The Nightcap from SPAC Track

The Nightcap newsletter: SPAC Track’s nightly recap of the action in the SPAC world. (December 21, 2021)

IMPORTANT UPDATE ON THE NIGHTCAP NEWSLETTER:

This detailed version of the Nightcap newsletter will become the Pro version beginning next Monday, December 27th. It will be exclusively offered to SPAC Track Pro subscribers.

The free version of the Nightcap newsletter, however, isn’t going anywhere! We will still be sliding into your inbox nightly to keep you up to date on all of the key news in the SPAC world (stories, deals, S-1s, IPOs ++) — the Pro version will just be much more detailed.

What will be the difference between the Free and the Pro version of the nightly Nightcap newsletter?

The Pro version of the Nightcap newsletter will contain much more detail (that will not be included in the free newsletter):

deal details (valuation, PIPE & additional financing details, merger partner descriptions)

S-1 details (unit & warrant details, focus, and notable leadership)

S-4 filing updates

post-closing S-1 updates (incl. PIPE registrations)

quick links to investor presentations, press releases, and relevant filings

The Pro version is essentially the current Nightcap that has been sent out for many months with some new recent additions (such as S-4 filing updates).

How do I sign up to continue receiving the free Nightcap newsletter?

If you are receiving this email in your inbox, no need to do anything! You’re already subscribed. If you did not already subscribe (this email didn’t hit your inbox directly) here is the link to do so (free version):

What do I get with a SPAC Track Pro subscription?

SPAC Track Pro is a premium SPAC information service to discover, track, and analyze SPACs & De-SPACs. The Pro version of our SPAC Screener comes with 4x more data points than the free version and includes several other useful features such as premium filters and table views, a unified view of SPACs and De-SPACs, as well as unlimited downloads of the Active & De-SPAC list.

In addition, you will now receive the Pro version of the nightly Nightcap newsletter, which provides a highly detailed view of the daily activity in the SPAC world!

From now until the end of the year, we are offering 20% off of the first month or the first year of the annual subscription with the coupon: ‘20NIGHTCAP2021’.

To learn more about Pro and subscribe, click the link below!

Feel free to reach out with any questions or inquiries at spactrack@commonfi.com.

The Stats:

The Deals:

1) Zanite Acquisition Corp. (ZNTE: warrants +38.76%) & Eve, an Embraer company

Merger Partner Description:

Eve is dedicated to accelerating the UAM ecosystem. Benefitting from a startup mindset, backed by Embraer's more than 50-year history of aerospace expertise, and with a singular focus, Eve is taking a holistic approach to progressing the UAM ecosystem, with an advanced eVTOL project, a comprehensive global services and support network and a unique air traffic management solution.

Valuation: $2.37B EV

PIPE: $305M including $175M from Embraer, $25M from the sponsor, and $105M from investors including Azorra Aviation, BAE Systems, Bradesco BBI, Falko Regional Aircraft, Republic Airways, Rolls-Royce, and SkyWest

“In connection with such commitments, Embraer has entered into arrangements with certain of such strategic investors to provide them with price protections in the amount of up to their $30 million aggregate commitments in the form of credits for parts and services or cash in exchange for the transfer of shares to Embraer”

News:

Private investors plot Forbes buyout (Axios)

Investment firm GSV is working on a bid to buy Forbes Media at a $620 million valuation as an alternative to Forbes' announced SPAC merger, Axios has learned.

Why it matters: BuzzFeed's public listing last week added to growing skepticism about the SPAC market for media companies. Its shares are down roughly 40% from its opening price, and 94% of investors redeemed their stock following the merger news.

Forbes previously announced plans to go public via a SPAC merger that was set to close in Q4 of this year or Q1 2022.

"We are moving full steam ahead with SPAC transaction," Forbes Media chief communications officer Bill Hankes told Axios. "We remain on schedule to close the transaction in the first quarter."

The blank check company that Forbes is expected to merge with, Magnum Opus Acquisition (OPA), is sponsored by Hong Kong-based investment firm L2 Capital.

Details: The bid is led by GSV Asset Management CEO Michael Moe, with participation from "top family offices and institutional investors," according to a pitch a participating investor is circulating to others and seen by Axios.

The deal would value Forbes at $620 million, slightly less than the $630 million valuation Forbes would get via its merger with Magnum Opus.

According to the pitch, the first tranche is set to close on December 31st, and the second in March 2022.

SEC cracks down on SPAC claims as electric truck maker Nikola agrees to pay $125 million to settle fraud charges (CNBC)

Electric truck maker Nikola (NKLA) has agreed to pay the Securities and Exchange Commission $125 million to settle charges that it defrauded investors by misleading them about its products, technical capacity and business prospects.

SEC officials said they hoped the penalty would serve as a warning to all companies hoping to enter public markets via a merger deal with a special-purpose acquisition company, or SPAC. Specifically, officials said statements from companies hoping tap public capital markets need to be wholly accurate.

The action, announced Tuesday morning, marked the SEC’s most recent move to more thoroughly regulate SPACs, which are also known as “blank check companies.” The regulator issued new accounting guidance in the spring, effectively halting a surge in SPACs at the time. They started surging again as the year went on. Former President Donald Trump, for instance, is pursuing a SPAC merger that he says would result in the creation of a social media and streaming company. The SEC is investigating the Trump SPAC deal.

