March 11th, 2021

Good evening,

Thanks for reading “The Nightcap”, a nightly recap of all the day’s highlights in the SPAC world. In this newsletter, you will find a breakdown of the day’s deals, IPO’s, “in talks” reports, and noteworthy new SPAC S-1 filings.

Of course, you can always discover and track all of the SPACs at spactrack.net.

The SPAC Market Stats:

We now officially have more SPAC IPO’s year-to-date than we had in FY 2020.

The Deals:

No deals today.

Deal News Reports:

1) Grab, a Southeast Asian ride-hailing and delivery company, is in talks to merge with a SPAC affiliated with Altimeter Capital at a valuation of $35-40B with a PIPE of $3-4B, according to the WSJ.

The deal would be the biggest SPAC merger to date. The particular Altimeter SPAC was not mentioned, but the two Altimeter SPACs are Altimeter Growth Corp (AGC) and Altimeter Growth Corp 2 (AGCB).

2) Seven Oaks Acquisition Corp. (SVOK) is in talks to merge with Boxed, an online grocery retailer, at a valuation of more than $1B, according to Bloomberg.

Notable IPO’s to begin trading tomorrow:

1) and 2) Gores Technology Partners, Inc. (GTPA.U) and II (GTPB.U)

Focus: Tech

Officers: Alec Gores (Founder and CEO of The Gores Group)

GTPA.U:

$240M, 1/5 warrant

Directors:

Manik Gupta (Former Chief Product Officer of Uber)

Muhammad Shahzad (Former CFO of The Honest Company)

GTPB.U:

$400M, 1/5 warrant

Sponsor’s Previous SPAC to Announce a Deal: Gores Holdings V, Inc (GRSV) announced a merger deal with Ardagh Metal Packaging last month. GRSV closed the day at $10.10.

Other SPAC Activity: Gores now has a total of seven active SPACs with one more that has filed for IPO. Five of the seven are currently searching for a merger partner.

3) Ross Acquisition Corp II (ROSS.U)

Focus: companies that “will benefit from the next industrial revolution” including EV’s, Renewable Energy, Automation/Robotics, Semiconductors, Space, and Transportation.

Officers:

Wilbur Ross (Former US Secretary of Commerce under President Trump)

Directors:

Lord William Astor (Conservative Peer in the House of Lords of the UK Parliament and Chairman of Silvergate Media)

Larry Kudlow (Former Director of the National Economic Council under President Trump and Former host of "The Kudlow Report" on CNBC)

4) Stratim Cloud Acquisition Corp. (SCAQ.U)

$250M, 1/3 warrant

Focus: Software (cloud infrastructure, consumer and enterprise SaaS, and security)

Officers:

Sreekanth Ravi (Founder & Executive Chairman of RSquared AI and Co-Founder & Former CEO of Tely)

Directors:

Scott Wagner (Former CEO of GoDaddy)

Doug Bergeron (Co-managing Partner of Hudson Executive Capital)

5) CF Acquisition Corp. VIII (CFFE.U)

$220M, 1/4 warrant

Focus: Financial Services, Healthcare, Real Estate Services, Tech, & Software

Officers:

Howard Lutnick (Chairman & CEO of Cantor)

Anshu Jain (President of Cantor, Former Co-CEO of Deutsche Bank)

6) FTAC Parnassus Acquisition Corp. (FTPA.U)

$220M, 1/4 warrant

Focus: Tech, Fintech

Officers:

Daniel Cohen (Chairman of Cohen & Company and Chairman of The Bancorp)

Notable S-1 Filings:

1) N2 Acquisition Holdings Corp. (NTWO)

$450M, 1/4 warrant

Officers:

Noam Gottesman (Co-founder & Former CEO of GLG Partners and Founder & Managing Director of Tom’s Capital)

Sir Martin Franklin (Founder & CEO of Mariposa Capital, Founder, Chairman & CEO of Jarden, Former Director of Newell Brands, Burger King Worldwide, and Restaurant Brands International)

Directors:

Steve Stoute (Founder & CEO of UnitedMasters)

2) Brimstone Acquisition Holdings Corp. (BRIM)

$250M, 1/4 warrant

Officers:

Sir Martin Franklin (Founder & CEO of Mariposa Capital, Founder, Chairman & CEO of Jarden, Former Director of Newell Brands, Burger King Worldwide, and Restaurant Brands International)

Michael Goss (Former CFO of Conde Nast and Sotheby’s)

Directors:

Domenico De Sole (Co-Founder of Tom Ford and Former CEO of Gucci Group, Former Chairman of Sotheby's, and Former Director of Conde Nast, Bausch & Lomb, Delta Airlines, Gap, Newell Brands, and Procter & Gamble)

3) Catalyst Partners Acquisition Corp. (CPAR)

$400M, 1/5 warrant

Focus: Enterprise Software

Sponsor Affiliate: General Catalyst

Officers:

