May 21st, 2021

Good evening,

Thanks for reading “The Nightcap”, a nightly recap of the highlights of the SPAC world. You can always discover and track all of the SPACs at spactrack.net.

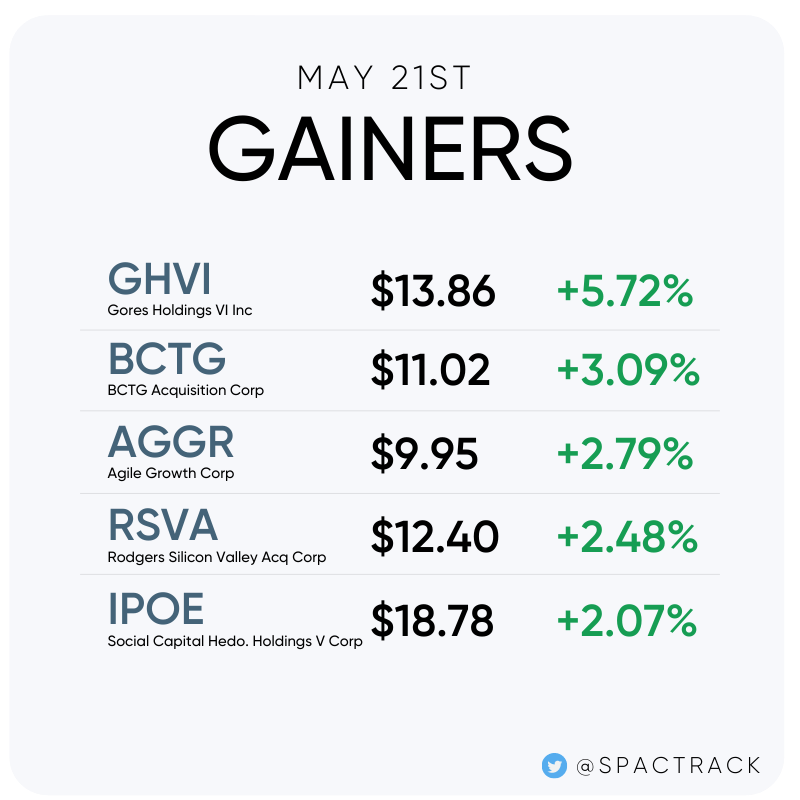

The Stats:

The Deals:

None today.

Deal News Reports:

1) Legato Merger Corp. (LEGO) is in talks to merge with Algoma Steel.

Canada’s Algoma Steel Is in Talks to Go Public via Legato SPAC

A deal is set to value the combined entity at more than $1 billion, one of the people said, asking not to be identified discussing private negotiations. Terms could change and, as with all transactions that aren’t yet finalized, it’s possible talks could collapse.

Representatives for Algoma Steel and Legato didn’t immediately respond to requests for comment.

Algoma, based in Sault Ste. Marie, Ontario, and led by Chief Executive Officer Michael McQuade, is a producer of hot- and cold-rolled steel products. The company has said its estimated production capacity is about 2.8 million tons per year.

In February, Moody’s Investors Service upgraded Algoma’s rating to reflect “an improvement in operating performance and credit metrics due to higher steel prices and the expectation that the company will generate positive free cash flow.” It previously went through a restructuring.

2) Virtuoso Acquisition Corp. (VOSO) is in talks to merge with Wejo.

GM-Backed Wejo Is in SPAC Merger Talks With Virtuoso

Virtuoso is seeking to raise new equity to support a transaction with a combined enterprise value of more than $1 billion, according to one of the people, who asked not to be identified discussing private negotiations. Terms could change and, as with all transactions that aren’t yet finalized, it’s possible the talks could collapse.

A representative for Virtuoso declined to comment and Wejo didn’t immediately respond to requests for comment.

Founded in 2014 and led by Chief Executive Officer Richard Barlow, Wejo describes itself as a connected-vehicle data specialist. It says its technology interprets information from more than 10 million vehicles.

In addition to GM, the company’s investors include Hella Ventures, Platina Partners, DIP Capital and the U.K. government’s Future Fund.

Wejo, based in Manchester, England, with an office in Detroit, named John Maxwell chief financial officer in March.

New S-1 Filings:

1) Integrated Rail and Resources Acquisition Corp. (IRRX)

$275M, 1/2 warrant

Focus: Railroad

IPOs to Begin Trading Tomorrow:

Notable SPAC News:

1) Aerion Supersonic — previously reported as in talks with Altitude Acquisition Corp. (ALTU) — shuts down, ending plans to build silent high speed business jets (CNBC)

“In the current financial environment, it has proven hugely challenging to close on the scheduled and necessary large new capital requirements” to begin production of its AS2 supersonic jet, the company said in a statement.

“Aerion Corporation is now taking the appropriate steps in consideration of this ongoing financial environment,” the company said.

Florida Today first reported the company’s abrupt closure.

Aerion aimed to fly its first AS2 jet by 2024, with the goal of beginning commercial services by 2026. The company developed a patented technology it calls “boomless cruise,” which it said would allow AS2 to fly without creating a sonic boom – an issue that plagued the supersonic Concorde jets of the past.

Upcoming Dates:

Next Week’s Shareholder Meetings and Unit Splits (common shares and warrants to commence trading separately from underlying units)

Monday, May 24th

Big Rock Partners Acquisition Corp (BRPA) Shareholder Meeting to Approve Business Combination with NeuroRX

Thursday, May 27th

Social Capital Hedosophia Holdings Corp. V (IPOE) Shareholder Meeting to Approve Business Combination with SoFi

Friday, May 28th

Northern Star Acquisition Corp. (STIC) Shareholder Meeting to Approve Business Combination with Barkbox

If you found this newsletter useful and you aren’t a subscriber yet, subscribe for free here:

Thanks for reading,