The Nightcap from SPAC Track

The Nightcap newsletter: SPAC Track’s nightly recap of the action in the SPAC world. (January 7, 2022)

Discover and track all of the SPACs at spactrack.io

If you haven’t subscribed to this Free nightly newsletter, you can do so below.

Exactly one year to the day after Chamath Palihapitiya’s last SPAC deal announcement ⤵️, we have news that one of his four biotech SPACs is in talks with a kidney restoration company.

Quick kidney joke to elicit eyerolls from everyone you tell:

Donate one kidney, they call you a hero. Donate two, they call you a saint.

But donate three or more and suddenly, you’re a “monster.”

The Stats:

The Deals:

None today

News:

Palihapitiya SPAC Is Said to Be in Talks With ProKidney (Bloomberg)

A blank-check firm started by serial dealmaker Chamath Palihapitiya and Suvretta Capital is in merger talks with medical technology company ProKidney LLC, according to people with knowledge of the matter.

The combined company would be valued at more than $1 billion in a transaction, the people said, asking not to be identified discussing private information. An announcement could come as soon as next week, the people said.

ProKidney and the special purpose acquisition company, Social Capital Suvretta Holdings Corp. III (DNAC), haven’t reached a final agreement and it’s possible talks could end without one, they added.

Representatives for ProKidney and the SPAC didn’t immediately respond to requests for comment.

ProKidney is developing a technology that restores kidney function by using the patient’s own cells, according to its website. The company was started by a group of investors led by Pablo Legorreta, the founder and chief executive officer of Royalty Pharma Plc.

Winston-Salem, North Carolina-based ProKidney acquired InRegen and its affiliate Twin City Bio in 2019 in a $62 million transaction, according to a statement at the time.

Carousell, L Catterton Said in $1.5 Billion SPAC Deal Talks (Bloomberg)

Carousell Pte, a Singapore-based online classifieds marketplace operator, is in talks to go public through a merger with blank-check company L Catterton Asia Acquisition Corp. (LCAA), according to people familiar with the matter.

A transaction could value the combined entity at as much as $1.5 billion, the people said, asking not to be identified because the information is private. Carousell has entered into exclusive talks with the special purpose acquisition company, the people said.

The U.S.-listed SPAC is backed by L Catterton, the $30 billion buyout firm minority-owned by Paris-based luxury goods company LVMH Moet Hennessy Louis Vuitton SE and billionaire Bernard Arnault’s investment firm.

The SPAC plans to carry out due diligence on Carousell over the coming weeks with the goal of reaching a merger agreement as early as this quarter, the people said. The deal may include a private investment in public equity, or PIPE, worth a few hundred million dollars, the people said.

Considerations are ongoing and there’s no certainty the talks will result in a deal, the people said, adding details such as timing and valuation could change. Representatives for Carousell and L Catterton declined to comment.

Virgin tycoon Sir Richard Branson to launch first SPAC on European stock exchange (Sky News)

Sky News has learnt that Virgin Group is drawing up detailed plans to list a new special purpose acquisition company (SPAC) in Amsterdam in the coming months.

Sir Richard's business is working with bankers on a listing, which could be announced as soon as the first quarter of 2022, according to insiders.

The news may be interpreted as a snub to the London market given that Virgin Group is based in the UK and that British regulators have reformed listing rules to make it easier to pursue SPAC deals in London.

One source said the Amsterdam-listed vehicle would probably seek to raise an initial sum of around €200m, although the final details have yet to be determined.

Merger Votes/ Completions:

Merger Vote Set:

Ivanhoe Capital Acquisition Corp. (IVAN) & SES Holdings: 2/1

Quick News:

Vickers Vantage Corp. I (VCKA) extends its deadline to 4/11 by depositing a ~$1M non-interest bearing loan into the trust (can be repaid after closing a merger or converted into warrants at a price of $0.75 per warrant)

AGBA Acquisition Limited (AGBA) and TAG Holdings enter into merger amendment including, among other things, the extension of the outside date from 1/31 to 4/30

If you find this newsletter useful, feel free to share it with a friend and suggest they subscribe:

S-4 Activity:

Pro subscriber content only

Tracking De-SPAC S-1s (including PIPE resale registrations):

Pro subscriber content only

New S-1s:

None today

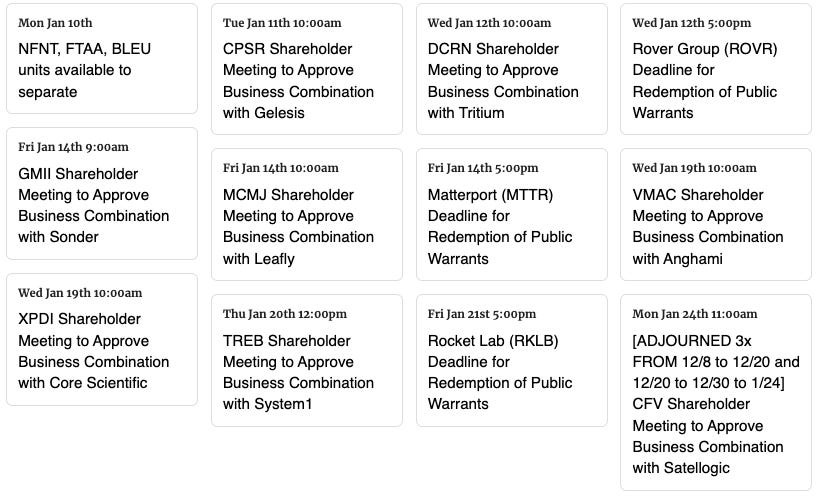

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions, Earnings, and Expected Ticker Changes

See the full calendar here.

The Pro edition of the Nightcap newsletter is sent to SPAC Track Pro subscribers and includes: deal details, S-1 registration details, S-4 merger filing updates, post-closing S-1 updates (incl. PIPE share registrations), and quick links to investor presentations, press releases, and relevant filings.

Sign up for SPAC Track Pro with 10% off of the first month or the first year of the annual subscription with the coupon: ‘10NIGHTCAP2022’.The Pro edition of the Nightcap newsletter is sent to SPAC Track Pro subscribers and includes: deal details, S-1 registration details, S-4 merger filing updates, post-closing S-1 updates (incl. PIPE share registrations), and quick links to investor presentations, press releases, and relevant filings.

Sign up for SPAC Track Pro with 10% off of the first month or the first year of the annual subscription with the coupon: ‘10NIGHTCAP2022’.

Thanks for reading,