The Morning Update

Four deals announced including an aerial firefighting business and another crypto miner in this edition of the Morning Update, the pre-market recap for SPAC Track Pro subscribers.

Good Morning,

Here’s the good news: 4 deals were announced this morning and a total of 7 for the week, thus far. If we were to assume no more IPOs (there was one today — the first since June 24th) and we continue at a pace of 7 deals per week, we will work through the backlog of SPACs searching for a target in a little over a year and a half!

Previous Session Stats

Gainers & Losers

Volume Leaders

The Deals

1) Globalink Investment [$GLLI] & Tomorrow Crypto Group

Tomorrow Crypto is a Bitcoin/Ethereum (“ETH”) mining company in the United States dedicated to becoming a vertically integrated provider of cryptocurrency mining infrastructure and services in the global blockchain ecosystem. By leveraging its high-powered computers and mining rigs to solve complicated mathematical formulas, Tomorrow Crypto expects to generate Bitcoins/ETHs, and validate and verify the digital transactions onto the global blockchain ledger system. Tomorrow Crypto plans to establish and provide critical mining infrastructure at mining facilities for prospective institutional grade clients to mine Bitcoins/ETHs.

Valuation: $310M Enterprise Value

Additional Financing: $15M PIPE (convertible preferred stock and warrants)

Pending Investor Presentation

2) Colonnade II [$CLAA] & Plastiq

Founded in 2012, Plastiq is a leading B2B payments company for SMBs. Plastiq has helped tens of thousands of businesses improve cash flow with instant access to working capital, while automating and enabling control over all aspects of accounts payable and receivable. Plastiq provides growing finance teams with technology and know-how once reserved for only large enterprises. The flagship product, Plastiq Pay, pioneered a way for businesses to pay suppliers by credit card regardless of acceptance as an alternative to expensive, scarce bank loan options. Plastiq Accept offers an alternative to expensive merchant services, enabling businesses to accept credit cards with no merchant fees and get paid across any customer touch point, including a website, invoice, checkout process, and in person via QR code.

Valuation: $480M Pro-forma Enterprise Value

3) Jack Creek Investment [$JCIC] & Bridger Aerospace

Based in Bozeman, Montana, Bridger Aerospace Group Holdings, LLC is one of the nation's largest privately held aerial firefighting companies. Bridger is committed to utilizing its team, aircraft and technology to save lives, property and habitats threatened by wildfires. Bridger provides aerial firefighting and wildfire management services to federal and state government agencies, including the United States Forest Service, across the nation.

Valuation: $869M Pro-forma Enterprise Value

4) INFINT Acquisition Corporation [$IFIN] & Seamless Group

Seamless delivers global financial inclusivity for the unbanked and migrant workers in South East Asia. Under the Seamless solutions umbrella are Tranglo, one of Asia’s leading cross-border payment hubs that provides smart services not only for airtime top-ups, but also foreign remittance and business payments, and WalletKu, a fintech application that aims to help Indonesian micro, small and medium enterprises develop digital selling businesses. Seamless enables cross-border digital remittances as well as cashless payment solutions to millions without proper access to mainstream financial services.

Seamless Group Inc. pioneers a global fintech banking platform for e-wallets, financial institutions and merchants worldwide, delivering frictionless interoperable real-time fund transfers and instant messaging. Our state-of-the-art digital ecosystem empowers billions of smart consumers and businesses to win in over 150 countries.

Valuation: $400M Pro-forma Enterprise Value

Pending Investor Presentation

SPAC Updates

Merger Votes / Completions

Completion: Alpha Capital (ASPC) & Semantix [$STIX] with ticker change to STIX today

Deal Updates

Backstop no more: Venus’ [$VENA] backstop agreement up to $15M with WiMi in connection with the merger with VIYI Algorithm was automatically terminated on June 30th (SF)

IPOs

Mobiv [$MOBV-U]

$87M, 1 Warrant

UW: EF Hutton

Registrations

New S-1s

No new S-1s

Registration Withdrawals

Blue Water II (BWTR)

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

Key Filings

SPAC S-4 Activity

S-4

Frazier Lifesciences [$FLAC] & NewAmsterdam Pharma

*Latest S-4 filings are found in the “Deal Details” view under the column “S-4 Link”

De-SPAC/ Post-Merger S-1s

Global Business Travel Group [$GBTG]

*including PIPE resale registrations where applicable — latest post-merger S-1 filings are found in the “De-SPAC" view under the column “Post-Close S-1”

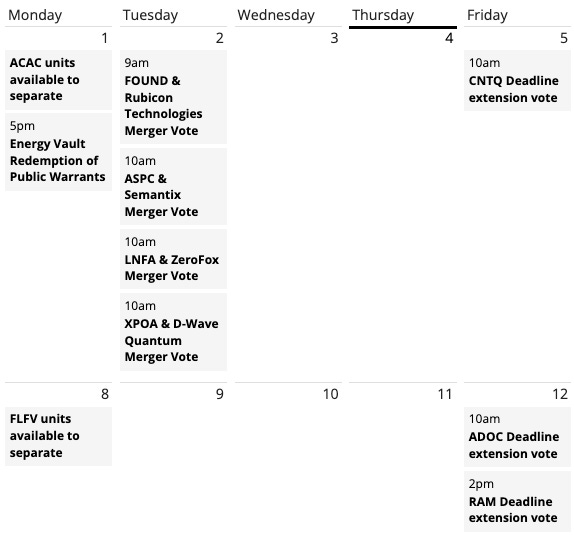

Upcoming Dates:

Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar with proxy links here.

SPAC Track Pro:

Please note that a list of all the data points available on the Pro Screener with download eligibility can be found here: spactrack.io/data-catalog

Thanks for reading,

The team at SPAC Track (spactrack.io)