The FTC isn't iBuying Opendoor

SPAC deals are losing financing and the FTC is fining Opendoor in this edition of the Morning Recap, the pre-market recap for SPAC Track Pro subscribers.

Good Morning,

A couple of SPACs [$ACEV, $BREZ] are reporting that the supplemental financing deals in connection with their mergers have been terminated.

Also, Opendoor [$OPEN] received a fine from the Federal Trade Commission for allegedly misleading consumers in their advertising practices.

Random De-SPACs:

Over $10: Agiliti [$AGTI] — $21.73 (completed its merger Jan 2019)

Not far from 10 cents: Quanergy Systems [$QNGY] — $0.36 (completed its merger Feb 2022)

Previous Session Stats

Gainers & Losers

Volume Leaders

News & De-SPAC Updates

The FTC just slapped Opendoor [$OPEN] with a $62 million fine for 'misleading' customers about the true costs of its home-buying business (BI)

The Deals

Monday afternoon announcement:

1) Energem [$ENCP] & Graphjet Technology

Graphjet Technology Sdn. Bhd. was founded in 2019 in Malaysia as an innovative graphene and graphite producer. Graphjet Technology has the world’s first patent-pending technology to recycle palm kernel shells generated in the production of palm seed oil to produce single layer graphene and artificial graphite. Graphjet’s sustainable production methods utilizing palm kernel shells, a waste agricultural product that is common in Malaysia, will set a new shift in Graphite and Graphene supply chain of the world.

Valuation: $1.49B Pro-forma Enterprise Value

Pending Investor Presentation

SPAC Updates

Liquidations

Gobi (GOBI), though no report from the SPAC, has been delisted from the Nasdaq. GOBI had successfully convened a shareholder meeting to vote on advancing its deadline from July 2023 to July 2022, in order for the SPAC to liquidate early.

Deal Updates

Financing Down:

Breeze Holdings [$BREZ] and its merger partner, D-Orbit, reported that ATW Partners, which agreed to buy $30M of convertible debentures from D-Orbit upon closing of the merger, terminated the agreement (SEC)

ACE Convergence [$ACEV] reported that Oaktree and Tor Asia terminated their agreement to purchase $175M and $25M respectively in convertible senior notes upon closing of the merger with Tempo Automation. The agreement stipulated that Oaktree and Tor could terminate if the merger was not consummated by July 18th (SEC)

Registrations

New S-1s

No new S-1s

Registration Withdrawals

RMG Acquisition Corp. IV (RMGD)

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

Key Filings

SPAC S-4 Activity

S-4

Americas Technology [$ATA] & Rally

S-4/A

*Latest S-4 filings are found in the “Deal Details” view under the column “S-4 Link”

De-SPAC/ Post-Merger S-1s

Effective

Symbotic [$SYM]

*including PIPE resale registrations where applicable — latest post-merger S-1 filings are found in the “De-SPAC" view under the column “Post-Close S-1”

Upcoming Dates:

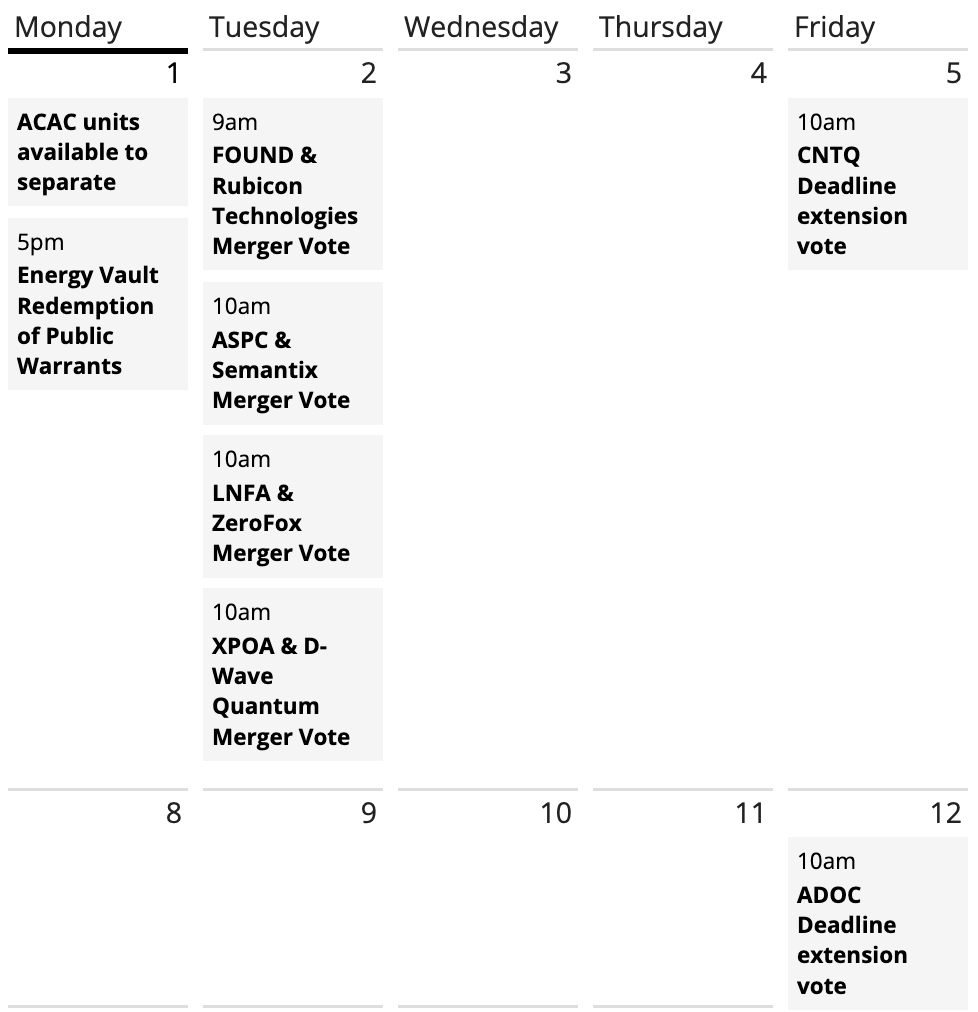

Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar with proxy links here.

SPAC Track Pro:

Please note that a list of all the data points available on the Pro Screener with download eligibility can be found here: spactrack.io/data-catalog

Thanks for reading,

The team at SPAC Track (spactrack.io)