The Nightcap from SPAC Track

The Nightcap newsletter: SPAC Track’s nightly recap of the action in the SPAC world. (January 11, 2021)

Discover and track all of the SPACs at spactrack.io

If you haven’t subscribed to this Free nightly newsletter, you can do so below.

The Stats:

The Deals (0):

News:

Aesthetics Firm Suneva Is in Talks for Viveon Health SPAC Deal (Bloomberg)

Suneva Medical Inc., which sells beauty and anti-aging products to doctors’ offices, is in advanced talks to go public through a merger with blank-check company Viveon Health Acquisition Corp. (VHAQ), according to people with knowledge of the matter.

The deal is expected to value San Diego-based Suneva at about $511 million including debt, said the people, who asked not to be identified because the information is private.

The deal is expected to be announced as soon as this week, they said.

Representatives for Suneva and Viveon Health Acquisition declined to comment.

Suneva specializes in so-called regenerative aesthetics that use the body’s own collagen to improve the skin’s appearance. Its biggest product is Bellafill, an FDA-approved dermal filler that is advertised to “smooth smile lines” and reduce the appearance of acne scars.

SEC Bars SPACs From Blanket Disclaimers About Accounting Risks (Bloomberg Tax)

SPACs can’t put disclaimers in their financial statements that their financial reporting could run afoul of U.S. accounting rules, market regulators are warning.

At issue is just how far special purpose acquisition companies—blank-check outfits whose sole purpose is to acquire and take a promising company public—can go in issuing catch-all warnings to investors. The Securities and Exchange Commission in letters to some SPACS warned against broad disclaimers that long-standing SPAC accounting practice could change and lead to future errors. The letters come on the heels of a top SEC accountant saying the agency would object to such disclaimers.

The SPAC warnings—and the SEC’s admonishment against them—follows a turbulent year in SPAC accounting, coupled with increased regulator scrutiny of the market.

Twice in 2021, the SEC flagged pervasive accounting errors with SPAC financial statements. Hundreds of SPACs had to restate, or redo, their past financial statements in the spring because of how they accounted for key money-raising tools and again in the fall because of problems with how they classified shares they offer to investors.

In both cases, auditors and SPACs themselves were taken aback because even though the accounting was wrong, the accounting methods were ingrained in practice and hadn’t been questioned in the past.

Merger Votes/ Completions:

Capstar Special Purpose Acquisition Corp. (CPSR -28.51%) shareholders approved its merger with Gelesis

Dave (DAVE) releases redemption results from its merger with VPC Impact Acquisition Holdings III, Inc. (VPCC):

22.4M shares were redeemed, or an estimated 88% of the public SPAC shares

Quick News:

Benessere Capital Acquisition Corp. (BENE) receives shareholder approval for Extension of Deadline to Complete Business Combination. The new deadline is 7/7

EJF Acquisition Corp. (EJFA) adds $220M to the PIPE for its merger with Pagaya Technologies, bringing the total PIPE investment to $350M

The new capital includes commitments from Tiger Global, Whale Rock, GIC – Singapore’s Sovereign Wealth Fund, Healthcare of Ontario Pension Plan (HOOPP), and G Squared

Leafly and Merida Merger Corp. I (MCMJ -16.02%) announces they have:

(1) entered into convertible note financing of $30M and (2) adjourned the meeting set for 1/14 to a later date TBA to give shareholders "sufficient time to evaluate the terms of the note"

MCMJ went ex-redemption today, but due to the redemption deadline will be pushed to 2 business days prior to the new meeting date, when it is set

If you find this newsletter useful, feel free to share it with a friend and suggest they subscribe:

S-4 Activity:

Pro subscriber content only

Tracking De-SPAC S-1s (including PIPE resale registrations):

Pro subscriber content only

New S-1s:

1) Evergreen Corp. (Ticker not available yet)

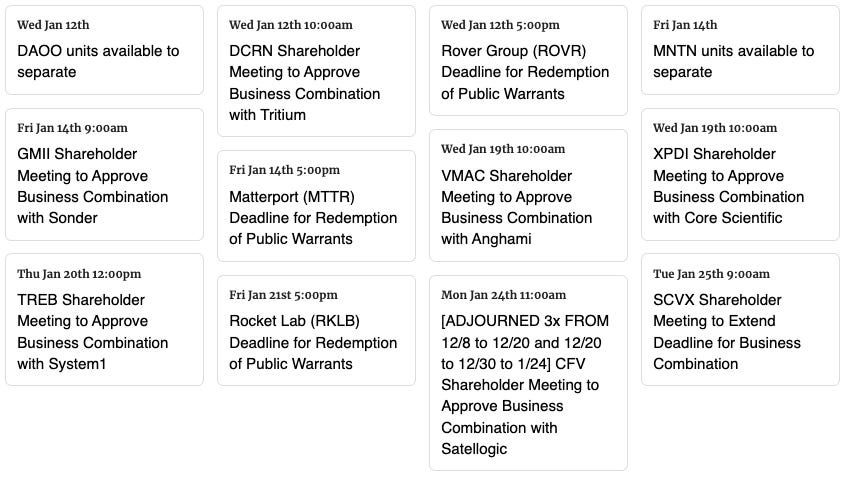

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions, Earnings, and Expected Ticker Changes

See the full calendar here.

The Pro edition of the Nightcap newsletter is sent to SPAC Track Pro subscribers and includes: deal details, S-1 registration details, S-4 merger filing updates, post-closing S-1 updates (incl. PIPE share registrations), and quick links to investor presentations, press releases, and relevant filings.

Sign up for SPAC Track Pro with 10% off of the first month or the first year of the annual subscription with the coupon: ‘10NIGHTCAP2022’.The Pro edition of the Nightcap newsletter is sent to SPAC Track Pro subscribers and includes: deal details, S-1 registration details, S-4 merger filing updates, post-closing S-1 updates (incl. PIPE share registrations), and quick links to investor presentations, press releases, and relevant filings.

Sign up for SPAC Track Pro with 10% off of the first month or the first year of the annual subscription with the coupon: ‘10NIGHTCAP2022’.

Thanks for reading,