The SPAC Week in Review

A newsletter recapping the previous week's SPAC activity (June 13, 2022)

The Stats:

The Deals from Last Week (1):

1) Mudrick Capital Acquisition Corporation II (MUDS) & Blue Nile

Valuation: $683M Pro-forma Enterprise Value

SPAC Track Pro:

SPAC Track Pro subscribers get access to the premium SPAC dataset on spactrack.io and get the premium newsletter sent to their inbox each morning that recaps the daily SPAC activity.

Sign up for 20% off the annual subscription with the promo code: ‘20JUNE’.

News from Last Week:

Hippo (HIPO) board replaces CEO Wand after stock price drops 80% (Globes)

Better.com [merging with Aurora Acquisition Corp. (AURC)] Misled Investors Ahead of Stalled SPAC Deal, Former Executive Alleges (WSJ)

Akulaku [which in January was reported to be in talks with Catcha Investment Corp (CHAA)] to increase stake in Indonesian digibank to 40% (Tech in Asia)

Cazoo (CZOO) to cut 750 jobs in UK and across Europe amid recession fears (The Guardian)

Bird (BRDS) is laying off 23% of staff (TechCrunch)

Asti associate EoCell in talks for potential SPAC combination (Business Times)

Ex-Credit Suisse Boss Thiam Loses Pimco Backing for Fintech SPAC (Bloomberg)

Grove Collaborative [merging with Virgin Group Acquisition Corp. II (VGII)] slashes long-term growth expectations as revenue drops (Retail Dive)

EV [De-]SPAC Faraday Future (FFIE) Now Has the Attention of the DOJ (TechCrunch)

Updates from Last Week:

Terminations / Liquidations

Silver Spike Acquisition Corp. II (SPKB) and Eleusis mutually agreed to terminate their merger “as a result of current unfavorable market conditions”

Today: Biotech Acquisition Company (BIOT) and Blade Therapeutics mutually agreed to terminate their merger

Merger Votes/ Completions

Merger vote set: Social Capital Suvretta Holdings Corp. III (DNAC) & ProKidney (7/6)

Oaktree Acquisition Corp. II (OACB) shareholders approved the merger with Alvotech

Dynamics Special Purpose Corp. (DYNS) completes its merger with Senti Biosciences and the combined company started trading as SNTI

14.5M shares were redeemed or an estimated ~63% of the public SPAC shares. 7.96M shares were subject to non-redemption agreements

SVF Investment Corp. 3 (SVFC) completed its merger with Symbotic and the combined company started trading as SYM

Globis Acquisition Corp. (GLAQ) completed its merger with Forafric and the combined company is now trading as AFRI

9.6M shares were redeemed or an estimated ~83% of the public SPAC shares

Forafric also entered into an FPA to purchase 1.5M shares at $10.80 per share from non-redeeming shareholders 3 months after closing

Tuatara Capital Acquisition Corporation (TCAC) shareholders approved the merger with SpringBig

19.1M shares were redeemed or an estimated ~96% of the public SPAC shares (estimated ~876k public SPAC shares remaining)

TCAC also had an up to 1M bonus share pool allocated for non-redeeming shareholders

Extensions

Global Consumer Acquisition Corp. (GACQ) announces it will extend its deadline from 6/11 to 9/11 by depositing ~$1.8M into trust

Delwinds Insurance Acquisition Corp. (DWIN) shareholders approved the extension of the deadline from 6/15 to 9/15 and DWIN will add $0.035 per remaining public share for each month

9.1M shares were redeemed or an estimated ~45% of the public SPAC shares

Other Deal/ SPAC Updates

Tribe Capital Growth Corp I (ATVC) Tribe Capital Growth Corp, led by Arjun Sethi- a former partner at Social Capital, is handing the reigns of the SPAC over to their co-sponsor, Arrow Capital

Pimco, a sponsor of Freedom Acquisition I (FACT), which is led by the former CEO of Credit Suisse, Tidjane Thiam, "sold its entire interest in our sponsor to NextG Limited”

Altitude Acquisition Corp. (ALTU) announces non-redemption agreements with holders of 1.25M shares in exchange for $0.033 per share per month for the 4-month extension (funded by ALTU’s CEO, Gary Teplis)

ALTU also announced that is in talks with a "leading global travel technology business and intends to announce a definitive agreement for the transaction in the coming weeks"

Benessere Capital Acquisition Corp. (BENE) and eCombustible amend the merger agreement, to among other things, add a minimum cash condition of $25M and to extend the outside date from 5/23 to 10/7

Isleworth Healthcare Acquisition Corp. (ISLE) and Cytovia amend their merger agreement to among other things eliminate “Isleworth’s satisfaction of the Minimum Cash Amount as a conditions to closing the Business Combination”

8i Acquisition 2 Corp. (LAX) and Euda Health amend the merger agreement to, among other things, reduce Euda’s pre-money equity valuation from $550M to $140M

PMV Consumer Acquisition Corp. (PMVC) announced that, as it has not yet filed a definitive proxy yet, it will not hold the meeting on the 6/14 date that was filed in the preliminary proxy. A date will be announced with the definitive proxy filing

Digital World Acquisition Corp. (DWAC) received a document request and subpoena from the SEC seeking various documents and information regarding its merger with Trump Media & Technology Group

De-SPAC Updates

Forge (FRGE) Announces Redemption of Public Warrants with an exercise deadline of 7/11

De-SPAC S-1 Filings (including PIPE resale registrations*):

S-1 Effective:

Allego (ALLG)

LumiraDx (LMDX)

Forge Global (FRGE)

Microvast (MVST)

*When applicable

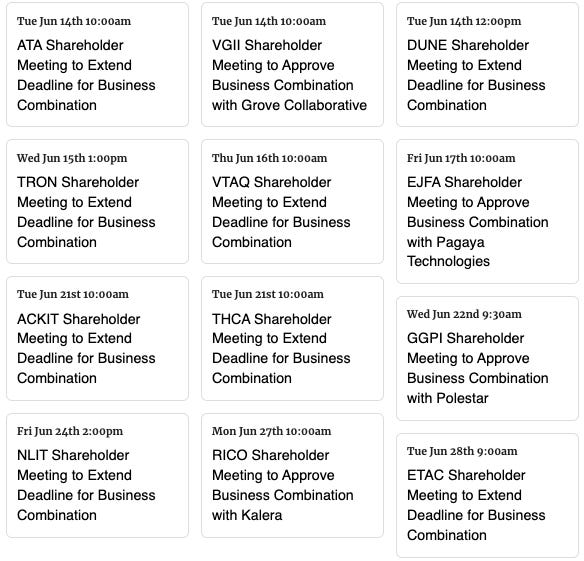

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

Thanks for reading,