The Nightcap Newsletter from SPAC Track

The Nightcap newsletter: SPAC Track’s nightly recap of the action in the SPAC world. (October 5, 2021)

Discover and track all of the SPACs at spactrack.net.

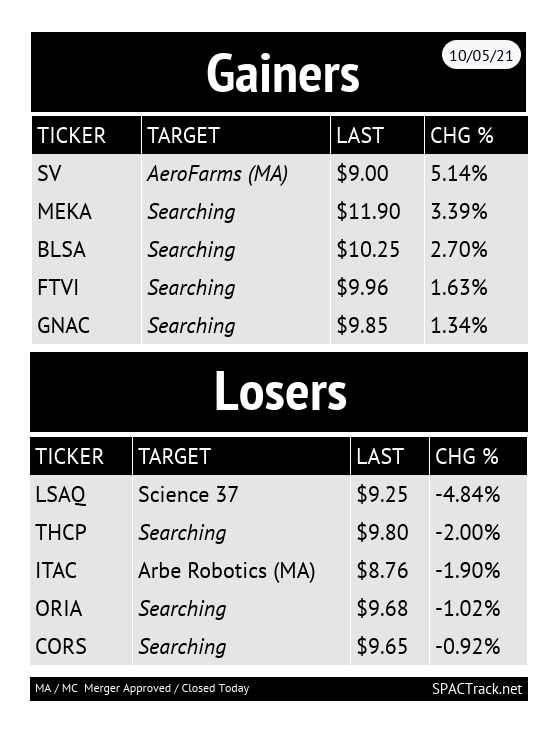

The Stats:

If you haven’t subscribed to this Free nightly newsletter, you can do so below.

The Deals:

None today.

Merger Votes/ Completions:

ACON S2 Acquisition Corp. (STWO) shareholders approved its merger with ESS Tech

~20.7M redemptions (estimated 83.1% of public shares)

Closing expected on 10/8 with the ticker change to GWH expected on 10/11

Industrial Tech Acquisitions, Inc. (ITAC) shareholders approved its merger with Arbe Robotics

Pending redemption and closing information

News:

Lordstown Motors falls 10% as Morgan Stanley says the EV maker sold its Ohio factory for a fifth of its value (Business Insider)

Lordstown Motors (RIDE: $5.20 -11.11%) sank 10% Tuesday, marking the third consecutive day of losses, as Morgan Stanley said the stock has even farther to fall after the EV startup announced plans to sell its factory for a fraction of the worth.

The stock has lost a third of its value in three days of trading after the company announced a $230 million sale of its Ohio factory to Foxconn, the top assembler of Apple iPhones. The deal is contingent on the two reaching a manufacturing agreement and Lordstown providing Foxconn with certain rights to future vehicle programs.

Morgan Stanley analysts led by Adam Jonas said they had previously valued the factory, which once housed 10,000 GM workers, at $1.3 billion.

"The agreed plant value is roughly one-fifth the value we had assumed in our prior price target," Morgan Stanley wrote, slashing its price target to $2 from $8 and dropping the stock rating to underweight from equal-weight. The stock traded at $5.24 at 9:38 a.m. in New York.

Also last week, Lordstown Motors said it will continue with plans to build a limited number of its Endurance electric trucks through the first part of 2022.

To that, the analysts said they had assumed the Endurance project would be canceled as there's not a "path to commercial viability at any appreciable scale."

"In our opinion, continuing with the Endurance likely exposes the company to the risk of further elevated cash burn and liquidity risks even in a contract manufacturing scenario which involves shifting much of the fixed cost burden (plant and most labor) to Foxconn," Jonas wrote.

The EV maker has already faced several production delays, a cash shortage, and an inquiry from the US Securities and Exchange Commission on statements made about demand for the Endurance.

The company originally planned to begin mass producing the Endurance this fall, but now is aiming to start deliveries of its pickup truck next year.

Congress Targets SPAC Founder Shares (Institutional Investor)

The House Financial Services Committee is working on legislation that would prohibit investment advisors, brokers, and registered representatives of brokers from recommending special purpose acquisition companies whose sponsors receive more than 5 percent ownership “or similar economic compensation,” according to draft legislation.

…

The draft legislation takes aim at one of the biggest criticisms of SPAC sponsors, which is the 20 percent of the SPAC’s ownership, or promote, that they receive for a nominal consideration.

The 20 percent promote was also raised as a major concern in a letter written to SPAC executives two weeks ago by Senator Elizabeth Warren and three other Democratic senators: Sherrod Brown, Tina Smith, and Chris Van Hollen.

“We are concerned about the misaligned incentives between SPACs’ creators and early investors on the one hand, and retail investors on the other,” they wrote. The 20 percent promote, they said, “reduces the cash per share for investors,” among other issues.

The letter was sent to Howard Lutnick, chairman and CEO of Cantor Fitzgerald; Michael Klein, founder of M. Klein and Co.; Tilman Fertitta, chairman and CEO of Fertitta Entertainment; Chamath Palihapitiya, co-Founder and CEO of the Social+Capital Partnership; David Hamamoto, CEO and chairman of DiamondHead Holdings Corp.; and Stephen Girsky, managing partner at VectoIQ

PowerTap Considers Spinning Out Hydrogen Subsidiary Via SPAC (The Deep Dive)

PowerTap Hydrogen Capital (NEO: MOVE) this morning indicated that it has begun the process of undergoing a strategic review. Primarily, it appears the review pertains to whether or not the firm will elect to take one of its subsidiaries, PowerTap Hydrogen Fueling Corp, public via a special purpose acquisition corporation transaction.

