March 9th, 2021

Good evening,

Thanks for reading “The Nightcap”, a nightly recap of all the day’s highlights in the SPAC world. In this newsletter, you will find a breakdown of the day’s deals, IPO’s, “in talks” reports, and noteworthy new SPAC S-1 filings.

Of course, you can always discover and track all of the SPACs at spactrack.net.

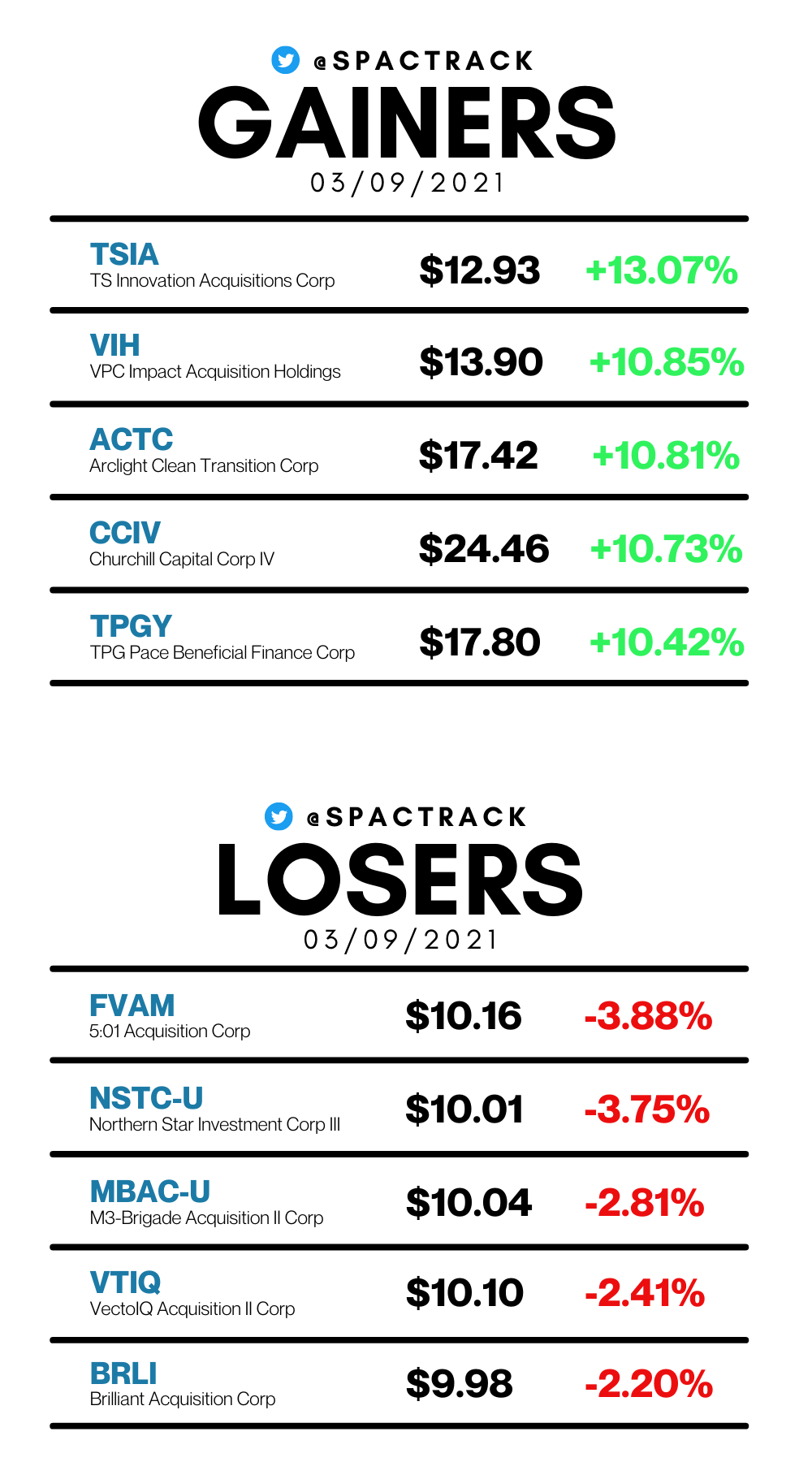

The SPAC Market Stats:

The Deals:

1) Motion Acquisition Corp. (MOTN) & Ambulnz (dba DocGo), a “provider of last-mile telehealth and integrated medical mobility services.”

$900M EV

$125M PIPE

MOTN closed the day at $10.00 (+0.81%)

Deal News Reports:

None

Notable IPO’s to begin trading tomorrow:

1) Forest Road Acquisition Corp. II (FRXB.U)

$305M, 1/5 warrant

Focus: Tech, Media, Telcom, and Consumer (“TMTC”)

Co-CEO and Co-Chairman:

Thomas Staggs (Former COO of The Walt Disney Company and Director of Spotify)

Kevin Mayer (Former CEO of TikTok)

Director: Martin Luther King III (Son of Martin Luther King Jr. and Former CEO of The King Center)

Strategic Advisor: Shaquille “Shaq” O’Neal (Former NBA Player, Director of Papa John’s)

Sponsor’s Previous SPAC to Announce a Deal: Forest Road Acquisition Corp (FRX) announced a merger deal with Beachbody and Myx Fitness on February 10th. FRX closed the day at $11.36.

2) Colonnade Acquisition Corp. II (CLAA.U)

$300M, 1/5 warrant

Sponsor’s Previous SPAC to Announce a Deal: Colonnade Acquisition Corp. I (CLA) announced a merger deal with Ouster in December (and received shareholder approval today). CLA closed the day at $10.70.

