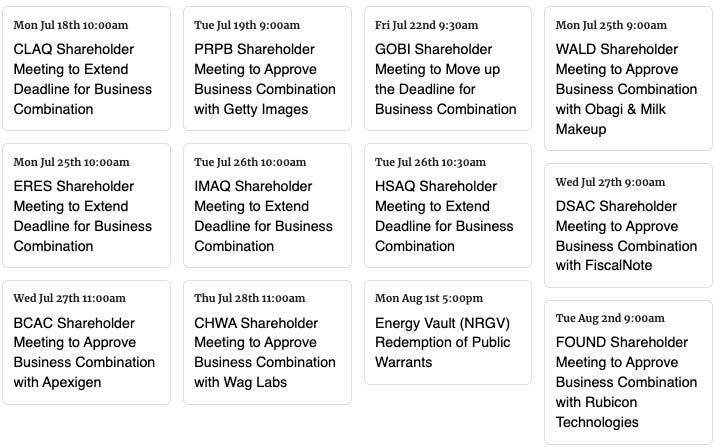

B. Riley Principal 150 Merger Corp. (BRPM) shareholders approved the merger with FaZe Clan

—> The merger is expected to close on 7/19 with the combined company trading as FAZE starting on 7/20

ITHAX Acquisition Corp. (ITHX) shareholders approved the merger with Mondee

—> The merger is expected to close on 7/18 with the combined company trading as MOND following completion

—> “As of July 15, 2022” 24,011,532 shares were redeemed, or an estimated ~99.4% of the public SPAC shares

ArcLight Clean Transition Corp. II (ACTD) shareholders approved the merger with OPAL Fuels

—> Upon completion of merger the combined company will begin trading as OPAL

OCA Acquisition Corp. (OCAX) announces they plan on extending the deadline from 7/20/22 to 1/20/23 and intends to deposit $0.05 per public share to the trust on or before 7/20

Waldencast Acquisition Corp. (WALD) adds $5M to the PIPE for its merger with Obagi & Milk Makeup

Redbox (RDBX) sets 8/9 as the date for its shareholder meeting to vote on its merger with Chicken Soup for the Soul Entertainment (CSSE)

New SPACs (S-1s):

No new S-1s

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

S-1/A:

MoonLake Immunotherapeutics (MLTX)

S-4 Activity:

S-4/A:

Riverview Acquisition Corp. (RVAC) & Westrock Coffee Company (2nd amendment)

CF Acquisition Corp. VI (CFVI) & Rumble (3rd amendment)

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

SPAC Track Pro Notes:

Please note that a list of all the data points available on the Pro Screener with download eligibility can be found here: spactrack.io/screener-instructions

Thanks for reading,