The Nightcap from SPAC Track

The Nightcap newsletter: SPAC Track’s nightly recap of the action in the SPAC world. (January 10, 2021)

Discover and track all of the SPACs at spactrack.io

If you haven’t subscribed to this Free nightly newsletter, you can do so below.

The Stats:

The Deals (0):

News:

SEC Pushes for More Transparency From Private Companies (WSJ)

The Securities and Exchange Commission is preparing to force more transparency from big private companies, as regulators grow concerned about the lack of oversight of the private fundraising that has fueled their rise.

Private capital markets have become an increasingly popular way for companies to raise money in the U.S. in recent decades, allowing firms to acquire funding from institutions and wealthy individuals without the regulatory burdens of going public. The number of so-called unicorns—private companies valued at $1 billion or more—has continued to grow even amid the recent boom in initial public offerings.

The SEC, Wall Street’s top regulator, has begun work on a plan to require more private companies to routinely disclose information about their finances and operations, according to a semiannual rule-making agenda and people familiar with the matter. It is also considering tightening the qualifications that investors must meet to access private markets, and increasing the amount of information that some nonpublic companies must file with the agency.

“When they’re big firms, they can have a huge impact on thousands of people’s lives with absolutely no visibility for investors, employees and their unions, regulators, or the public,” said Democratic SEC Commissioner Allison Lee, who has called for the change. “I’m not interested in forcing medium- and small-sized companies into the reporting regime.”

The SEC’s push is at an early stage, but it is likely to garner stiff resistance from Silicon Valley and other sectors, such as oil and natural-gas infrastructure, that rely heavily on funding from private markets. The information that public companies have to disclose—about their earnings, business outlooks, risks and manager pay—is closely guarded by private companies.

Merger Votes/ Completions:

Capstar Special Purpose Acquisition Corp. (CPSR) released redemption numbers ahead of its shareholder vote to approve its merger with Gelesis

27.3M shares were redeemed or an estimated ~99% of the public SPAC shares… a record!

Decarbonization Plus Acquisition Corporation II (DCRN) announces that the merger with Tritium is on track to be approved at the shareholder meeting scheduled for 1/12

Merger Vote Set:

Quick News:

Trebia Acquisition Corp. (TREB) added backstop commitments from Cannae bringing the total backstop commitments to $250M (from $200M) for its merger with System1

The transaction now includes up to $650M of committed financing including a $400M term loan and the $250M backstop commitment

The merger is expected to close on 1/24 with the ticker change to SST on 1/25

If you find this newsletter useful, feel free to share it with a friend and suggest they subscribe:

S-4 Activity:

Pro subscriber content only

Tracking De-SPAC S-1s (including PIPE resale registrations):

Pro subscriber content only

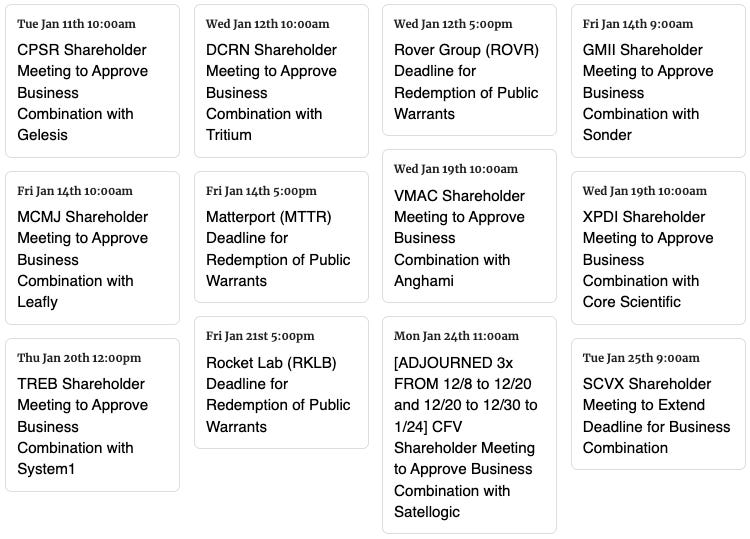

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions, Earnings, and Expected Ticker Changes

See the full calendar here.

The Pro edition of the Nightcap newsletter is sent to SPAC Track Pro subscribers and includes: deal details, S-1 registration details, S-4 merger filing updates, post-closing S-1 updates (incl. PIPE share registrations), and quick links to investor presentations, press releases, and relevant filings.

Sign up for SPAC Track Pro with 10% off of the first month or the first year of the annual subscription with the coupon: ‘10NIGHTCAP2022’.The Pro edition of the Nightcap newsletter is sent to SPAC Track Pro subscribers and includes: deal details, S-1 registration details, S-4 merger filing updates, post-closing S-1 updates (incl. PIPE share registrations), and quick links to investor presentations, press releases, and relevant filings.

Sign up for SPAC Track Pro with 10% off of the first month or the first year of the annual subscription with the coupon: ‘10NIGHTCAP2022’.

Thanks for reading,