3) ESM Acquisition Corporation (ESM.U)

$300M, 1/3 warrant

Focus: Energy transition (“companies, projects or technologies which benefit from the global transition towards a low carbon economy”)

CEO: Sir Michael (“Mick”) Davis (Former CEO of Xstrata, Former CFO of Billiton, and Former Executive Director of Eskom)

4) PWP Forward Acquisition Corp. I (FRWAU)

$200M, 1/5 warrant

Focus: “Women-Forward Companies: businesses that are founded by, led by or enrich the lives of women”

Chairman: Joseph Perella (Founding Partner of Perella Weinberg Partners)

Director: Courtney Leimkuhler (Former CFO of Marsh)

5) Sandbridge X2 Corp. (SBII.U)

$220M, 1/3 warrant

Focus: Consumer

Chairman and CEO: Ken Suslow (Founder of Sandbridge Capital)

Director: Domenico De Sole (Co-Founder of Tom Ford and Former CEO of Gucci Group)

Sponsor’s Previous SPAC to Announce a Deal: Sandbridge Acquisition Corp. (SBG) announced a merger with Owlet last month. SBG closed the day at $10.03.

6) Digital Transformation Opportunities Corp. (DTOC.U)

$300M, 1/4 warrant

Focus: Healthcare Tech

Chairman and CEO: Kevin Nazemi (Co-Founder and Former Co-CEO of Oscar Health)

Directors:

Bradley Fluegel (Former Chief Strategy Officer of Walgreens and Anthem)

Jim Moffatt (Former Global CEO of Deloitte Consulting)

Notable S-1 Filings:

1) AdMY Technology Group, Inc (Ticker not available yet)

$250M, 1/4 warrant

Focus: Communications and cloud infrastructure (including 5G and distributed edge & cloud computing)

Co-Chairman & Director:

Harry You (Former CFO of Oracle and Founder of GTY Technology Holdings)

Niccolo de Masi (Chairman and Former CEO of Glu and CEO of dMY Technology Group III)

Director: Darla K. Anderson (Academy Award winner, Film Producer at Netflix, and Former Film Producer at Pixar Animation Studio— produced “Coco,” “Toy Story 3,” “Cars,” “Monsters, Inc.” )

Sponsor’s Previous SPAC to Announce a Deal: dMY Technology Group, Inc. III (DMYI) announced a merger with IonQ yesterday. DMYI closed the day at $11.31.

2) and 3) New Beginnings Acquisition Corp. II (NBAB) and III (NBAD)

Both are $100M, 1/2 warrant

NBAB

Focus: Travel, Hospitality, Leisure, Fintech, InsurTech, Proptech in the US

NBAD

Focus: Travel, Hospitality, Leisure, Fintech, InsurTech, Proptech outside of the US

Sponsor’s Previous SPAC to Announce a Deal: New Beginnings Acquisition Corp. (NBA) announced a merger deal with Airspan Networks yesterday. NBA closed the day at $10.18.

4) and 5) GigCapital5 (GIA) and GigCapital6 (GIF)

Both are $350M, 1/3 warrant

GIA

Focus: TMT, Aerospace & Defense, Automation, Sustainability

Executive Chairman: Dr. Avi Katz (Serial SPAC Sponsor)

GIF

Focus: TMT, Cybersecurity, Privacy, Sustainability

Director: Dr. Avi Katz (Serial SPAC Sponsor)

Sponsor’s Previous SPAC to Announce a Deal: GigCapital3 Inc (GIK) announced a merger with Lightning eMotors in December. GIK the day at $11.50.

6) Virgin Group Acquisition Corp. III (VIII)

$500M, 1/5 warrant

Focus: Consumer

Founder: Sir Richard Branson (Founder of the Virgin Group)

CEO & Director: Josh Bayliss (CEO of the Virgin Group),

CFO & Director: Evan Lovell (CIO of the Virgin Group)

Sponsor’s Previous SPAC to Announce a Deal: VG Acquisition Corp (VGAC) announced a merger with 23andMe in early February. VGAC closed the day at $10.73.

7) Panacea Acquisition Corp. II (PANA)

$150M, no warrants

Focus: Biotech

Sponsor’s Previous SPAC to Announce a Deal: Panacea Acquisition (PANA) merged with Nuvation Bio (NUVB) last month. NUVB closed the day at $12.66.

SPACs Leaving the Nest:

Colonnade Acquisition Corp. (CLA) shareholder approved the business combination with Ouster. CLA will begin trading as OUST upon closing of the merger.

Upcoming Dates:

This Week’s Shareholder Meetings:

Wednesday, 3/10:

GigCapital2, Inc (GIX) Shareholder Meeting to Extend Deadline for Business Combination

Thursday, 3/11:

Interprivate Acquisition Corp (IPV) Shareholder Meeting to Approve Business Combination with Aeva

Friday, 3/12:

New Providence Acquisition Corp (NPA) Shareholder Meeting to Extend Deadline for Business Combination

This Week’s Unit Splits (common shares and warrants to commence trading separately from underlying units):

Wednesday, 3/10

European Sustainable Growth Acquisition Corp. (EUSG)

Quantum FinTech Acquisition Corporation (QFTA)

Friday, 3/12

Monument Circle Acquisition Corp. (MON)

If you would like to share the Nightcap nightly newsletter, click the link below.

Thanks for reading,