Nikola, which went public in June 2020, had warned investors its fine was likely. The company was the catalyst for pre-revenue electric vehicle start-ups to go public through SPAC deals. They followed investor interest in such companies soaring after Tesla skyrocketed to become the world’s most values automaker by market cap in 2020.

Nikola on Tuesday confirmed the settlement and said in a statement that it neither admits nor denies the findings from the SEC.

“We are pleased to bring this chapter to a close as the company has now resolved all government investigations,” the company said.

The SEC said Nikola agreed to continue cooperating with “ongoing litigation and investigation.”

Merger Votes/ Completions:

MCAP Acquisition Corporation (MACQ) shareholders approved its merger with AdTheorent

European Sustainable Growth Acquisition Corp. (EUSG) shareholders approved its merger with ADS-TEC Energy

Appx 66.12% of the public shares were redeemed

Altimar Acquisition Corp. II (ATMR) shareholders approved its merger with Fathom

HealthCor Catalio Acquisition Corp. (HCAQ) shareholders approved its merger with Hyperfine & Liminal Sciences

Bowlero Corp (BOWL) provided redemption figures: 13.6M shares were redeemed (an estimated ~54% of the public shares)

Merger Vote Set:

If you find this newsletter useful, feel free to share it with a friend and suggest they subscribe:

Quick News:

AdMY Technology Group, Inc. (ADMY) formally withdrew its registration today.

This registration from the well-known serial sponsor team, dMY, was filed back in March. The “A” in AdMY may have been referring to the partner of Niccolo de Masi and Harry You noted on the registration for this particular SPAC, Shekar Ayyar (a former executive at VMware).

Another dMY SPAC, dMY Technology Group, Inc. VI (DMYS), which IPO’d in October, was called “TdMY Technology Group” in its initial registration. The “T” may have referred to who was at the time the Non-Executive Chairman of that particular SPAC: Gabrielle Toledano (Former Chief People Officer at Tesla). The final registration filing showed Toledano as only a Director.

IPOs to begin trading tomorrow*:

1) Gardiner Healthcare Acquisitions Corp. Announces Pricing of $75 Million Initial Public Offering (GDNR-U)

*Priced as of this writing

S-4 Activity:

S-4 filings:

Apollo Strategic Growth Capital (APSG) & American Express Global Business Travel

S-4/A filings:

CITIC Capital Acquisition Corp. (CCAC) & Quanergy (5th amendment)

G Squared Ascend I Inc. (GSQD) & Transfix (1st amendment)

Omnichannel Acquisition Corp. (OCA) & Kin Insurance (4th amendment)

Far Peak Acquisition Corporation (FPAC) & Bullish (2nd amendment)

Ivanhoe Capital Acquisition Corp. (IVAN) & SES Holdings (4th amendment)

S-4 Effective:

Decarbonization Plus Acquisition Corporation II (DCRN)

Merida Merger Corp. I (MCMJ)

Trebia Acquisition Corp. (TREB)

De-SPAC S-1 Activity (including PIPE resale registrations*):

S-1 filings:

*When applicable

New S-1s (2):

1) Counter Press Acquisition Corp (CPAQ)

$75M, 1/2 Warrant

Focus: Sports, media, and data analytics, with a focus on professional sports

Management:

Paul Conway (Co-Founder of Pacific Media Group and Co-Chairman of Barnsley Football Club)

Randy Frankel (Co-owner of the Tampa Bay Rays)

Directors:

Andrew Friedman (Los Angeles Dodgers' President of Baseball Ops)

Julie Uhrman (Co-Founder & President of Angel City Football Club)

2) Deep Space Acquisition Corp. I (DPAC)

$210M, 1/2 Warrant, 1 Right (1/16th of a share)

Focus: Space tech

Management:

Andrew Chanin (CEO of Procure Holdings and Co-founder of PureShares)

Directors:

Timothy Hascall (Former COO of Maxar Technologies)

Timothy Wolf (Former CFO of Coors Brewing Company)

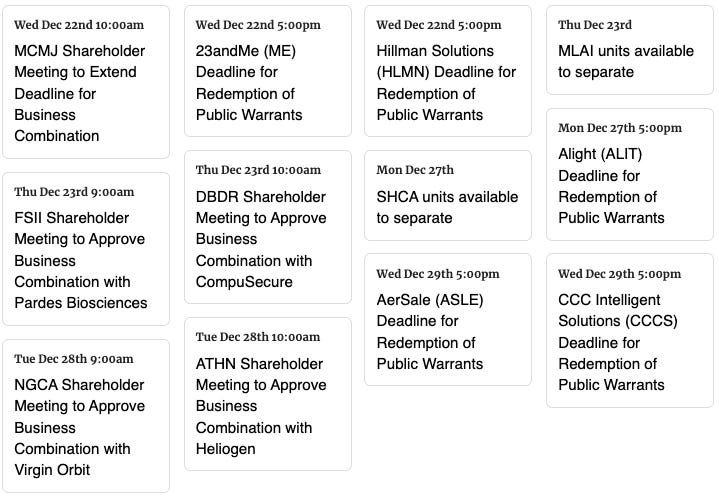

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions, Earnings, and Expected Ticker Changes

See the full calendar here.

Thanks for reading,