March 5th, 2021

Good evening,

Thanks for reading “The Nightcap”, a nightly recap of all the day’s highlights in the SPAC world. In this newsletter, you will find a breakdown of the day’s deals, IPO’s, “in talks” reports, and noteworthy new SPAC S-1 filings.

Of course, you can always discover and track all of the SPACs at spactrack.net.

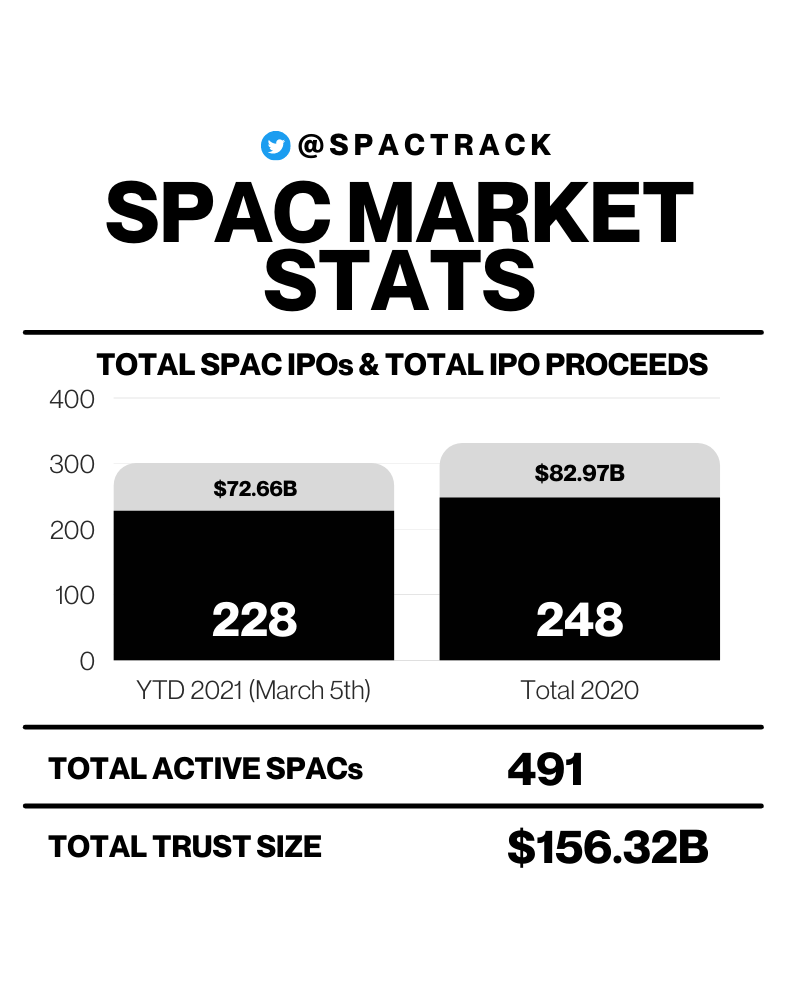

The SPAC Market Stats:

Volume Leaders:

The Deals:

