March 23rd, 2021

Good evening,

Thanks for reading “The Nightcap”, a nightly recap of all the day’s highlights in the SPAC world. In this newsletter, you will find a breakdown of the day’s deals, IPO’s, “in talks” reports, and noteworthy new SPAC S-1 filings.

Of course, you can always discover and track all of the SPACs at spactrack.net.

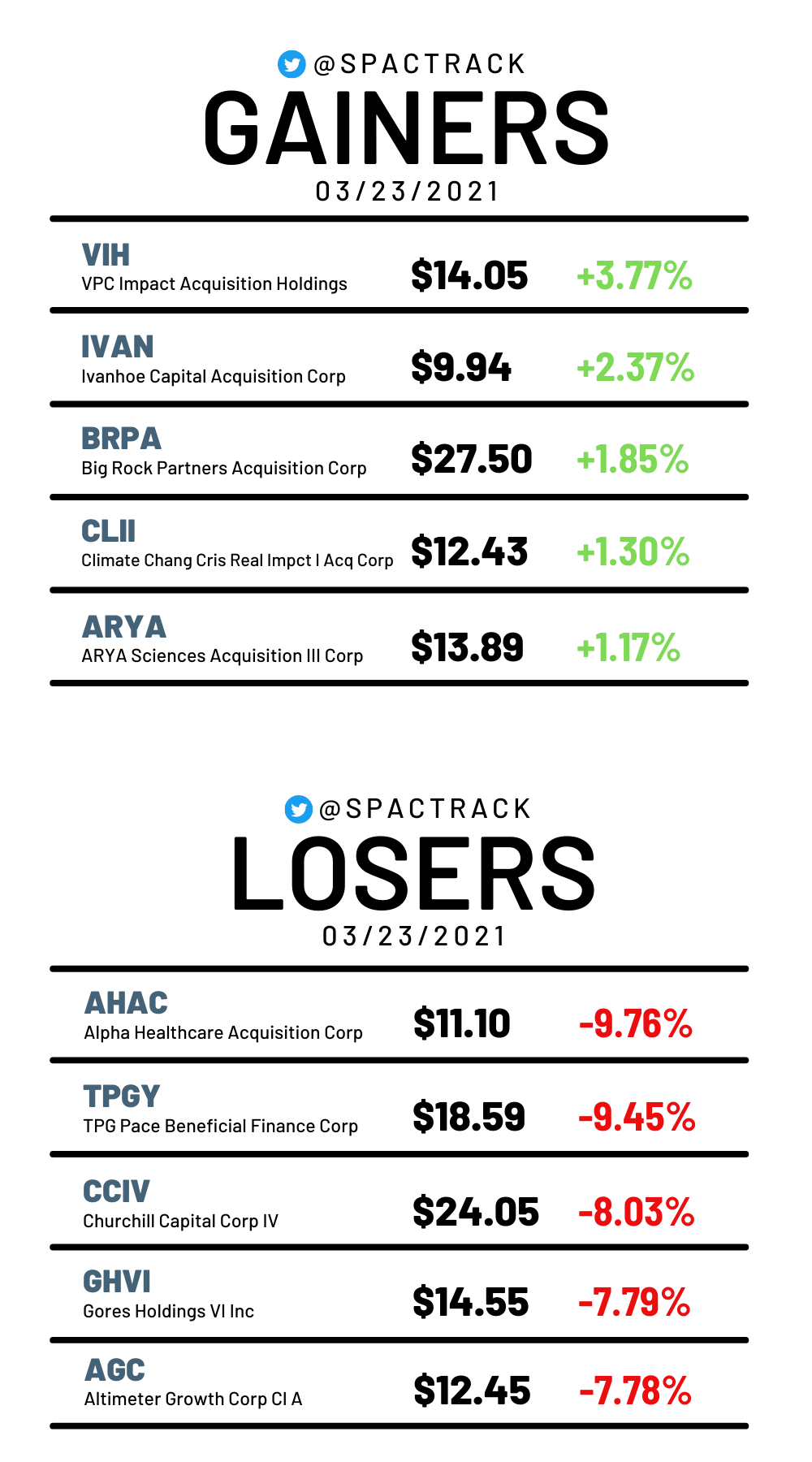

The SPAC Market Stats:

The Deals:

1) Jaws Spitfire Acquisition Corporation (SPFR) & VELO3D, a 3D metal printing technology company.

$1.61B EV

$155M PIPE including investments from Baron Capital Group and Hedosophia

2) Chardan Healthcare Acquisition 2 Corp (CHAQ) & Renovacor, a preclinical stage gene therapy company focused on cardiovascular disease.

$84.6M EV

$30M PIPE

Deal News Reports:

1) Kingswood Acquisition Corp (KWAC) has signed an LOI with Lombard, a UK wealth management group owned by Blackstone, according to Sky News.

