The Nightcap from SPAC Track

The Nightcap newsletter: SPAC Track’s nightly recap of the action in the SPAC world. (January 14, 2021)

Discover and track all of the SPACs at spactrack.io

If you haven’t subscribed to this Free nightly newsletter, you can do so below.

The Stats:

The Deals:

No deals announced today.

News:

Ant-Backed Akulaku Mulls SPAC Merger at $2 Billion Value (Bloomberg)

Akulaku Inc., an Indonesian online lender backed by Jack Ma’s Ant Group Co., is considering a U.S. listing via a merger with a blank-check company that could value the combined entity at about $2 billion, according to people with knowledge of the matter.

The fintech startup is working with advisers on a potential deal and is in early talks with Catcha Investment Corp. (CHAA), the special purpose acquisition company set up by internet entrepreneur Patrick Grove, said the people, who asked not to be named as the process is private. A merger with a blank-check company could take place as soon as this year, the people said.

The Indonesian company is currently seeking to raise $200 million to $300 million from a private funding round, the people said.

Discussions are preliminary and could fall apart, and the company could decide to explore a combination with a different SPAC, the people said. A representative for Catcha Group declined to comment, while Akulaku didn’t immediately respond to requests for comment.

The Jakarta-based startup would join a growing list of companies in Southeast Asia that have agreed go public in the U.S. via SPAC mergers. They include Singapore’s PropertyGuru Pte and FinAccel Pte, the parent of Indonesian fintech Kredivo.

Akulaku, founded in 2014, offers digital banking, consumer credit, digital investment and insurance brokerage services, according to its website. It operates in Indonesia, Vietnam, Malaysia and the Philippines, the site shows. The company expected annual revenue of $619 million and gross merchandise value of about $5 billion in 2021, according to an internal document from October seen by Bloomberg News.

Baron Davis SPAC In Talks With ESports Startup ReKTGlobal (Bloomberg)

ReKTGlobal, an esports startup, is in talks to go public through a merger with Baron Davis’s blank-check firm Bull Horn Holdings Corp. (BHSE), according to people with knowledge of the matter.

The special purpose acquisition company is discussing raising a so-called private investment in public equity, or PIPE, to support the transaction, which is set to value the combined entity at more than $400 million, the people said. A deal hasn’t been finalized and terms may change, or talks could collapse.

A ReKTGlobal representative declined to comment and a Bull Horn spokesperson didn’t immediately respond to requests for comment.

Bull Horn, led by Chief Executive Officer Rob Striar, raised $75 million in an October 2020 initial public offering. The SPAC counts former NBA star Davis as a board member. It said at the time it would focus on “leading sports, entertainment and brand companies that have potential for brand and commercial growth.”

ReKTGlobal, founded by Dave Bialek and Amish Shah, connects brands with Gen Z-aged esports and video-game enthusiasts, its website shows. It has worked with State Farm, NortonLifeLock Inc. and Kia Corp., and owns esports teams including Rogue and the London Royal Ravens. The Ravens have partnered with LG UltraGear, placing the gaming-monitor brand’s logo on team jerseys.

The company has said investors include Summit Partners; Nick Gross, the son of billionaire Bill Gross; DJ Steve Aoki; pop-rock band Imagine Dragons; and athletes such as Rudy Gobert of basketball’s Utah Jazz, and tennis player Taylor Fritz.

Dog Walking Startup Wag In Merger Talks With CHW SPAC (Bloomberg)

Dog-walking startup Wag Labs Inc. is in talks to go public through a merger with CHW Acquisition Corp. (CHWA), according to people with knowledge of the matter.

The special purpose acquisition company is in discussions to raise funds for a private investment in public equity, or PIPE, to support the transaction with Wag. The combined entity is set to have an enterprise value of about $350 million, the people said, declining to be named discussing private information. The transaction value is based on a multiple of projected revenue of about $42 million in 2022 and $71 million in 2023. Terms aren’t finalized and it’s possible talks could collapse.