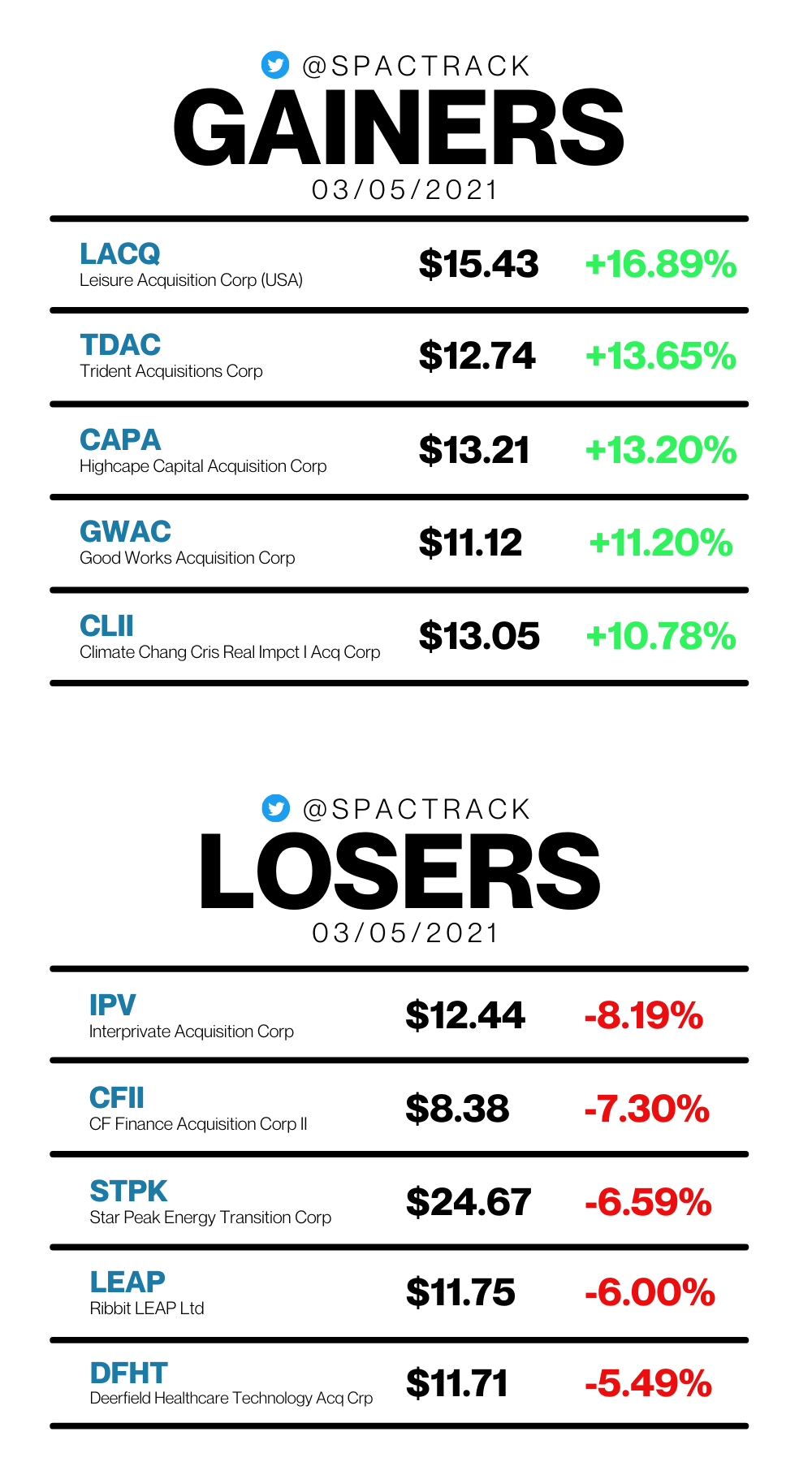

1) Good Works Acquisition Corp. (GWAC) & Cipher Mining, a newly formed US-based Bitcoin mining subsidiary of Bitfury Group.

$2B EV

$425M PIPE

GWAC closed the day at $10.45(-5.9%)

Deal News Reports:

1) Wejo, a British automotive data company, is in talks to merge with an unnamed SPAC at a valuation of more than $2B, according to Reuters.