Notable IPO’s to begin trading tomorrow:

1) Disruptive Acquisition Corp I (DISA.U)

$250M, 1/3 warrant

Focus: Health and wellness, entertainment, and consumer tech

Officers:

Alexander Davis (Founder & CEO of Disruptive and Founding Managing Director of Ten-X)

Mardy Fish (Former Professional Tennis Player)

Directors:

Karen Finerman (Co-founder & CEO of Metropolitan Capital Advisors)

Galen Smith (CEO of Redbox)

“Athlete Advisory Council” Members:

Justin Verlander (Professional baseball player), Canelo Alvarez Barragan (Mexican professional boxer), Patrick Mahomes II (Professional football player), Naomi Osaka is (Professional tennis player), Robert Lewandowski (Polish professional soccer player)

2) Decarbonization Plus Acquisition Corp III (DCRC.U)

$350M, 1/3 warrant

Focus: Decarbonization

Sponsor’s Previous SPAC Activity: Decarbonization Plus Acquisition Corp I (DCRB) announced a merger deal last week with Hyzon Motors, a hydrogen fuel cell truck company. DCRB closed the day at $10.75.

3) Corazon Capital V838 Monoceros Corp (CRZN.U)

$200M, 1/3 warrant

Focus: Consumer Tech

Officers:

Sam Yagan (CEO of ShopRunner, Former Vice Chairman of Match Group, and Co-founder of OkCupid)

Steve Farsht (Director of TradingView)

Phil Schwarz (Former CMO of Tinder)

Notable S-1 Filings:

1) Avanea Energy Acquisition Corp. (AVEA)

$200M, 1/3 warrant

Focus: Energy Tech in Europe and North America

Officers:

Faysal Sohail (Managing Director at Presidio Partners Management LLC, co-founder of Silicon Architects, executive chairman of the board of InoBat Auto,

Directors:

Andrew Palmer (Former CEO of Aston Martin Lagonda, Founder & Former CEO of Palmer Automotive, and Former Chairman of Infiniti)

Advisors:

Tom Baruch (Founding Partner of Formation 8 Partners, Founding Partner of CMEA Capital, and Senior Advisor to Breakthrough Energy Ventures)

2) Gateway Strategic Acquisition Co. (GCSA)

$300M, 1/2 warrant

Focus: Tech in Real Estate and Healthcare

Officers:

Goodwin Gaw (Chairman, Managing Principal & Co-Founder of GCP

Advisors:

Kenneth Gaw (Managing Principal & Co-Founder of GCP)

3) Swiftmerge Acquisition Corp. (IVCP)

$250M, 1/3 warrant

Focus: Consumer Tech/Internet

Officers:

George Jones (Former CEO of Borders and Former CEO of Saks Department Store Group)

Directors:

General (Ret.) Wesley Clark

Advisors:

Dario Meli (Co-Founder of Hootsuite)

Praveen Varshney (Co-Founder & Director of Mogo)

4) Siddhi Acquisition Corp. (SDHI)

$200M, 1/3 warrant

Focus: Food and Beverage

Directors:

Lauri Kotcher (Former CMO of Godiva Chocolatier)

James Monsees (Co-founder of JUUL Labs)

Advisors:

Susan Kilsby (Director of Unilever & Diageo)

5) Andretti Acquisition Corp. (WNNR)

$250M, 1/2 warrant

Focus: Automotive sector including advanced mobility and related next-generation tech

Officers:

Michael Andretti (Racecar driver and Owner of Andretti Autosport)

Directors:

Zak Brown (CEO of McLaren Racing)

Jim Keyes (Former CEO of Blockbuster and Former CEO of 7-Eleven)

Jerry Putnam (Former CO-COO of NYSE Euronext, Former Co-COO of NYSE Group, and Founder & Former CEO of Archipelago Holdings)

Advisors:

Mario Andretti (Former Racecar driver)

Upcoming Dates:

This Week’s Shareholder Meetings and Unit Splits (common shares and warrants to commence trading separately from underlying units)

Wednesday, March 24th:

Unit Splits: Adara Acquisition Corp. (ADRA), BlueRiver Acquisition Corp. (BLUA)

Thursday, March 25th:

Foley Trasimene Acquisition Corp. II (BFT) Shareholder Meeting to Approve Business Combination with Paysafe

Replay Acquisition Corp (RPLA) Shareholder Meeting to Approve Business Combination with Finance of America Equity Capital

Unit Splits: African Gold Acquisition Corp (AGAC), Thimble Point Acquisition Corp. (THMA)

Friday, March 26th

Unit Splits: The Music Acquisition Corporation (TMAC)

If you would like to share the Nightcap nightly newsletter, click the link below.

Thanks for reading,