The Nightcap from SPAC Track

The Nightcap newsletter: SPAC Track’s nightly recap of the action in the SPAC world. (December 13, 2021)

Discover and track all of the SPACs at spactrack.io

If you haven’t subscribed to this Free nightly newsletter, you can do so below.

The Stats:

The Deals:

1) SVF Investment Corp. 3 (SVFC: no warrants, commons +0.71%) & Symbotic

Merger Partner Description:

Symbotic LLC is a robotics and automation-based product movement technology platform focused on transforming the consumer goods supply chain. The Company has spent more than a decade perfecting its warehouse automation platform to disrupt the supply chain of goods between manufacturers and consumers. Symbotic’s unique platform, with more than 250 issued patents, is an end-to-end system that reimagines every aspect of the warehouse and is fueled by a unique combination of proprietary software and a fleet of fully autonomous robots. The system enhances storage density, increases available SKUs, reduces product damage and improves throughput and speed to customers. Symbotic is rapidly growing with a pipeline to build its transformative systems for Fortune 100 retailers and wholesalers in new and existing warehouses throughout the United States and Canada.

Valuation: $4.75B EV

PIPE & Additional Financing: $205M PIPE including investments by Walmart and $200M FPA from an affiliate of SoftBank Vision Fund 2

2) Aries I Acquisition Corporation (RAM: warrants +17.17%) & InfiniteWorld

Merger Partner Description:

InfiniteWorld serves as a bridge between the physical and digital worlds. The Company empowers leading global brands, creators and Web3 companies with the infrastructure they need to create digital assets and NFTs (non-fungible tokens) and engage with customers and fans in the Metaverse, allowing them to support and foster stronger relationships with consumers. InfiniteWorld currently has 130 employees globally and has partnered with over 75 brands and creators since its founding. Current investors in InfiniteWorld include Morgan Creek Digital, GSR, Wintermute, Blockchain Coinvestors, Bill Shihara, among others.

Valuation: $700M Pro-forma equity value EV

PIPE: No PIPE

3) Haymaker Acquisition Corp. III (HYAC: warrants -19.05%) & Biote

Merger Partner Description:

Biote operates a high growth, differentiated medical practice-building business within the hormone optimization space. Similar to a franchise model, Biote provides the necessary components to enable practitioners to establish, build, and successfully operate a hormone optimization center to treat patients appropriate for therapy. Biote trains practitioners how to identify and treat early indicators of hormone-related aging conditions.

Valuation: $667M EV

PIPE: No PIPE

4) AEA-Bridges Impact Corp. (IMPX: warrants +72.88%) & LiveWire, a division of Harley-Davidson

Merger Partner Description:

LiveWire, Harley-Davidson's electric motorcycle division, to create a new publicly traded company. Its common stock is expected to be listed on the New York Stock Exchange under the symbol "LVW".

LiveWire plans to redefine motorcycling as the industry-leading, all-electric motorcycle company, with a focus on the urban market and beyond. As a strong and desirable brand with growing global recognition, LiveWire plans to develop the technology of the future and to invest in the capabilities needed to lead the transformation of motorcycling. LiveWire will draw on its DNA as an agile disruptor from the lineage of Harley-Davidson, capitalizing on a decade of learnings in the EV sector and the iconic heritage of the most desirable motorcycle brand in the world.

Valuation: $1.77B EV

PIPE: $200M — $100M from Harley-Davidson and $100M from KYMCO

5) Global Consumer Acquisition Corp. (GACQ: warrants -13.16%) & GP Global and Luminex

Merger Partner Description:

About GP Global

GP Global’s primary assets are controlling stakes in MVP Group International, Inc. and Primacy Industries Ltd, two leading Air Care solution companies based out of the U.S. and India, respectively. Primacy Industries also has a strong, emerging personal care segment. GP Global has a strong portfolio of in-house brands coupled with existing partnerships with major retailers across Europe and the U.S. GP Global will bring key platform capabilities such as centres of excellence for digital & analytics, product development expertise, global sourcing & global manufacturing base to the combined entity.

About Luminex

Luminex, headquartered in the U.S. – formed through the merger of Candle-lite, a portfolio company of Centre Lane Partners, and PartyLite, a portfolio company of Carlyle Investment Management – has quickly grown into the #1 market leader in branded and private label solutions in Air Care in North America with top retailers as customers, with a heritage of 180+ years in manufacturing candles, as well as substantial direct to consumer presence in Europe through a combination of online and agency models.

Valuation: $507.1M EV

PIPE: No PIPE

News:

eToro SPAC merger again postponed (Globes)

Israeli trading platform eToro [merging with FinTech Acquisition Corp V (FTCV)] will not complete its SPAC merger by the end of 2021. According to the current agreement, if the merger, which was already due to be completed in the third quarter but postponed, is not completed by December 31, then this could cause its cancellation.