Dr. James Cash (Senior Associate Dean, Emeritus, of the Harvard Business School, Director of Chubb, Advisor to General Catalyst Partners, Former Director of Walmart, GE, Microsoft, and Sprint)

Paul Sagan (Former CEO of Akamai Technologies and Director of Moderna and VMware)

Robin Washington (Former CFO of Gilead Sciences, Director of Alphabet, Honeywell International, Salesforce.com, and Veritiv)

Directors:

Ken Chenault (Chairman and Managing Director of General Catalyst, Former Chairman and CEO of American Express, Director of Airbnb and Berkshire Hathaway, Former Director of IBM and Procter & Gamble)

Steven Reinemund (Former Executive Chairman and CEO of PepsiCo, Director of Vertiv, Walmart, Chick-fil-A, and Former Director of Johnson & Johnson, American Express, Exxon Mobil, and Marriott International)

4) Sizzle Acquisition Corp. (SZZL)

$125M, 1/2 warrant

Focus: Restaurant, Hospitality, Food and beverage, Retail, Consumer, Food and Food related Tech, Real Estate, Proptech

Officers:

Steve Salis (Co-founder of &pizza)

Jamie Karson (Former Chairman & CEO of Steve Madden)

SPACs Leaving the Nest:

Interprivate Acquisition Corp (IPV) shareholders approve the business combination with Aeva. IPV will trade as AEVA upon completion of the merger.

Upcoming Dates:

This Week’s Shareholder Meetings and Unit Splits (common shares and warrants to commence trading separately from underlying units)

Friday, 3/12:

New Providence Acquisition Corp (NPA) Shareholder Meeting to Extend Deadline for Business Combination

Unit Split: Monument Circle Acquisition Corp. (MON), Ignyte Acquisition Corp. (IGNY)

Visuals:

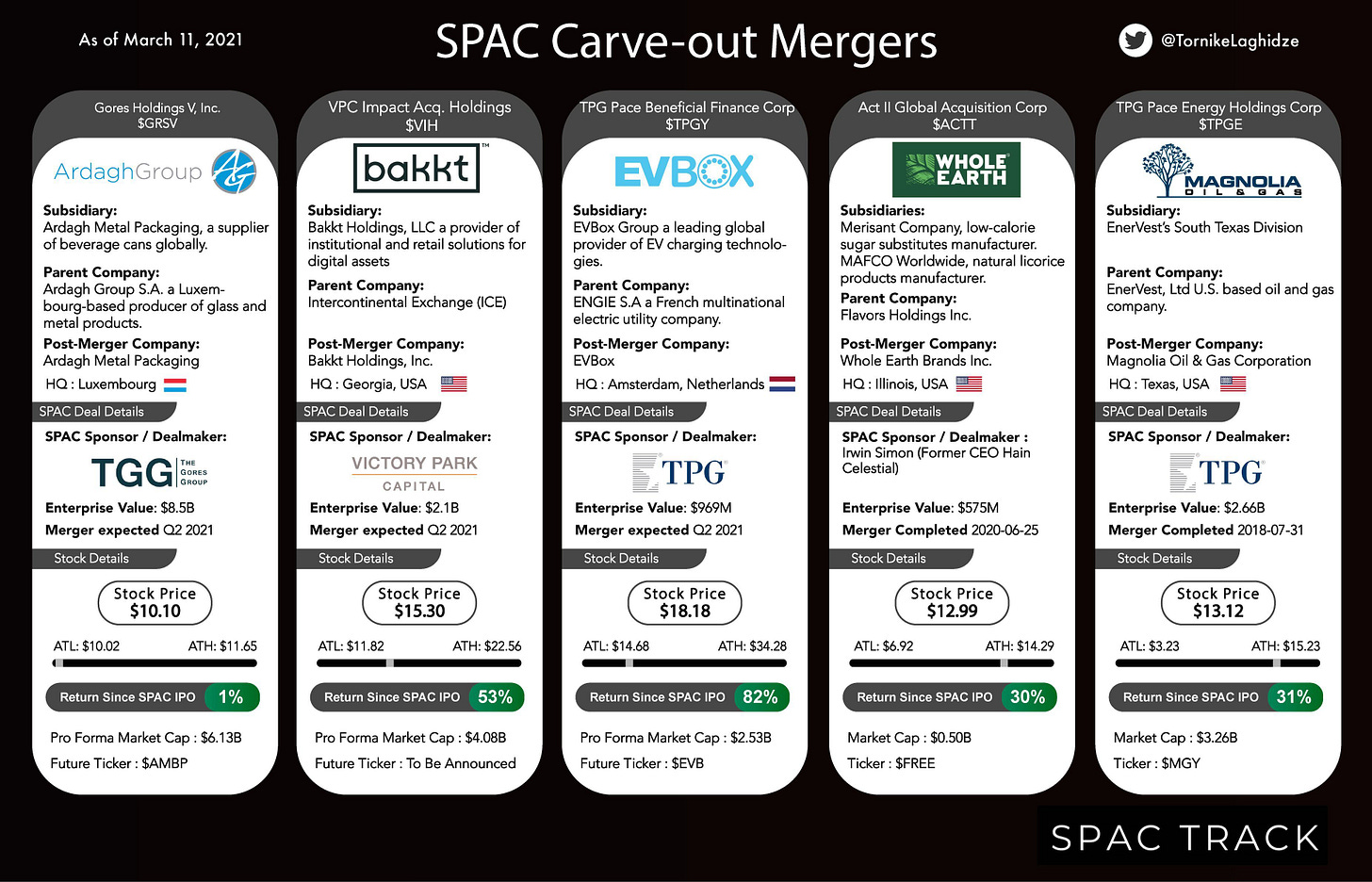

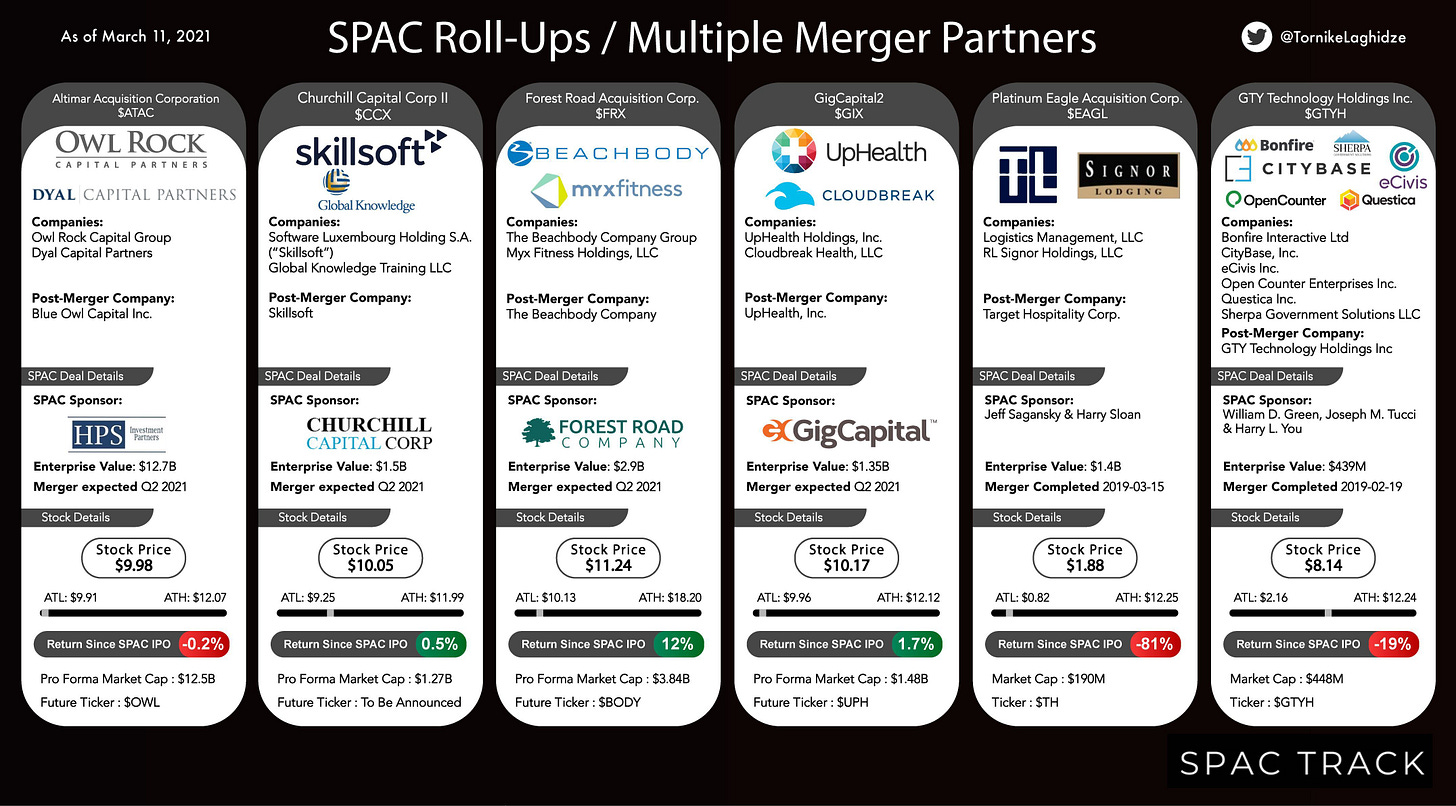

There are now 405 SPACs searching for a merger partner. With the increased competition amongst SPACs, we may see some sponsors getting more creative with their deals. A couple of strategies that we could see more of are: corporate carve-outs/spinouts and roll-ups.

Check out the examples of SPAC carve-out and roll-up mergers in the graphics below:

If you would like to share the Nightcap nightly newsletter, click the link below.

Thanks for reading,