As with all strategic reviews, the company has indicated that it will be reviewing a range of options for the firm to move forward. Such options include international joint ventures, strategic investments, and mergers, in addition to the SPAC method mentioned.

Commenting on the potential for the subsidiary to broken off from the company and taken public via a SPAC, CEO Kilambi commented, “In light of various inquiries we have received from potential strategic partners globally and several USA listed SPACs over the past few months, we decided it was prudent to retain financial advisors and conduct a formal process to maximize shareholder value.”

Such a transaction would see the firms onsite hydrogen production tech put into a separate listed vehicle, with the vehicle to focus on clean energy and hydrogen, while likely becoming significantly capitalized.

SEC slaps stablecoin issuer Circle with a subpoena as the agency homes in on crypto (Business Insider)

The Securities and Exchange Commission has issued an "investigative subpoena" to USD coin issuer Circle Financial as the agency ramps up its scrutiny of the crypto industry.

The subpoena was sent to Circle in July as the stablecoin backer filed for a $4.5 billion SPAC deal with sponsor Concord Acquisition Corp (CND).

The regulator is asking for information on Circle's "holdings, customer programs, and operations."

Circle told several outlets that it was cooperating with the investigation but couldn't comment on specifics. CoinDesk first reported the subpoena on Monday.

The SEC's interest in Circle was not made clear in the subpoena. But a potential focus could be a recent interest-bearing product called Circle Yield that the stablecoin issuer is rolling out.

Many of the SEC's recent crypto enforcement actions have centered on the legal definition of a security. For instance, the agency's back-and-forth with Coinbase in September over the crypto exchange's Lend product saw the SEC threaten to sue over an unregistered securities offering.

Coinbase CEO Brian Armstrong has complained that the agency's "sketchy" enforcement approach makes it hard for crypto companies to know what is allowed.

Circle isn't new to dealing with the SEC. Also in July, Circle said it had set aside $10 million for a possible settlement with the agency over Poloniex, a crypto exchange and former Circle subsidiary. But in August, when the SEC formally settled with Poloniex, Circle said it was not part of the settlement deal.

Lidar developer Ouster agrees to buy Sense Photonics as it takes aim at the auto industry (TechCrunch)

Ouster (OUST), a lidar company that went public this year via a SPAC merger, said it would acquire solid-state lidar startup Sense Photonics in an all-stock deal that was valued at around $68 million at close of markets on Monday.

Once the acquisition is complete, Ouster said it would establish a new business arm, Ouster Automotive, which will be headed by Sense CEO Shauna McIntyre. That business will integrate Sense’s 200-meter range solid-state lidar into a new lidar suite. San Francisco-based Sense’s claim to fame is also its improved field of view, as TechCrunch’s Devin Coldewey explained.

According to a news statement, Ouster Automotive will also aim to advance negotiations with five automotive OEMs, though additional details about these potential deals were not provided. Should they turn into something solid, production would begin in 2025 or 2026.

Lidar is a key sensor in most autonomous driving stacks. The sensor, whose name is a shortened form of “light detection and ranging,” measures distance using lasers to generate a 3D map of the world. Along with radar, cameras and software, lidar is a critical part of the AV systems of some of the leading developers today, including companies like Waymo and Argo AI.

In February, Ouster CEO Angus Pacala said on the podcast “Shift” that the future of the lidar industry would be marked by consolidation. “There’s going to be three to five lidar companies within the next five years,” he said. This new acquisition is a mark that Ouster will be at the forefront of turning this prediction into a reality.

Tracking De-SPAC S-1s (including PIPE resale registrations):

S-1s that went effective today:

Benson Hill (BHIL: $6.38 -1.54%)

Redwire (RDW: $9.11 +0.89%)

424B3 filings (meaning S-1 is likely to go effective tomorrow):

Cazoo Group (CZOO: $7.03 -3.70%)

eFFECTOR Therapeutics (EFTR: $12.13 -0.66%)

IPOs to Begin Trading Tomorrow*

1) Parsec Capital Acquisitions Corp. Announces Pricing of $75,000,000 Initial Public Offering (PCXC-U)

2) Phoenix Biotech Acquisition Corp. Announces Pricing of $155,000,000 Initial Public Offering (PBAX-U)

*priced as of this writing

New S-1s (2):

1) Pyrophyte Acquisition Corp. (PHYT)

$175M, 1/2 Warrant

Focus: Energy transition ecosystem

Management:

Bernard Duroc-Danner (Former Chairman & CEO of EVI and Chairman Emeritus of Weatherford)

Advisors:

Andy Karsner (Former Assistant Secretary of Energy for Efficiency and Renewable Energy of the United States, Director of Exxon Mobil, and Director of Applied Materials)

2) ExcelFin Acquisition Corp. (XFIN)

$200M, 1/2 Warrant

Focus: Fintech

Management:

Jennifer Hill (Former CFO of Merrill Lynch & Co.)

Upcoming Dates:

This Week’s Announced Shareholder Meetings, Unit Splits, Warrant Redemptions, and Expected Ticker Changes

See the full calendar here.

Thanks for reading,