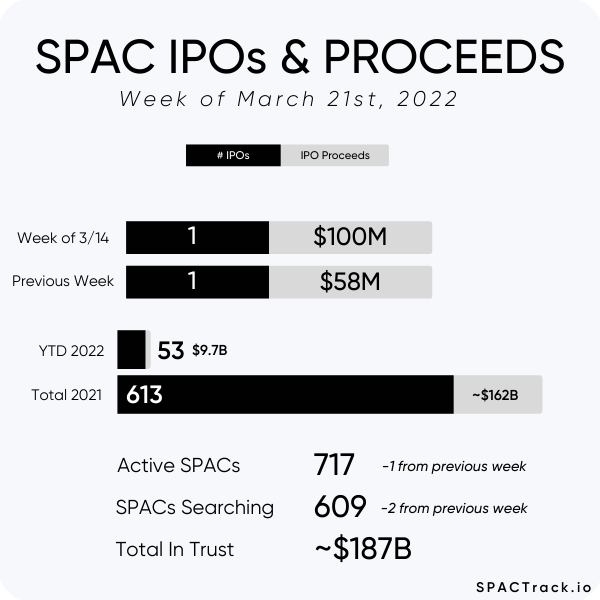

The Stats:

The Deals from the Past Week (4):

1) Avista Public Acquisition Corp. II (AHPA) & OmniAb (a subsidiary of Ligand)

Valuation: $1.5B EV

PIPE & Additional Financing: $15M & $100M redemption backstop from Avista, and a $15M contribution from Ligand

2) Primavera Capital Acquisition Corp. (PV) & Lanvin Group

Valuation: $1.5B EV

PIPE & FPA: $50M fully committed PIPE and forward purchase agreements of $130M “from investors including Fosun International Limited, ITOCHU Corporation, Stella International Limited, Baozun Hong Kong Investment Limited, Golden A&A, Aspex Master Fund and Sky Venture Partners L.P.”

Additional Notes: “A bonus pool of 3.6 million PubCo shares will be made available exclusively to PCAC non-redeeming public shareholders. Bonus shares forfeited by redeeming PCAC shareholders will be distributed to non-redeeming PCAC shareholders on a pro rata basis.”

3) Mount Rainier Acquisition Corp. (RNER) & HUB Cyber Security

Valuation: $1.28B EV

PIPE: $50M “anchored by Israeli and American institutional and existing investors”

“Proceeds from the PIPE are expected to satisfy the minimum cash closing condition and will be used as working capital to support continued growth and to fund acquisitions.”

4) Thunder Bridge Capital Partners IV, Inc. (THCP) & Coincheck, Inc. (a subsidiary of Monex Group)

Valuation: $1.25B transaction value

No PIPE

SPAC Track Pro:

Sign up for SPAC Track Pro and get 15% off of the first month or the first year of the annual subscription with the coupon: ‘15PRECAP2022’. View all of the data points available for SPAC Track Pro users here:

If you only want to subscribe to the premium daily newsletter (sent each morning before the market opens), you can do so here.

News:

Pacific Media Group Co-Founder Nears Stake in German Soccer Team (Front Office Sports)

Nikola Stock Soars as Production Begins on Battery-Electric Truck (Barron’s)

SmartRent acquires maintenance service platform SightPlan for $135M (FinLedger)

Fresh off dramatic majority shareholder exit, Firefly could be headed for a SPAC (TechCrunch)

FTX Invests $100M in Banking App Dave (DAVE), Forms Partnership for Crypto Payments (CoinDesk)

Koch Industries, Built on Oil, Bets Big on U.S. Batteries (WSJ)

Updates:

