February 26th, 2021

Good evening,

Thanks for reading “The Nightcap”, a nightly recap of all the day’s highlights in the SPAC world. In this newsletter, you will find a breakdown of the day’s deals, IPO’s, “in talks” reports, and noteworthy new SPAC S-1 filings.

Of course, you can always discover and track all of the SPACs at spactrack.net.

The SPAC Market Stats:

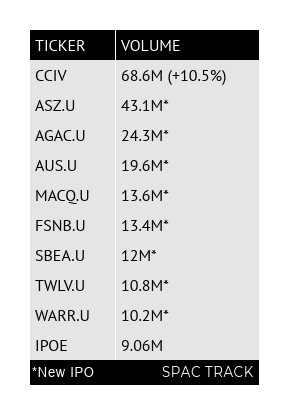

Volume Leaders:

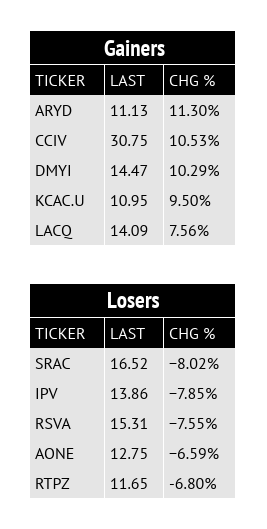

Top Gainers and Losers:

The Deals:

No deals today.

Deal News Reports:

No deal news reports today.

Notable S-1 Filings:

1) Foresite Life Sciences Corp. (Ticker not yet available)

$250M shares, no warrants

Focus: Biotech, Life Sciences

President, CEO, & Director: Jim Tananbaum (Founder & CEO of Foresite Capital)

Sponsor’s Previous SPAC to Announce a Deal: (FSDC) merged with Gemini Therapeutics (GMTX) earlier this month. GMTX closed the day at $15.20.

2) and 3) RMG Acquisition Corp. IV (RMGD) and VII (RMGG)

Executive Chairman & Director: James Carpenter (CEO of Riverside Management Group)

CEO: Robert Mancini (Chairman of Romeo Power)

Advisors:

Jeffrey Bornstein (Former Vice Chairman & CFO of GE)

Randel Falco (Former Chairman & CEO of AOL)

Edward Forst (Former CEO of Cushman & Wakefield)

Eric Smith (Former CEO of Swiss Re Americas)

RMGD

$275M, 1/5 warrant

RMGG

$725M, 1/5 warrant

Sponsor’s Previous SPACs to Announce a Deal:

RMG Acquisition Corp (RMG) merged with Romeo Systems (RMO) in December of last year. RMO closed the day at $12.33.

RMG Acquisition Corp. II (RMGB) announced a merger deal with ReNew Power this week. RMGB closed the day at $11.00.

4) FAST Acquisition Corp. II (FZT)

$200M, 1/4 warrant

Focus: Restaurant, Hospitality

CEO & Director: Sandy Beall (Founder of Ruby Tuesday),

Chairman: Kevin Reddy (Former COO of Chipotle and CEO of Noodles & Company)

Director: Michael Lastoria (Co-founder and CEO of &pizza)

Sponsor’s Previous SPAC to Announce a Deal: FAST Acquisition Corp. (FST) announces a merger deal with Fertitta Entertainment early this month. FST closed the day at $11.48.

5) Blueprint Health Merger Corp. (Ticker not yet available)

$200M, 1/3 warrant

Focus: Digital Health

CEO & Director: Dr. Rajiv Kumar (Chief Medical Officer of Virgin Pulse)

Vice Chairman: Neil Parikh (Co-founder & Director of Casper Sleep)

Director: Richard Harrington (Former CEO of Thomson Reuters, Former Director of Aetna & Xerox)

6) Build Acquisition Corp. (BGSX)

$200M, 1/3 warrant

Focus: SaaS, Infrastructure Software, Fintech

Chairman & Co-CEO: Lanham Napier (Former CEO of Rackspace)

Director: Owen Van Natta (Former COO of Facebook, Former CEO of MySpace, Former Director of Zynga)

7) and 8) Tiga Acquisition Corp II (TTO) and II (TTRE)

Chairman & CEO: Raymond Zage (CEO of Tiga Investments)

TTO:

$200M, 1/4 warrant

TTRE:

$300M, 1/4 warrant

9) Cornerstone Investment Capital Holdings Co. (CSIC)

$250M, 1/3 warrant

Focus: Tech

Chairman & CEO: Robert Greifeld (Former Chairman & CEO of Nasdaq, Chairman of Virtu Financial)

10) Switchback III Corporation (SWBT)

$275M, 1/5 warrant

Focus: Energy Transition, Sustainability

Director: Philip Deutch (Former COO of Social Capital)

Sponsor’s Previous SPAC to Announce a Deal: Switchback Energy Acquisition Corp (SBE) completed its merger with ChargePoint (CHPT) today. SBE (will be CHPT on Monday) closed the day at $30.83.

11) TortoiseEcofin Acquisition Corp. III (TRTL)

$300M, no warrants

Focus: Energy Transition, Sustainability

Sponsor’s Previous SPACs to Announce a Deal:

Tortoise Acquisition Corp (SHLL) merged with Hyliion (HYLN) in October of last year. HYLN closed the day at $15.12.

Tortoise Acquisition Corp. II (SNPR) announced a merger deal with Volta Industries earlier this month. SNPR closed the day at $12.74.

12) Big Sky Growth Partners (BSKY)

$300M, 1/5 warrant

Focus: Internet Retail and Direct-to-Consumer

Chairman & CEO: Mark Vadon (Co-founder of Zulily, Former Chairman of Chewy)

Directors:

Joseph Zwillinger (Co-founder of Allbirds)

Michael Smith (Director & Former COO of Stitch Fix, Former COO of Walmart.com, Director of Ulta Beauty)

SPACs Leaving the Nest:

Switchback Energy Acquisition Corporation (SBE) announced the closing of the business combination with Chargepoint.

The new company, “ChargePoint Holdings” is expected to begin trading on the NYSE as CHPT on Monday, March 1st.

Upcoming Dates:

Next Week’s Shareholder Meetings:

Friday, 3/5:

CF Finance Acquisition Corp II (CFII) Shareholder Meeting to Approve Business Combination with View

Next Week’s Unit Splits (common shares and warrants to commence trading separately from underlying units):

Monday, 3/1:

Locust Walk Acquisition Corp. (LWAC), Provident Acquisition Corp. (PAQC), Ivanhoe Capital Acquisition Corp. (IVAN), Empowerment & Inclusion Capital I Corp. (EPWR), KL Acquisition Corp (KLAQ), Tastemaker Acquisition Corp. (TMKR), Prospector Capital Corp. (PRSR), Bright Lights Acquisition Corp. (BLTS), KludeIn I Acquisition Corp. (INKA)

Wednesday, 3/3

Adit EdTech Acquisition Corp. (ADEX)

Thank you for reading.

Thanks,