At the same time, the private investment public equity (PIPE) investors can cancel their participation in the deal, or demand a change in the pricing. Despite all this, sources familiar with the deal believe that while the merger has again been delayed, it will eventually go ahead at the original valuation of $10.4 billion, reflecting an enterprise value of $9.6 billion for eToro, and with the original PIPE investment of $650 million. eToro is expected to sign with the investors on extension agreements.

eToro was founded in 2007 by brothers Yoni and Ronen Assia and David Ring. Yoni Assia serves as CEO. The company's platform allows users to invest in a range of stocks, commodities, indices and cryptocurrencies.

eToro said the company, "is in a process of transition into a public company by merging with the SPAC FinTech V and we are working with all the relevant bodies in order to complete the process as soon as possible."

…

Because the deal won't be completed by the end of the year, eToro has stayed in close contact with the PIPE investors to discuss extending the loan agreements. The investors include ION Investment Group, SoftBank, Third Point, Fidelity, and Wellington.

Sources familiar with the deal believe that due to the financial results published by eToro, and despite the difficulties in the SPAC market, the investors will sign an extension and won't cancel the investment or require the valuation to be cut.

Merger Votes/ Completions:

SCVX Corp. (SCVX) and Bright Machines mutually agree to terminate their merger “In light of the low likelihood that the business combination agreement could be completed prior to the January 15, 2022 “outside date” set forth in the merger agreement and current market conditions”

“SCVX is considering alternative transactions, including extending its current dissolution deadline of January 28, 2022 and pursuing another business combination.”

Broadstone Acquisition Corp. (BSN) Expects to Close Business Combination with Vertical Aerospace on 12/16 with the ticker change to EVTL upon closing

Yucaipa Acquisition Corporation (YAC) shareholders approved its merger with SIGNA Sports United

Closing is expected to be tomorrow, 12/14, with the ticker change to SSU on 12/15

The transaction raised appx $484M after 31.8M shares were redeemed (an estimated ~92% of the public shares)

Merger Vote Set:

VPC Impact Acquisition Holdings III, (VPCC) & Dave: 1/4/22

If you find this newsletter useful, feel free to share it with a friend and suggest they subscribe:

Tracking De-SPAC S-1s (including PIPE resale registrations*):

No activity today.

Quick News:

Tims China Announces Pre-merger Financing and PIPE Commitments

Rover Group (ROVR) announces redemption of public warrants with a deadline of 1/12

IPOs to begin trading tomorrow*:

1) Kairous Acquisition Corp. Limited Pricing of $75 Million Initial Public Offering (KACL-U)

*Priced as of this writing

New S-1s:

None today.

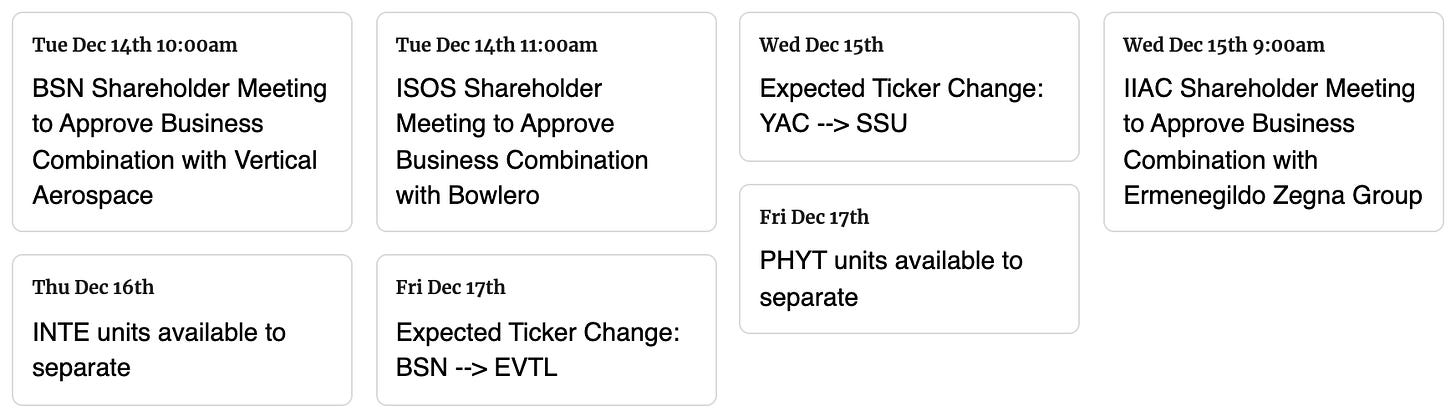

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions, Earnings, and Expected Ticker Changes

See the full calendar here.

SPAC TRACK PRO

SPAC Track Pro is a premium monthly subscription service to discover, track, and analyze SPACs & De-SPACs. The Pro version comes with 4x more data points than the standard version and includes several other useful features such as premium filters and table views, a unified view of SPACs and De-SPACs, as well as unlimited downloads of the Active & De-SPAC list.

We are offering introductory rates — the annual subscription is currently 30% off of the monthly rate (no coupon needed as the 30% off is already in the listed price) and you can get an additional 10% off the monthly or the annual subscription with the coupon: ‘NIGHTCAP10’. Check out spactrack.io/pro to learn more about Pro and to subscribe!

Feel free to reach out with any questions at spactrack@commonfi.com.

For inquiries on enterprise accounts (5 or more users), please send an email to spactrack@commonfi.com.

Thanks for reading,