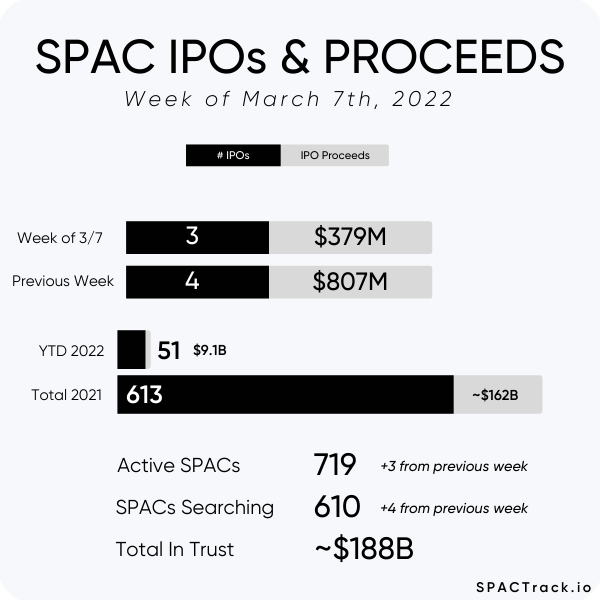

The Stats:

This Week’s Newsletter is brought to you by Rows

It’s your choice how to invest your capital. But one thing you’ll need for sure – a reliable spreadsheet for your portfolio.

Rows has reinvented spreadsheets to work the way you need. Instantly connect 40+ integrations with platforms like Stripe, Google Analytics, Twitter, Salesforce, Crunchbase, LinkedIn or custom APIs - all the data is now right in your spreadsheet. Get started for free.

The Deals from the Past Week (2):

1) Endurance Acquisition Corp. (EDNC) & SatixFy

Merger Partner Description:

SatixFy is developing satellite communication modems with Software Defined Radio (SDR) and Electronically Steered Multi Beam Antennas (ESMA) to support the most advanced communications standards, such as DVB-S2X. SatixFy’s ASICs radically increase system performance and reduce the weight and power requirements of terminals, payloads and save real estate for gateway equipment. The company delivers the industry’s smallest VSATs and multi-beam electronically steered antenna arrays for a variety of mobile applications and services such as Connected Car, IoT, consumer broadband, in-flight connectivity, communications payloads, and more. The company was founded in 2012, and is headquartered in Rehovot, Israel with additional offices in the United States, United Kingdom and Bulgaria.

Valuation: $632M EV

PIPE: $29M in units (1 share & 1/2 warrant), with downside protection to $6.50 (“non-dilutive” via share transfer from SPAC sponsor and Satixfy) including investments from Sensegain Group and Antarctica Capital

Additional Financing: Up to $75M equity from an affiliate of Cantor Fitzgerald

2) AMCI Acquisition Corp. II (AMCI) & LanzaTech NZ

Merger Partner Description:

LanzaTech harnesses the power of biology and big data to create climate-safe materials and fuels. With expertise in synthetic biology, bioinformatics, artificial intelligence and machine learning coupled with engineering, LanzaTech has created a platform that converts waste carbon into new everyday products that would otherwise come from virgin fossil resources. LanzaTech’s first two commercial scale gas fermentation plants have produced over 30 million gallons of ethanol, which is the equivalent of offsetting the release of 150,000 metric tons of CO2 into the atmosphere. Additional plants are under construction globally. LanzaTech is based in Illinois, USA.

Valuation: $1.82B EV

PIPE: $125M at $10 per share including investments from AMCI, ArcelorMittal, BASF, K1W1, Khosla Ventures, Mitsui & Co., LTD., New Zealand Superannuation Fund, Oxy Low Carbon Ventures LLC, Primetals Technologies, SHV Energy, and Trafigura