Representatives for Wag didn’t immediately respond to a request for comment. A CHW representative declined to comment.

CHW, the blank-check firm, is led by President Paul Norman, a former Kellogg Co. executive and co-Chief Executive Officers Jonah Raskas and Mark Grundman. It raised $125 million in an August initial public offering, and has said it will target a merger in the consumer and retail sectors.

Wag experienced significant growth during the pandemic as U.S. households raced to adopt pets, which CEO Garrett Smallwood last year described as “pawgress” in an email to Bloomberg Businessweek. The startup, which counts Battery Ventures and ACME as investors, in 2019 repurchased a 50% stake in itself from SoftBank Vision Fund. SoftBank first invested $300 million in the company in 2018.

Merger Votes/ Completions:

Gelesis (GLS) completed its merger with Capstar Special Purpose Acquisition (CPSR) and began trading as GLS today

Quick News:

Roth CH Acquisition III Co. (ROCR) enters into amendments to its financing agreements for its merger with QualTek including, among other things, the reduction of PIPE price from $10 to $8 per share, and a reduction in conversion price per share for the Pre-PIPE notes from $8 to $6

IPOs*:

1) Technology & Telecommunication Acquisition Corporation Announces Pricing of $100,000,000 Initial Public Offering (TETE-U) — begins trading Tuesday

*Priced as of this writing

If you find this newsletter useful, feel free to share it with a friend and suggest they subscribe:

S-4 Activity:

Pro subscriber content only

Tracking De-SPAC S-1s (including PIPE resale registrations):

Pro subscriber content only

New S-1s:

1) First Digital Health Acquisition Corp. (FDHA)

Upcoming Dates:

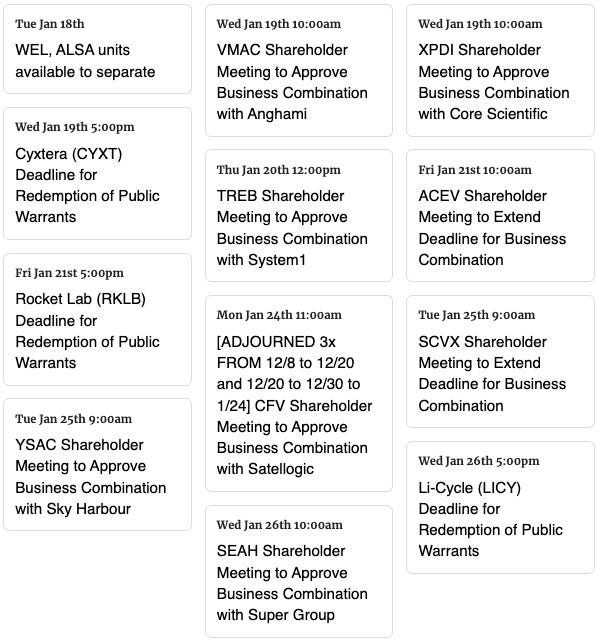

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions, Earnings, and Expected Ticker Changes

See the full calendar here.

The Pro edition of the Nightcap newsletter is sent to SPAC Track Pro subscribers and includes: deal details, S-1 registration details, S-4 merger filing updates, post-closing S-1 updates (incl. PIPE share registrations), and quick links to investor presentations, press releases, and relevant filings.

Sign up for SPAC Track Pro with 10% off of the first month or the first year of the annual subscription with the coupon: ‘10NIGHTCAP2022’.The Pro edition of the Nightcap newsletter is sent to SPAC Track Pro subscribers and includes: deal details, S-1 registration details, S-4 merger filing updates, post-closing S-1 updates (incl. PIPE share registrations), and quick links to investor presentations, press releases, and relevant filings.

Sign up for SPAC Track Pro with 10% off of the first month or the first year of the annual subscription with the coupon: ‘10NIGHTCAP2022’.

Thanks for reading,