The Precap from SPAC Track

The Precap newsletter: SPAC Track’s morning recap of the action in the SPAC world. (January 24, 2021)

Important Update:

The Nightcap newsletter is now the Precap — a SPAC newsletter sent in the morning before the market opens each day. After this first edition, The Precap will be sent to premium subscribers only.

Due to the slow pace of activity across the SPAC asset class, the free nightly newsletter, for now, will be replaced with a weekly newsletter (sent on the weekend) that will recap the SPAC market activity of each week with more data and analysis.

We will be focused on growing our team to help us with the new services and content that we are currently building that will cover more of the capital markets (in addition to improving SPAC Track)!

SPACTrack.io and the Pro service will continue to run as normal with many improvements coming in the future. Whether you are playing a long, short, arb, swing, or any other strategy, or simply an observer of the asset class, there is something for you on SPAC Track and more to come!

Sign up for SPAC Track Pro and get 20% off of the first month or the first year of the annual subscription with the coupon: ‘20PRECAP2022’ (Expires Jan 31st).

The Stats:

Pre-market Movers (at time of this publishing):

CFV -22.8%, DWAC -8.3%, SEAH -6.4%, CFVI -5.3%

Friday’s Gainers and Losers:

The Deals:

Friday’s deal:

1) Cohn Robbins Holdings Corp. (CRHC: warrants closed Friday’s session at +8.9%) & Allwyn Entertainment

Merger Partner Description:

Allwyn Entertainment is a lottery, entertainment, and digital gaming operator, with trusted brands delivering over €16bn in wagers. Allwyn is one of Europe’s largest and fastest growing lottery companies and its strong performance across its markets is helping to fund good causes in Austria, the Czech Republic, Greece, Cyprus and Italy.

Valuation: $9.3B

PIPE: $353M including $50M from the sponsor

Additional deal notes: expected bonus pool of 6.6M common shares for non-redeeming SPAC shareholders and expected bonus pool of 2.8M shares for PIPE shareholders

News:

Wynn Reportedly Shopping Wynn Interactive Unit at Fire Sale Price of $500 Million (Casino.org)

Wynn Resorts (NASDAQ:WYNN) is reportedly looking to offload its Wynn Interactive unit at steeply discounted price of $500 million.

The Encore operator scrapped the blank-check merger [with Austerlitz Acquisition Corp I (AUS)] last November, citing promotional spending in the US sports betting industry.

In light of elevated marketing and promotional spend in the sports betting industry, we are pivoting our user acquisition efforts to a more targeted ROI-focused strategy,” said Wynn Interactive CEO Craig Billings in a statement issued at the time. “In so doing, we expect the capital intensity of the business to decline meaningfully beginning in the first quarter of 2022.”

Soon after, Morgan Stanley valued Wynn Interactive at $700 million as the integrated resort operator made clear it wanted no part of what it views as unfavorable economics to gain market share in the ultra-competitive sports betting space.

“The market is really not sustainable right now. Competitors are spending too much to get customers. The economics are just not something that we’re going to participate in in the short term,” said soon-to-be-former CEO Matt Maddox on Wynn’s third-quarter earnings conference call.

Merger Votes/ Completions:

Friday activity:

Quick News:

SPACs Are Running Out of Names to List (WSJ)

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

S-4 Activity:

S-4 filings:

Broadscale Acquisition Corp. (SCLE) & Voltus (Friday)

S-4/A filings:

Growth Capital Acquisition Corp. (GCAC) & Cepton Technologies (4th amendment)

Highland Transcend Partners I Corp. (HTPA) & Packable (3rd amendment)

East Stone Acquisition Corp (ESSC) & JHD Holdings (9th amendment)

RedBall Acquisition Corp. (RBAC) & SeatGeek (2nd amendment) (Friday)

S-4 Effective Today:

Novus Capital Corporation II (NXU) & Energy Vault

Tracking De-SPAC S-1s (including PIPE resale registrations*):

S-1 filings:

Pardes Biosciences (PRDS) (Friday)

ADS-TEC Energy (ADSE -10.6%) (Friday)

S-1/A filings:

S-1 Effective Today:

Altus Power (AMPS)

*When applicable

New S-1s:

Friday:

1) FG Merger Corp. (Ticker not available yet)

$70M, 1/2 Warrant

Focus: Financial services industry in North America

Upcoming Dates:

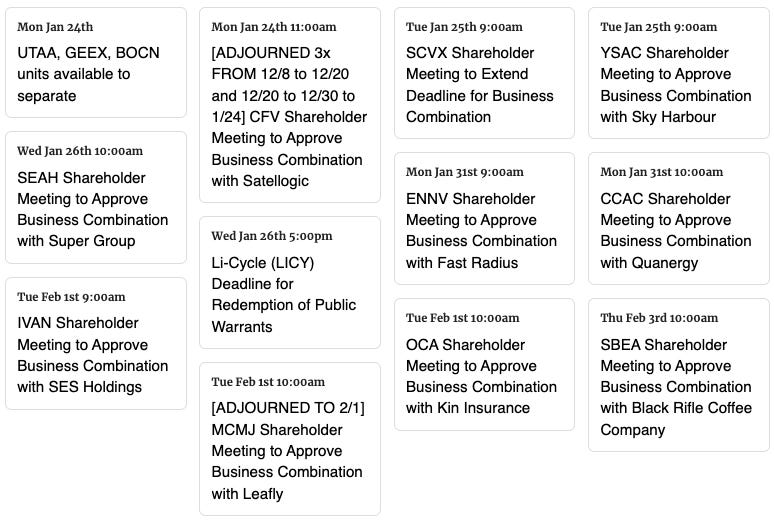

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions, Earnings, and Expected Ticker Changes

See the full calendar here.

Thanks for reading,