As a reminder, the Nightcap nightly newsletter is now the Precap — a SPAC newsletter sent in the morning before the market opens each day to our Pro subscribers only.

Sign up for SPAC Track Pro and for get 15% off of the first month or the first year of the annual subscription with the coupon: ‘15PRECAP2022’.

If you haven’t subscribed to this Free nightly newsletter, you can do so below.

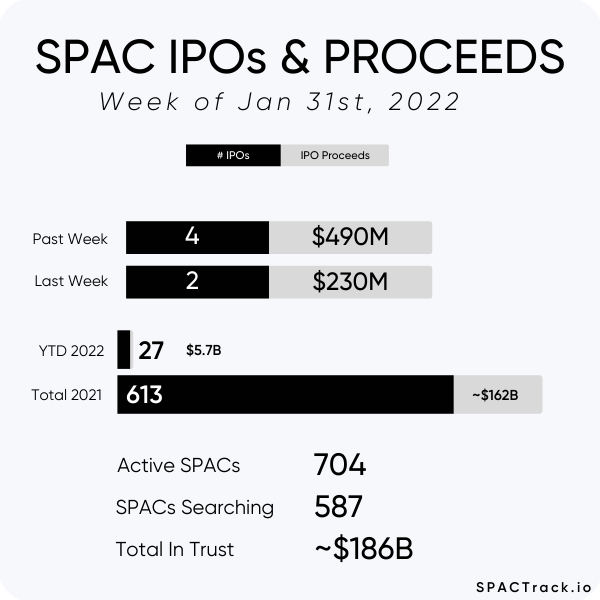

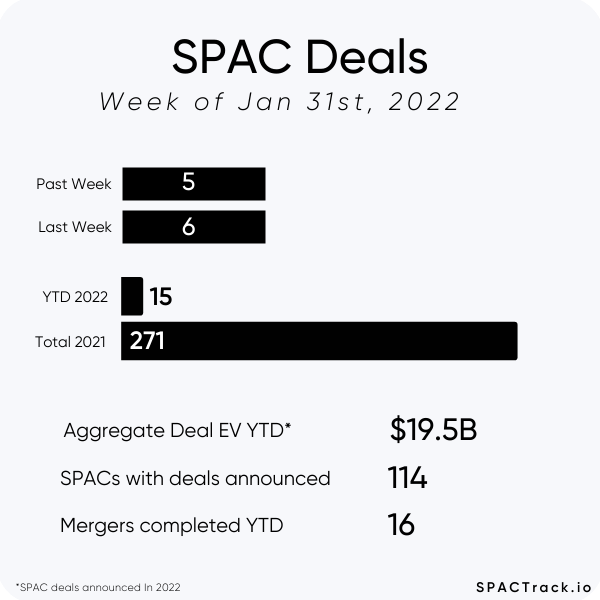

Stats from the Past Week:

The Deals (5):

1) Agrico Acquisition Corp. (RICO) & Kalera:

Kalera is a vertical farming company headquartered in Orlando, Florida. The company produces fresh, nutritious, and excellent tasting leafy greens with minimal environmental impact. It has spent several years optimizing plant nutrient formulas and developing an advanced automation and data acquisition system with Internet of Things, cloud, big data analytics and artificial intelligence. Kalera currently operates farms in Orlando (Florida), Atlanta (Georgia), Houston (Texas), and Kuwait.

Valuation: $222M EV

2) OTR Acquisition Corp. (OTRA) & Comera Life Sciences:

Leading a compassionate new era in medicine, Comera Life Sciences is applying a deep knowledge of formulation science and technology to transform essential biologic medicines from intravenous (IV) to subcutaneous (SQ) forms. The goal of this approach is to provide patients with the freedom of self-injectable care, reduce institutional dependency and to put patients at the center of their treatment regimen.

Valuation: $151.3M EV

3) Angel Pond Holdings Corp (POND) & MariaDB:

Merger Partner Description:

MariaDB uses pluggable, purpose-built storage engines to support workloads that previously required a variety of specialized databases. With complexity and constraints eliminated, enterprises can now depend on a single complete database for their needs, whether on commodity hardware or their cloud of choice. Deployed in minutes for transactional, analytical or hybrid use cases, MariaDB delivers unmatched operational agility without sacrificing key enterprise features, including real ACID compliance and full SQL. Trusted by organizations such as, Bandwidth, DigiCert, InfoArmor, Oppenheimer, Samsung, SelectQuote, SpendHQ – MariaDB meets the same core requirements as proprietary databases at a fraction of the cost. No wonder it’s one of the fastest growing database management systems companies.

Valuation: $672.1M EV

4) CHW Acquisition Corporation (CHWA) & Wag Labs:

Wag! strives to be the #1 app for pet parents, offering access to 5-star dog walking, pet sitting, expert pet advice, and training from local pet caregivers nationwide. Wag!'s community of over 350,000 pet caregivers are pet people, and it shows. Making pet parents happy is what Wag! does best. With safety and happiness at the forefront, pet caregivers with Wag! have a trusted record of experience with over 11 million pet care services and over $300 million total bookings across all 50 states, resulting in more than 96% of services earning 5 stars.