Notable S-1 Filings:

1) Logistics Innovation Technologies Corp. (LITT)

$400M, 1/3 warrant

Focus: Logistics Tech & Logistics

Chairman & CEO: Alan Gershenhorn (Former Chief Commercial Officer of UPS, Advisor to 8VC, and Director at Beacon Roofing Supply)

CFO & Director: Isaac “Yitz” Applbaum (Co-founder & Partner of MizMaa Ventures, Former Partner of Lightspeed Ventures, and Advisor to 8VC)

Directors:

Bruno Sidler (Former CEO of Panalpina and Former COO of CEVA Logistics)

Chris Sultemeier (Former CEO of Walmart Transportation and Director of Duke Realty Corp)

Andrew Clarke (Former CFO of C.H. Robinson)

Advisors:

Jake Medwell (Founding Partner of 8VC and Co-founder & Director of The Kairos Society)

Michael McLary (CEO of Ascend Transportation and Former President of Truckload Brokerage at Amazon)

2) Victory Acquisition Corp. (VACI)

$250M, 1/3 warrant

Focus: Media, sports, and entertainment

CEO & Director: James Lites (Executive Chairman of the Dallas Stars)

Directors:

Sammy Hagar (“Frontman” of Van Halen and Founder of Cabo Wabo Cantina restaurants & Tequila)

Roger Staubach (Pro Football Hall of Famer, Former Exec Chairman of JLL Americas, Former Exec Chairman of The Staubach Company, and Former Director of Cinemark Holdings)

3) Moose Pond Acquisition Corp, NCV I (MOOS)

$200M, 1/3 warrant

Focus: Consumer Tech

CEO & Director: Cotter Cunningham (Founder & Former Chairman & CEO of RetailMeNot and Former COO of Bankrate)

Chairman: Brian Sharples (Founder & Former CEO of HomeAway, Director of GoDaddy, Avalara, Yelp, & Ally Financial)

4) Climate Real Impact Solutions III Acquisition Corporation (CLIC)

$300M, 1/5 warrant

Focus: Carbon avoidance and removal

CEO: David Crane (Former CEO of IPR and NRG)

CCO: Beth Comstock (Former CMO & CCO of GE, and Director at Nike)

Sponsor’s Previous SPAC to Announce a Deal: Climate Change Crisis Real Impact I Acquisition Corp (CLII) announced a merger deal with EVgo in January. CLII closed the day at $13.05.

5) Chardan NexTech Acquisition Corp. (CNAQ)

$200M, 1/3 warrant

Focus: Healthtech, Fintech

Chairman: Kerry Propper (Co-founder & Former CEO of Chardan)

CFO: Steven Urbach (Co-founder & CEO of Chardan)

Sponsor’s Previous SPAC to Announce a Deal: Chardan Healthcare Acquisition (CHAC) merged with BiomX (PHGE) in October of 2019. PHGE closed the day at $7.04.

SPACs Leaving the Nest:

CF Finance Acquisition Corp II (CFII) shareholders approve the business combination with View. Will trade as VIEW upon closing of the merger.

Upcoming Dates:

Next Week’s Shareholder Meetings:

Monday, 3/8:

GigCapital2, Inc (GIX) Shareholder Meeting to Extend Deadline for Business Combination

Tuesday, 3/8:

Colonnade Acquisition Corp. (CLA) Shareholder Meeting to Approve Business Combination with Ouster

Thursday, 3/11:

Interprivate Acquisition Corp (IPV) Shareholder Meeting to Approve Business Combination with Aeva

Friday, 3/12:

New Providence Acquisition Corp (NPA) Shareholder Meeting to Extend Deadline for Business Combination

Next Week’s Unit Splits (common shares and warrants to commence trading separately from underlying units):

Monday, 3/8

Environmental Impact Acquisition Corp. (ENVI), Healthcare Capital Corp. (HCCC), Hennessy Capital Investment Corp. V (HCIC), Authentic Equity Acquisition Corp. (AEAC), Class Acceleration Corp. (CLAS)

Tuesday, 3/9

CA Healthcare Acquisition Corp. (CAHC)

Wednesday, 3/10

European Sustainable Growth Acquisition Corp. (EUSG)

If you found this newsletter useful and you’re not already subscribed, you can subscribe below.

If you would like to share the Nightcap nightly newsletter, click the link below.

Thanks for reading,