The Precap from SPAC Track

The Precap newsletter: SPAC Track’s morning recap of the action in the SPAC world for premium subscribers. (January 25, 2022)

Important Update:

The Nightcap newsletter is now the Precap — a SPAC newsletter sent in the morning before the market opens each day. After today, The Precap will be sent to premium subscribers only. The free nightly newsletter, for now, will be replaced with a weekly newsletter (sent on the weekend) that will recap the SPAC market activity of each week with more data and analysis.

We will be focused on growing our team to help us with the new services and content that we are currently building that will cover more of the capital markets (in addition to improving SPAC Track)!

SPACTrack.io and the Pro service will continue to run as normal with many improvements coming in the future. Whether you are playing a long, short, arb, swing, or any other strategy, or simply an observer of the asset class, there is something for you on SPAC Track and more to come!

Sign up for SPAC Track Pro and get 20% off of the first month or the first year of the annual subscription with the coupon: ‘20PRECAP2022’ (Expires Jan 31st).

The Stats:

Pre-Market Movers:

VMAC -5%, GGPI -2.6%, CFVI -1.83%, DWAC -1.65%

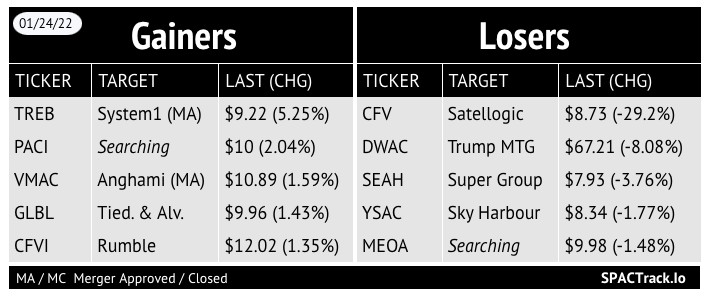

Yesterday’s Gainers & Losers + Volume Leaders:

The Deals:

1) Sports Ventures Acquisition Corp. (AKIC: warrants +47% pre-market) & DNEG

Merger Partner Description:

DNEG is one of the world’s leading visual effects (VFX) and animation companies for the creation of feature film, television, and multiplatform content. DNEG employs nearly 7,000 people with worldwide offices and studios across North America (Los Angeles, Montréal, Toronto and Vancouver), Europe (London) and Asia (Bangalore, Chandigarh, Chennai and Mumbai).

DNEG’s critically acclaimed work has earned the company six Academy Awards® for Best Visual Effects and numerous BAFTA and Primetime EMMY® Awards for its high-quality VFX work. Current and upcoming DNEG projects on behalf of its Hollywood and global studio and production company partners include Uncharted (February 2022), Death on the Nile (February 2022), Moonfall (February 2022), Borderlands (2022), Stranger Things S4 (2022), Aquaman and the Lost Kingdom (2022), Knives Out 2 (2022), The Last of Us (2022), The Flash (2022), and Shazam! Fury of the Gods (2023).

Valuation: $1.7B EV

PIPE & Additional Financing: $168M PIPE including affiliates of the sponsor: Sports Ventures, Novator Capital Limited, affiliates of Fairfax Financial and Arbor Financial. An affiliate of the sponsor will backstop a portion of the redemptions

In addition: “Contingent upon and concurrently with the closing of the proposed transaction, DNEG will enter into new senior secured credit facilities, consisting of a $325 million term loan facility that will be fully drawn at closing, and a $125 million revolving credit facility”

Additional Press: WSJ

2) Arisz Acquisition Corp. (ARIZ: warrants +40% pre-market) & BitFuFu

Merger Partner Description:

BitFuFu is a fast-growing digital asset mining service and world-leading cloud-mining service provider. BitFuFu has been invested by, and is the only cloud-mining strategic partner of Bitmain to date, a world-leading cryptocurrency mining hardware manufacturer.

BitFuFu is dedicated to fostering a secure, compliant, and transparent blockchain infrastructure, providing a variety of stable and intelligent hashrate service solutions to a global customer base. Leveraging its expanding global mining facility network and strategic partnership with Bitmain, BitFuFu enables institutional customers and digital asset enthusiasts to mine digital assets efficiently. With a robust business model covering cloud-mining, miner hosting, and self-mining, BitFuFu is well-positioned to weather market volatility and facilitate the vertical integration of global digital asset mining industry.

Valuation: $1.5B EV

PIPE & Additional Financing: $70M PIPE including investments from Bitmain and Antpool

Investor Presentation pending

Merger Votes/ Completions:

Merger Vote Set:

Sonder (SOND) released its redemption numbers from its merger with Gores Metropoulos II (GMII):

43.3M shares were redeemed, or an estimated 96% of the public SPAC shares

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

IPOs*:

1) LatAmGrowth SPAC Announces Pricing of $130,000,000 Initial Public Offering (LATG-U)

2) Keyarch Acquisition Corporation Announces Pricing of $100 Million Initial Public Offering (KYCH-U)

*Priced as of this writing

S-4 Activity:

S-4/A filings:

Bridgetown 2 Holdings Limited (BTNB) & PropertyGuru (1st amendment) (Monday)

S-4 Effective:

Growth Capital Acquisition Corp. (GCAC) & Cepton Technologies

Tracking De-SPAC S-1s (including PIPE resale registrations*):

S-1 filings:

S-1 Effective:

BuzzFeed (BZFD)

*When applicable

New S-1s:

No new S-1s yesterday.

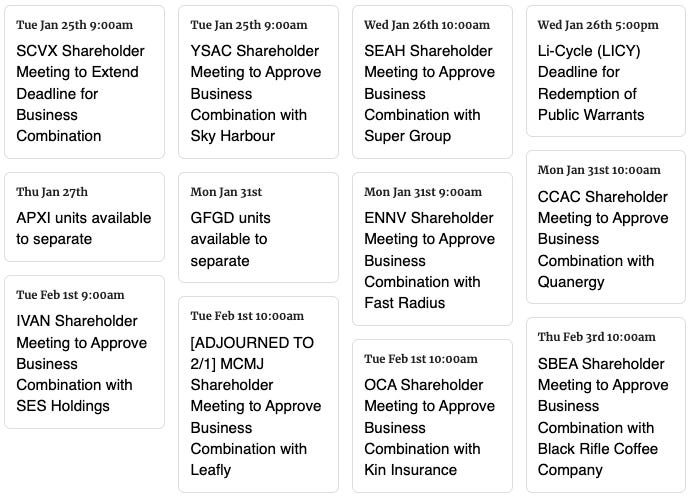

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions, Earnings, and Expected Ticker Changes

See the full calendar here.

Thanks for reading,