Terminations

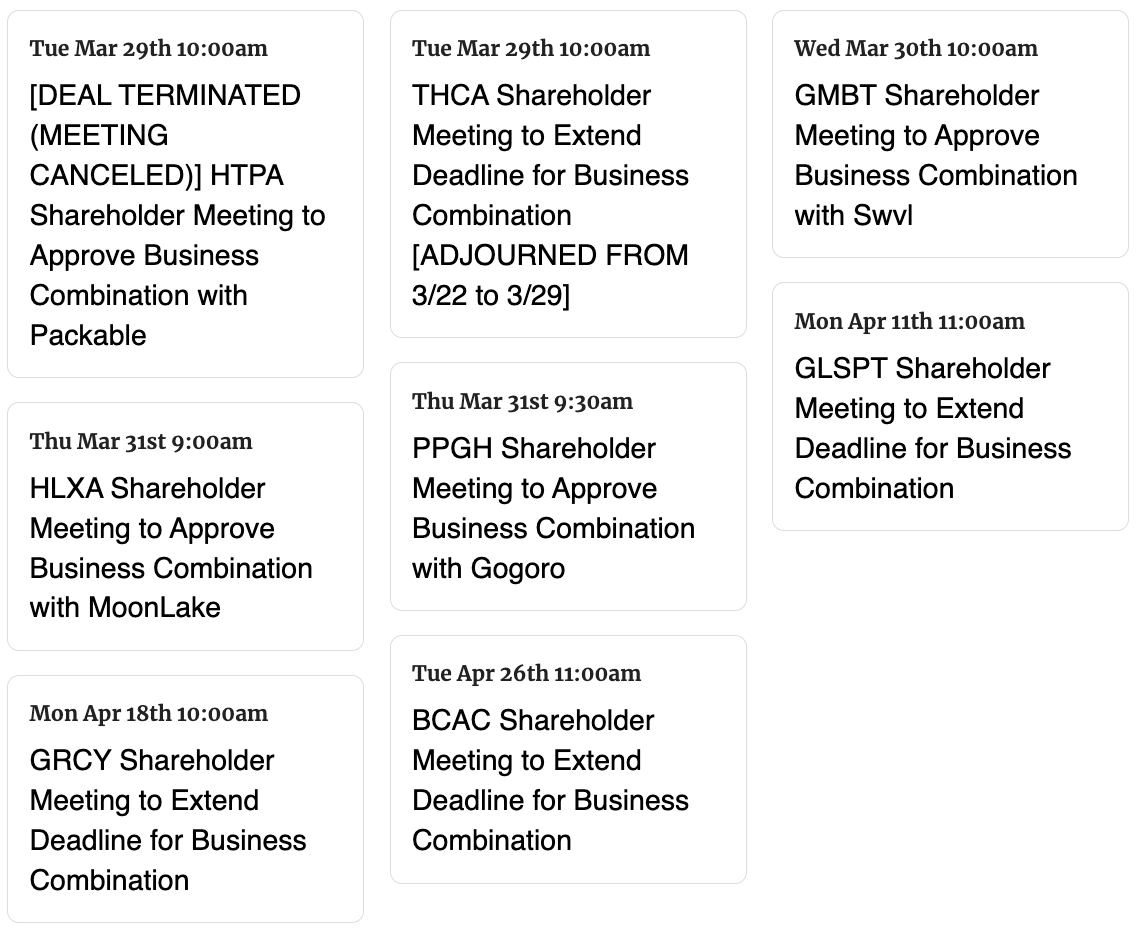

Highland Transcend Partners I Corp. (HTPA) and Packable terminate their merger agreement

Merger Votes/ Completions

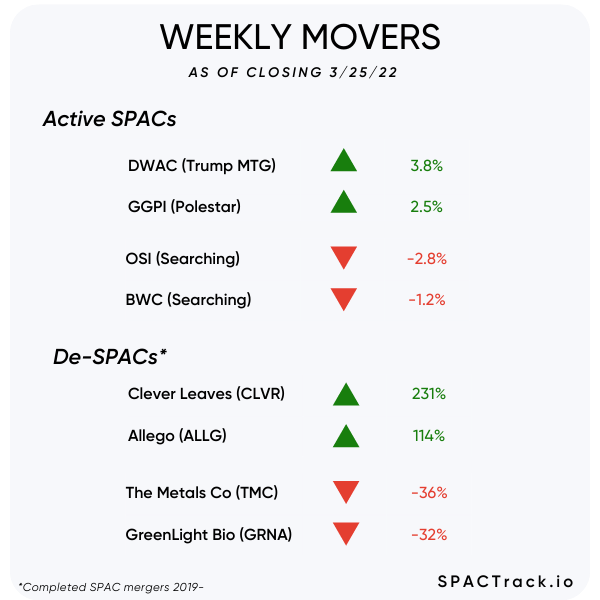

Spartan Acquisition Corp. III / Allego (ALLG) filed redemption numbers: 54M shares were redeemed or an estimated ~98% of the public SPAC shares

Motive Capital Corp (MOTV) and Forge Global announce the completion of the business combination and has begun trading as FRGE

The transaction raised appx. $215.6M in gross proceeds

Tailwind Two Acquisition Corp. (TWNT) announced the completion of its business combination with Terran Orbital and TWNT will begin trading as LLAP starting today

Extensions

Brilliant Acquisition Corporation (BRLI) shareholders approved the extension proposal, pushing the deadline to 7/23

Ackrell SPAC Partners I Co. (ACKIT) deposits $0.10 per share, extending its deadline to 6/23/22

American Acquisition Opportunity Inc (AMAO) shareholders approved the extension of the deadline from 3/22/22 to 9/22/22

Other Deal Updates

TradeUP Global Corp (TUGC) extends the outside date to 5/31 for its merger with SAITECH

De-SPAC S-1 Activity (including PIPE resale registrations*):

S-1 filings:

Rigetti Computing (RGTI)

Super Group (SGHC) Limited (SGHC)

*When applicable

S-4 Activity:

S-4 filings:

Provident Acquisition Corp. (PAQC) & Perfect Corp

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

Thanks for reading,