The Nightcap from SPAC Track

The Nightcap newsletter: SPAC Track’s nightly recap of the action in the SPAC world. (January 18, 2021)

Discover and track all of the SPACs at spactrack.io

If you haven’t subscribed to this Free nightly newsletter, you can do so below.

The Stats:

The Deals:

1) Social Capital Suvretta Holdings Corp. III (DNAC: no warrants, common +0.01%) & ProKidney

News:

Better founder Vishal Garg, who did mass Zoom layoff, returns as CEO (CNBC)

Vishal Garg, founder and CEO of digital mortgage lender Better, [merging with Aurora Acquisition Corp. (AURC)] is staying on as CEO, according to an internal memo obtained by CNBC.

The move comes less than two months after Garg came under fire for laying off roughly 900 employees, or 9% of its workforce, via Zoom on Dec. 1. He subsequently stepped back at the request of Better’s board of directors, and CFO Kevin Ryan took over as interim CEO.

“As you know, Better’s CEO Vishal Garg has been taking a break from his full-time duties to reflect on his leadership, reconnect with the values that make Better great and work closely with an executive coach,” reads the memo, which was attributed to the company’s board.

“Vishal will be resuming his full-time duties as CEO. We are confident in Vishal and in the changes he is committed to making to provide the type of leadership, focus and vision that Better needs at this pivotal time.”

The memo also reveals that board members Raj Date and Dinesh Chopra have resigned, though “not because of any disagreement with Better,” it reads.

SoFi stock soars after clearing final regulatory hurdle to become a bank (CNBC)

Shares of SoFi (SOFI -8.64% in the regular session, +16.7% after hours) rallied as more than 16% in after-hours trading on Tuesday following news that the fintech cleared its final regulatory hurdle in becoming a bank.

San Francisco-based SoFi received approval from the Office of the Comptroller of the Currency, or OCC, and Federal Reserve to become a bank holding company. The mobile-first finance company offers banking products including loans, cash accounts and debit cards. But it’s not technically a bank. Like many fintech companies, it relies on partnerships with FDIC-insured banks to hold customer deposits and issue loans.

In order to become a bank, SoFi plans to acquire California community lender Golden Pacific Bancorp and operate its bank subsidiary as SoFi Bank. The deal was announced last year and is expected to close in February.

While officially entering the banking business brings on more regulatory oversight, it also improves the company’s economics. By cutting out the middleman, SoFi gets a bigger slice of each transaction. CEO Anthony Noto said a national bank charter will allow lending at more competitive interest rates, and give SoFi customers higher-yielding accounts.

“This important step allows us to add to our broad suite of financial products and services to better be there for our members during the major financial moments in their lives and all of the moments in between,” Noto, a former partner at Goldman Sachs and formerly chief operating officer at Twitter, said in a statement.

Merger Votes/ Completions:

Gores Metropoulos II (GMII) completed its merger with Sonder. Ticker change to SOND set for tomorrow, 1/19

Merger Vote Set:

Quick News:

Pioneer Merger Corp. (PACQ: warrants -30.3%) and Acorns mutually terminate their merger agreement with Acorns paying a termination fee of $17.5M as well as $15M if PACQ doesn’t consummate a merger and decides to liquidate by December

Yellowstone Acquisition Company (YSAC) entered into a forward purchase agreement for up to $70M with an affiliate of Atalaya Capital

Poema Global Holdings Corp. (PPGH) announces $27.5M in additional PIPE investments in connection with its merger with Gogoro, including investments from Hero MotoCorp and Engine No. 1

Oaktree Acquisition Corp. II (OACB) Alvotech announces $21M in additional PIPE investments in connection with its merger with Alvotech, including investments from existing PIPE investors: Artica Finance, Arion Bank and Landsbankinn

CF Acquisition Corp. V (CFV) entered into a subscription agreement with Liberty Strategic Capital, in connection with its merger with Satellogic, in which among other things, Liberty is to pay $150M for 20M shares, 5M warrants (exercisable for 1 share at $10 per share), and an additional 15M warrants (exercisable for 1 share at $15 per share)

Chamath Palihapitiya, the billionaire investor and partial owner of the Golden State Warriors, is getting criticized after he said on a podcast that the genocide of the Uyghur minority in China isn’t something he is worried about right now. He added, “Until we actually clean up our own house,” the idea of “morally virtue-signaling about someone else’s human rights record is deplorable.” (Morning Brew)

IPOs*:

1) AIB Acquisition Corporation Announces Pricing of $75 Million Initial Public Offering (AIB-BU)

*Priced as of this writing

If you find this newsletter useful, feel free to share it with a friend and suggest they subscribe:

S-4 Activity:

Pro subscriber content only

Tracking De-SPAC S-1s (including PIPE resale registrations):

Pro subscriber content only

New S-1s:

None today

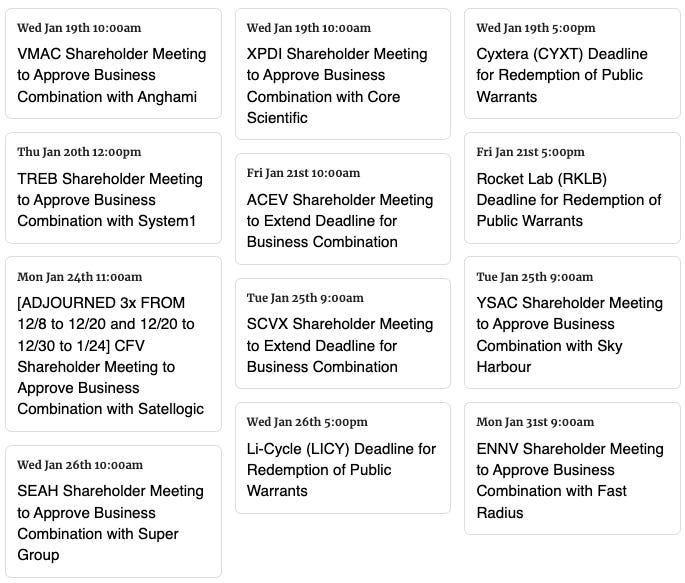

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions, Earnings, and Expected Ticker Changes

See the full calendar here.

The Pro edition of the Nightcap newsletter is sent to SPAC Track Pro subscribers and includes: deal details, S-1 registration details, S-4 merger filing updates, post-closing S-1 updates (incl. PIPE share registrations), and quick links to investor presentations, press releases, and relevant filings.

Sign up for SPAC Track Pro with 10% off of the first month or the first year of the annual subscription with the coupon: ‘10NIGHTCAP2022’.

Thanks for reading,