February 23rd, 2021

Good evening,

Thanks for reading “The Nightcap”, a nightly recap of all the day’s highlights in the SPAC world. In this newsletter, you will find a breakdown of the day’s deals, IPO’s, “in talks” reports, and noteworthy new SPAC S-1 filings.

Of course, you can always discover and track all of the SPACs at spactrack.net.

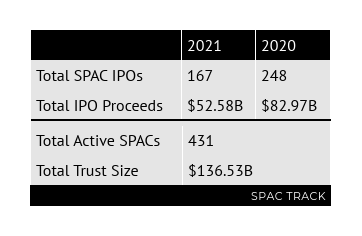

The SPAC Market Stats:

Volume Leaders:

Top Gainers and Losers:

The Deals:

1) Gores Holdings V, Inc (GRSV) & Ardagh Group’s metal packaging unit, Ardagh Metal Packaging, a producer of “infinitely”-recyclable metal beverage and glass packaging.

$8.5B EV

$600M PIPE

Deal News Reports:

1) DMY Technology Group Inc. III (DMYI) is in advanced talks to merge with IonQ, a quantum computing company, at a valuation of around $2B, according to Bloomberg.

Silver Lake, MSD Partners, Bill Gates’ Breakthrough Energy, and an affiliate of Hyundai Motor Co are in talks to invest in the PIPE.

2) RMG Acquisition Corp. II (RMGB) is close to a merger deal with ReNew Power, India’s largest renewable energy producer, at an enterprise value of $8B, according to Bloomberg. The PIPE is said to be $855M and to include investments from Chamath Palihapitiya and funds and accounts managed by BlackRock.

3) Sustainable Opportunities Acquisition Corp. (SOAC) is in talks to merge with DeepGreen Metals, a producer of metals obtained from seafloor deposits for use in electric vehicle batteries, at around a $2.8B valuation, according to Bloomberg.

Notable IPO’s:

1) Soaring Eagle Acquisition Corp. (SRNG.U) — will trade tomorrow

$1.5B, 1/5 warrant

Chairman & CEO: Harry Sloan (Former Chairman & CEO of MGM)

Jeff Sagansky (Former President of CBS Broadcasting) is one of the Managing Members of the sponsor.

Sloan and Sagansky’s most recent SPAC, Flying Eagle Acquisition Corp (FEAC) merged with Skillz (SKLZ) in December of last year. SKLZ closed the day at $30.96.

2) BOA Acquisition Corp. (BOAS.U) — will trade tomorrow

$220M, 1/3 warrant

Focus: PropTech

Chairman: Scott Seligman (Chairman, The Seligman Group)

Director: Shane Battier (Former NBA player; VP of Analytics and Basketball Development, Miami Heat)

Strategic Advisor: David Glazer (CFO, Palantir)

Notable S-1 Filings:

1) Guggenheim Special Purpose Acquisition Corp. I (GGI)

$500M, 1/3 warrant

Focus: Financial Services

CEO and Director: Andrew Rosenfield (President of Guggenheim Partners)

2) Khosla Ventures Acquisition Co. IV (KVSD)

$200M, no warrants

Focus: Companies with highly differentiated proprietary technology

Founder: Vinod Khosla (Founder, Khosla Ventures)

Directors:

Jagdeep Singh (Founder, Chairman, and CEO of QuantumScape)

Rajiv Shah (President of the Rockefeller Foundation)

3) Acies Acquisition Corp. II (ATWO)

$250M, 1/4 warrant

Focus: Live, location-based, and mobile experiential entertainment

Chairman: James Murren (Former CEO of MGM Resorts International and Co-chair of Cirque du Soleil)

Directors:

Sam Kennedy (CEO of the Boston Red Rox)

Curtis Polk (Managing Partner of Hornets Sports & Entertainment and the manager of Michael Jordan’s financial and business affairs)

Acies Acquisition Corp. (ACAC) announced a merger deal with PLAYSTUDIOS on February 1st. ACAC closed the day at $10.41.

4 and 5) Graf Acquisition Corp. III (GRAF) and Graf Acquisition Corp. IV (GFOR)

CEO & Director: James Graf (Former CEO of Graf Industrial Corp)

GRAF

$300M, 1/3 warrant

GFOR

$150M, 1/3 warrant

Graf Acquisition Corp (GRAF) merged with Velodyne Lidar (VLDR) last September. VLDR closed the day at $16.26.

6) Queen's Gambit Growth Capital II (QWNB)

$300M, 1/4 warrant

Focus: “Solutions promoting sustainable development, economic growth and prosperity”

CEO & Director: Victoria Grace (CEO of Colle Capital Partners)

CFO: Anastasia Nyrkovskaya (CFO of Fortune Media)

Director: Lone Fonss Schroder (Director of IKEA Group and Volvo Car Group)

7 and 8) Galliot Acquisition Corp. (TWCG) & Bilander Acquisition Corp. (TWCB)

Focus: Tech

Chairman & CEO: James Greene, Jr. (Founding Partner of True Wind Capital)

Directors:

Lee Kirkpatrick (Former CFO of Twilio)

Scott Wagner (Former CEO of GoDaddy)

TWCG

$250M, 1/6 warrant

TWCB

$150M, 1/6 warrant

Nebula Caravel Acquisition Corp (NEBC), one of two of the sponsor’s other active SPACs, announced a merger deal with Rover on February 11th. NEBC closed the day at $10.56.

Upcoming Dates:

This Week’s Shareholder Meetings:

Thursday, 2/25:

Switchback Energy Acquisition Corporation (SBE) Shareholder Meeting to Approve Business Combination with ChargePoint

This Week’s Unit Splits (common shares and warrants to commence trading separately from underlying units):

Friday, 2/26:

Sports Ventures Acquisition Corp. (AKIC)

Kairos Acquisition Corp. (KAIR)

Thank you for reading.

Thanks,