February 8th, 2021

Good evening,

Thanks for reading “The Nightcap”, a nightly recap of all the day’s highlights in the SPAC world. In this newsletter, you will find a breakdown of the day’s deals, IPO’s, “in talks” reports, and noteworthy new SPAC S-1 filings.

Of course, you can always discover and track all of the SPACs at spactrack.net.

The SPAC Market Stats:

Volume Leaders:

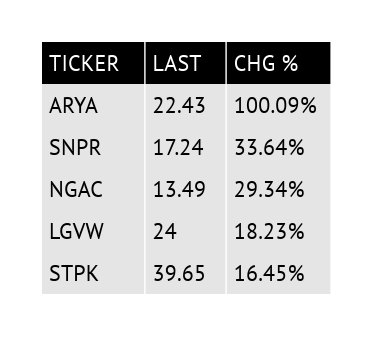

Top Gainers:

Top Losers:

The Deals:

The Morning Deals

1) Tortoise Acquisition Corp II (SNPR) & Volta Industries, a electric vehicle charging network with 1,602 stations across the US.

$1.42B Pro-forma equity value

$300M PIPE including an investment from funds and accounts managed by BlackRock

2) Gores Holdings VI & Matterport, maker of a 3D virtual property tour software platform.

$2.26B EV

$295M PIPE

3) Arya Sciences Acquisition Corp III (ARYA) & Nautilus Biotechnology, developer of “a single-molecule protein analysis platform for quantifying the human proteome”.

$905M EV

$200M PIPE

The Afternoon Deal

4) GreenVision Acquisition Corp (GRNV) & Helbiz, "a technology company that offers micro-mobility solutions", including e-scooters and e-mopeds.

$320.5M EV

$30M PIPE

Deal News Reports:

1) NextGen Acquisition Corp (NGAC) is in talks with Xos Trucks, an electric truck maker (formerly Thor Trucks), at a valuation around $2 billion, according to Reuters.

Today’s Notable IPO’s:

1) Spartan Acquisition Corp. III (SPAQ.U) — will trade tomorrow

$400M, 1/4 warrant

Affiliate of Apollo

Focus: Energy Transition, Sustainability

Spartan Energy Acquisition Corp I (also SPAQ) completed a merger with Fisker Inc. (FSR), electric vehicle maker, last October. FSR closed the day at $14.93

Spartan Acquisition II (SPRQ) announced their merger with Sunlight Financial, a residential solar panel financing company, on January 25th. SPRQ closed the day at $12.76

2) GigCapital4, Inc. (GIGG.U) — will trade tomorrow

$312M, 1/3 warrant

Focus: TMT, Sustainability

The sponsor’s two most recent SPACs announced deals a couple of months ago:

GigCapital2 (GIX) — announced merger with UpHealth and Cloudbreak Health on 11/23 of last year. GIX closed today at $12.74

GigCapital3 (GIK) — announced merger with Lightning eMotors on 12/10 of last year. GIK closed today at $18.24

3) Pivotal Investment Corp. III (PICC.U) — will trade tomorrow

$240M, 1/5 warrant

Focus: “industries ripe for disruption from continuously evolving digital technology and the resulting shift in distribution patterns and consumer purchase behavior”.

Chairman: Jonathan Ledecky (Serial sponsor with 3 completed SPAC mergers and Co-owner of the New York Islanders)

The sponsor’s previous SPAC, Pivotal Investment II closed its merger with XL Fleet (XL) in December of last year. XL closed the day at $20.40

Upcoming Dates:

Tomorrow’s Shareholder Meetings:

INSU Acquisition Corp. II (INAQ) Shareholder Meeting to Approve Business Combination with Metromile

Panacea Acquisition (PANA) Shareholder Meeting to Approve Business Combination with Nuvation Bio

Mountain Crest Acquisition Corp (MCAC) Shareholder Meeting to Approve Business Combination with Playboy

Tomorrow’s Unit Splits (common shares and warrants to commence trading separately from underlying units):

Big Cypress Acquisition Corp (BCYP), Blue Water Acquisition Corp (BLUW)

Visuals are tight:

Update to the SPAC Sponsor Leaderboard below — this only takes quantity of SPACs into consideration.

Thank you for reading.

Thanks,