May 12th, 2021

Good evening,

Thanks for reading “The Nightcap”, a nightly recap of all the day’s highlights in the SPAC world. In this newsletter, you will find a breakdown of the day’s deals, IPO’s, “in talks” reports, and noteworthy new SPAC S-1 filings.

Of course, you can always discover and track all of the SPACs at spactrack.net.

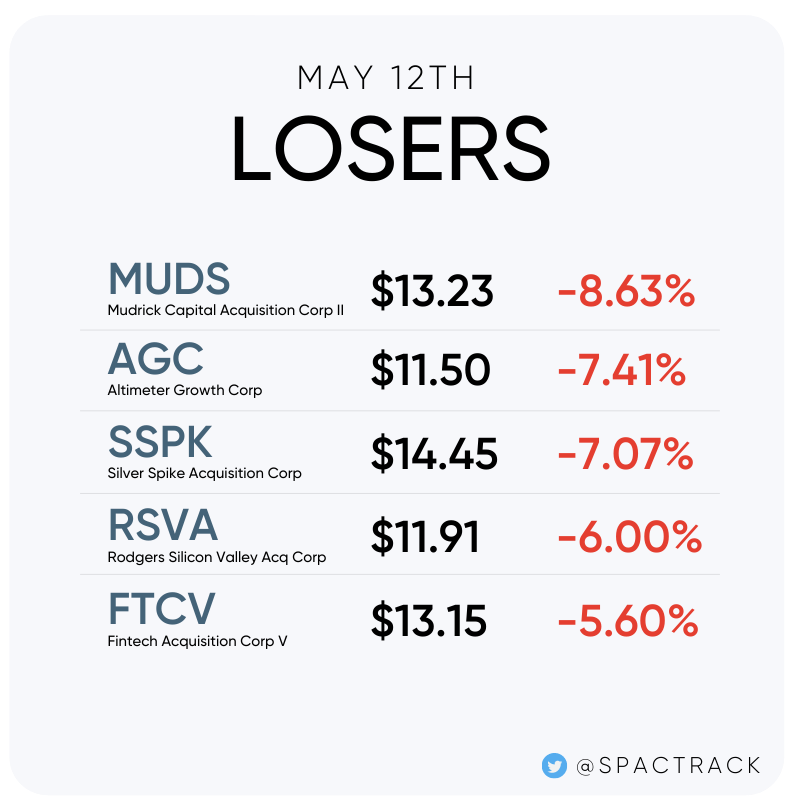

The Stats:

The Deals:

1) Switchback II Corporation (SWBK) & Bird Rides

$2.28B EV

$160M PIPE

2) Centricus Acquisition Corp. (CENH) & Arqit Limited

Centricus Acquisition Corp. to Combine with Arqit Limited, A Leader in Quantum Encryption Technology

$1.03B EV

$71M PIPE

Deal News Reports:

None today.

New S-1 Filings:

None today.

Notable SPAC News:

1) Inflation and 3 More Factors That Are Popping the EV Stock Bubble (Barron’s)

Stock in Churchill Capital Acquisition Corp. IV (CCIV), the SPAC merging with Lucid Motors, is down about 73% from its 52-week high. Hyliion (HYLN) shares are down about 86%. And the Chinese EV makers NIO (NIO), XPeng (XPEV) and Li Auto (LI) have fallen an average of about 45% from their 52-week highs.

Inflation is just the latest problem for the stocks. More competition in the EV business, with traditional auto makers pouring billions into developing vehicles, is one problem. At the same time, the global shortage of semiconductors is constraining automotive production around the globe, making it hard for EV makers to benefit from red-hot demand for cars and rising gasoline price.

What is more, many of the new EV companies became public by merging with special-purpose acquisition companies. Many SPAC stocks, not just the EV-related ones, are struggling. The Defiance Next Gen SPAC Derived ETF (SPAK) is down 34% from its February 52-week high.

A dozen EV-SPAC companies Barron’s tracks are now down 15% over the past year on average. Only five remain above their SPAC merger price of $10 a share: Lucid, Fisker (FSR), Arrival (ARVL), QuantumScape (QS), and Nikola (NKLA).

Investors might believe that means those are the long-term winners among the EV SPAC stocks. But it is also possible their higher prices mean there is still further to fall.

Upcoming Dates:

This Week’s Shareholder Meetings and Unit Splits (common shares and warrants to commence trading separately from underlying units)

Thursday, May 13th

Unit Splits: Supernova Partners Acquisition Co III, Ltd. (STRE), Forum Merger IV Corporation (FMIV), ArcLight Clean Transition Corp. II (ACTD), TB SA Acquisition Corp (TBSA), Gores Guggenheim, Inc. (GGPI), Virgin Group Acquisition Corp. II (VGII), NextGen Acquisition Corp II (NGCA)

Friday, May 14th

GX Acquisition Corp (GXGX) Shareholder Meeting to Extend Deadline for Business Combination

Unit Splits: Disruptive Acquisition Corporation I (DISA)

If you found this newsletter useful and you aren’t a subscriber yet, subscribe for free here:

Thanks for reading,