Valuation: $348M EV

5) Edoc Acquisition Corp. (ADOC) & Calidi Biotherapeutics:

Calidi Biotherapeutics is a clinical-stage immuno-oncology company with proprietary technology that is revolutionizing the effective delivery and potentiation of oncolytic viruses for targeted therapy against difficult-to-treat cancers. Calidi Biotherapeutics is advancing a potent allogeneic stem cell and oncolytic virus combination for use in multiple oncology indications. Calidi’s off-the-shelf, universal cell-based delivery platforms are designed to protect, amplify, and potentiate oncolytic viruses currently in development leading to enhanced efficacy and improved patient safety.

Valuation: $449M EV

News:

Triterras (TRIT: Delisted) announced that the company has received notice from Nasdaq that they denied the Company’s appeal of the delisting and suspension of trading of Triterras’ stock due to the Company’s failure to file its annual report on Form 20-F. Trading will be suspended effective today

Triterras intends to appeal the decision within the applicable 15-day appeal period

SOC Telemed (TLMD) announced on Tuesday that it will be acquired by Patient Square Capital at $3 per share. TLMD closed Monday’s session at $0.64, thus the price represented a premium of ~366%

Co-founders of embattled EV SPAC [Electric Last Mile (ELMS)] exit after bumpy last mile (TechCrunch)

Byju’s Aims for SPAC Merger Agreement Within a Month (Bloomberg)

Marcelo Claure officially resigns as CEO and a Director of LDH Growth Corp I (LDHA), a SoftBank sponsored SPAC targeting Latin America, after news of his departure from SoftBank last week

Faraday Future (FFIE) says review found inaccurate statements made to investors (Reuters)

Merger Votes/ Completions/ Extensions:

Liquidations:

Burgundy Technology Acquisition Corp. (BTAQ) will liquidate as of March 1st. All public SPAC shares will be redeemed for $10.05, while warrants will expire worthless

Terminations:

Longview Acquisition Corporation II (LGV) announces the mutual termination of its merger with HeartFlow

“Longview requested that HeartFlow management undertake a thorough analysis of its financial projections. Following the conclusion of that process, and extensive mutual efforts to negotiate an appropriate valuation adjustment, both parties agreed to terminate the Business Combination Agreement.”

Completions:

Merida Merger Corp (MCMJ) completed its merger with Leafly and will begin trading as LFLY on Monday

Environmental Impact Acquisition Corp. (ENVI) completed its merger with GreenLight Biosciences (GRNA) and began trading under its new ticker, GRNA

Vistas Media Acquisition Company Inc. (VMAC) completed its merger with Anghami and started trading as ANGH starting today

Ivanhoe Capital Acquisition Corp. (IVAN) completed its merger with SES and started trading as SES

ECP Environmental Growth Opportunities Corp. (ENNV) completed its merger with Fast Radius and will trade as FSRD starting Monday

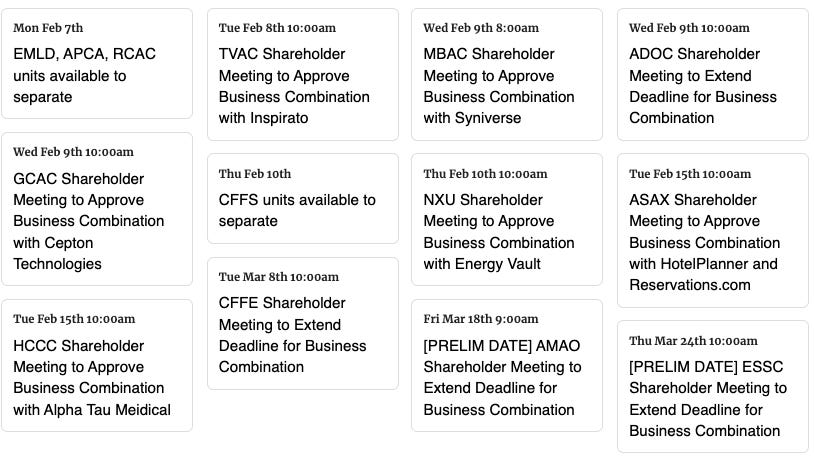

Merger Votes Set:

De-SPAC S-1s (including PIPE resale registrations*):

S-1 filings:

Sonder (SOND)

Thayer Ventures Acquisition Corporation / Inspirato (TVAC)

Dave (DAVE)

S-1 Effective:

Bowlero (BOWL)

AdTheorent (ADTH)

Pardes Biosciences (PRDS)

Hyperfine (HYPR)

Virgin Orbit (VORB)

ADS-TEC Energy (ADSE)

Heliogen (HLGN)

*When applicable

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions, Earnings

See the full calendar here.

Thanks for reading,