The Nightcap: 18 Things You Didn’t Know About The BuzzFeed SPAC Merger (#6 will shock you!)

Nightly recap of the day's SPAC highlights (June 24th, 2021)

Good evening,

Thanks for reading “The Nightcap”, a nightly recap of the highlights of the SPAC world. You can always discover and track all of the SPACs at spactrack.net.

Meme of the Day:

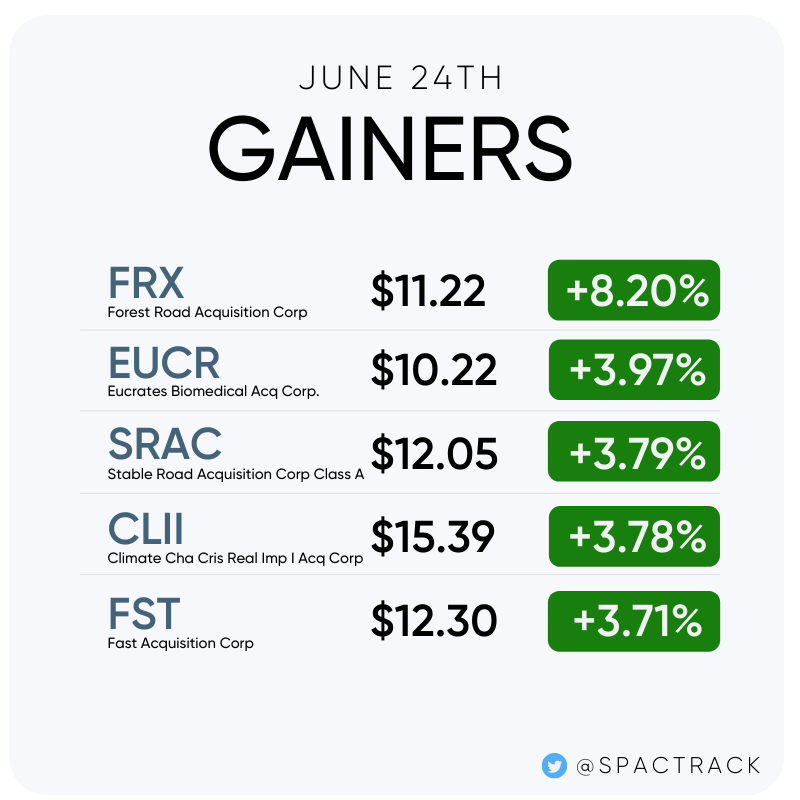

The Stats:

The Deals:

1) 890 5th Avenue Partners, Inc. (ENFA: $9.87) & BuzzFeed

BuzzFeed, the Leading, Culture-Defining Platform for Digital Content and Commerce, to Become a Publicly Listed Company through Merger with 890 Fifth Avenue Partners, Inc. (Press Release)

Merger Partner Description:

BuzzFeed has a strong portfolio of brands in key categories: Complex Networks, encompassing streetwear and fashion, food, music, and pop culture; two Pulitzer-Prize winning newsrooms, BuzzFeed News and HuffPost; BuzzFeed Entertainment, the flagship entertainment brand that curates the Internet and culture, and brings joy to its audience with quizzes, lists, and more; and Tasty Lifestyle Brands, which includes the world's largest food network and several other lifestyle brands that help its audiences live better.

Valuation: $1.5B EV

PIPE: No PIPE

Additional Financing: $150 million in convertible note financing led by Redwood Capital Management and including CrossingBridge Advisors, Cohanzick Management, and Silver Rock Financial LP

BuzzFeed Investor Presentation

If you didn’t get the “18 Things You Didn’t Know” reference above, then you might be a boomer, and to clarify… there is no list. Just some lighthearted humor.

2) ION Acquisition Corp 2 Ltd. (IACB: $9.90) & Innovid

Innovid, a Global Leader In Connected TV Ad Delivery and Measurement, to Become Publicly Listed at an Implied $1.3 Billion Valuation via a Merger with ION Acquisition Corp. 2 Ltd. (Press Release)

Merger Partner Description:

Innovid is the only independent omni-channel advertising and analytics platform built for television. We use data to enable the personalization, delivery, and measurement of ads across the widest breadth of channels in the market including TV, video, display, social, audio, and DOOH. Our platform seamlessly connects all media, delivering superior advertising experiences across the audience journey.

Valuation: $1.1B EV

PIPE: $150M including investments from Fidelity Management and Research Company LLC, Baron Capital Group, funds associated with ION, and others

Innovid Investor Presentation

Deal News Reports:

None today.

Quick News Corner:

Forum Merger III Corporation (FIII: $9.99) shareholders approve merger with Electric Last Mile

Forest Road Acquisition Corp. (FRX: $11.22) shareholders approve merger with Beachbody and Myx Fitness

FinTech Acquisition Corp. IV (FTIV: $13.28) completed its merger with Perella Weinberg Partners. FTIV will trade as PWP starting tomorrow.

Pershing Square Tontine Holdings’ (PSTH: $23.05) merger partner, Universal Media Group, signed a multiyear partnership with Snap to bring its artists’ tracks to the Snapchat platform

Northern Star Investment Corp. II’s (NSTB: $9.98) merger partner, Apex Fintech Solutions, announced its preliminary financial results for the first half of 2021: revenue of $219M and EBITDA of $92M, which is 86% of their previous guidance for FY2021 EBITDA ($106M)

New S-1 Filings:

1) Apeiron Capital Investment Corp. (APN)

$200M, 1/2 warrant

Focus: FinTech, media, gaming, and financial services, wealth-advisory & asset management industries

Management:

Dr. Joel M. Shulman (Founder, Managing Director, and CIO of ERShares)

S-1 Link: https://www.sec.gov/Archives/edgar/data/1849011/000110465921085208/tm219554-2_s1.htm

2) ARYA Sciences Acquisition Corp V (ARYE)

$130M, no warrants

Focus: Healthcare

Management:

Joseph Edelman (Founder, CEO, and Portfolio Manager of Perceptive Advisors)

S-1 Link: https://www.sec.gov/Archives/edgar/data/1852432/000114036121022099/nt10022624x2_s1.htm

3) Spinning Eagle Acquisition Corp. (SPNG)

$2B, 1/5 warrant

Management:

Harry Sloan (Former Chairman & CEO of MGM, Vice Chairman of DraftKings, and Director of Skillz)

Special Feature:

In the event that we determine not to use all of the proceeds held in the trust account for our initial business combination, based on the capital needs of our initial business combination target and related factors, we will have the ability to rightsize our trust account by allocating a portion of our trust account to a new blank check company, which we refer to as SpinCo, and spinning off SpinCo as an independent, publicly-traded special purpose acquisition company

S-1 Link: https://www.sec.gov/Archives/edgar/data/1852207/000119312521198506/d329768ds1.htm

Upcoming Dates:

This Week’s Shareholder Meetings and Unit Splits:

Friday, June 25th

Nothing scheduled

If you found this newsletter useful and you aren’t a subscriber yet, subscribe for free here:

Thanks for reading,