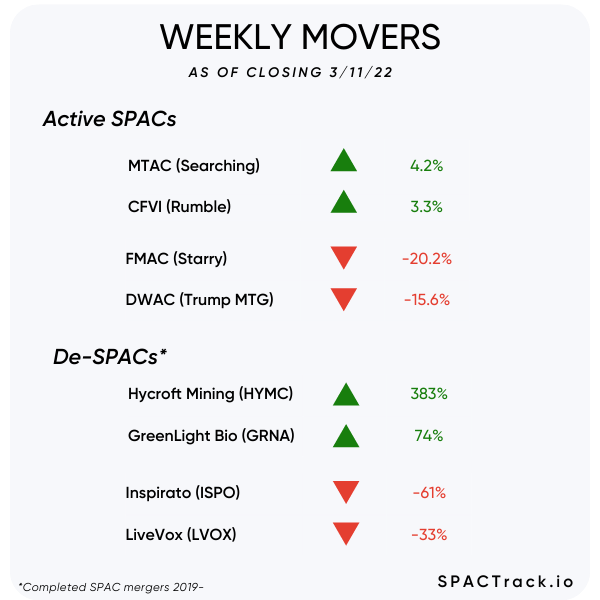

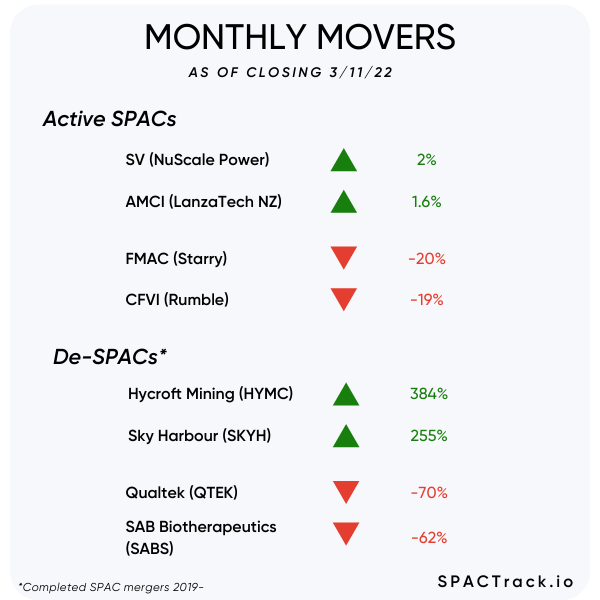

News:

Loeb Pushes Cano (CANO) Sale Due to Market’s Dislike of SPAC Deals (Bloomberg)

Games Global in Talks With Tailwind International (TWNI) SPAC (Bloomberg)

Better [merging with Aurora Acquisition Corp. (AURC)], after firing 900 employees over Zoom, is laying off 3,000 more workers (CNN Business)

Investing app Acorns taps ‘choppy’ private markets at $1.9 billion valuation after scrapping SPAC (CNBC)

Tomorrow.io Co-Founder Explains Backing out of SPAC, Maintains Satellite Constellation Plans (Via Satellite)

Bullish delays $9B SPAC merger, awaits SEC approval (Forkast)

B.Riley Principal 150 Merger Corp.’s (BRPM) merger partner, FaZe Clan, announces Snoop Dogg will become a member of the company’s Board of Directors upon closing of the merger

Updates:

Terminations

Rosecliff Acquisition Corp (RCLF) and Gett mutually agree to terminate their merger due to current market conditions

Gett also announced that it will be withdrawing from the Russian market (press release stated Russia business was less than 14% in Direct Gross Profit in Q4)

FoxWayne Enterprises Acquisition Corp. (FOXW) and Aerami Therapeutics mutually agree to terminate merger due to “current unfavorable market conditions”

Pine Technology Acquisition Corp. (PTOC) and Tomorrow.io Agree to Terminate Merger Agreement due to market conditions

Tomorrow.io will pay a breakup fee of $1.5M noted in more detail here

MedTech Acquisition Corporation (MTAC) and Memic Innovative Surgery mutually agree to terminate merger due to “market conditions and associated volatility as a result of recent world events”

Merger Votes/ Completions

Spartan Acquisition Corp. III (SPAQ) shareholders approve the merger with Allego. Closing is expected on the week of March 14th with the ticker changing to ALLG after closing

Bridgetown 2 Holdings Limited (BTNB) Announces it expects the Business Combination with PropertyGuru will close on or around 3/17 with the merged company beginning to trade on 3/18

Extensions

CF Acquisition Corp. VIII (CFFE) announces shareholder approval of extension of the deadline to 9/30/22.

2.9M shares were redeemed and $0.20 per non-redeeming share was deposited into trust.

Globis Acquisition Corp. (GLAQ) announces extension of the deadline to 6/15/22

Other Deal Updates

B. Riley Principal 150 Merger Corp. (BRPM) and FaZe Clan, among other things, agree to remove the minimum cash condition to close the merger and enter into a $10M bridge loan agreement

FirstMark Horizon Acquisition Corp. (FMAC) enters into non-redemption agreements for ~2.4M shares in connection with its merger with Starry

Silver Crest Acquisition Corporation (SLCR) announces a decrease in pre-money equity valuation from $1.69B to $1.4B and announces an up to $94.5M PIPE as well as additional financing

Sign up for SPAC Track Pro and get 15% off of the first month or the first year of the annual subscription with the coupon: ‘15PRECAP2022’. View all of the data points available for SPAC Track Pro users here: spactrack.io/pro

If you only want to subscribe to the premium daily newsletter (sent each morning before the market opens), you can do so here:

De-SPAC S-1 Activity (including PIPE resale registrations*):

Effective:

Codere Online (CDRO)

*When applicable

S-4 Activity:

S-4 filings:

CHW Acquisition Corp (CHWA) & Wag Labs

OTR Acquisition Corp. (OTRA) & Comera Life Sciences

Upcoming Dates:

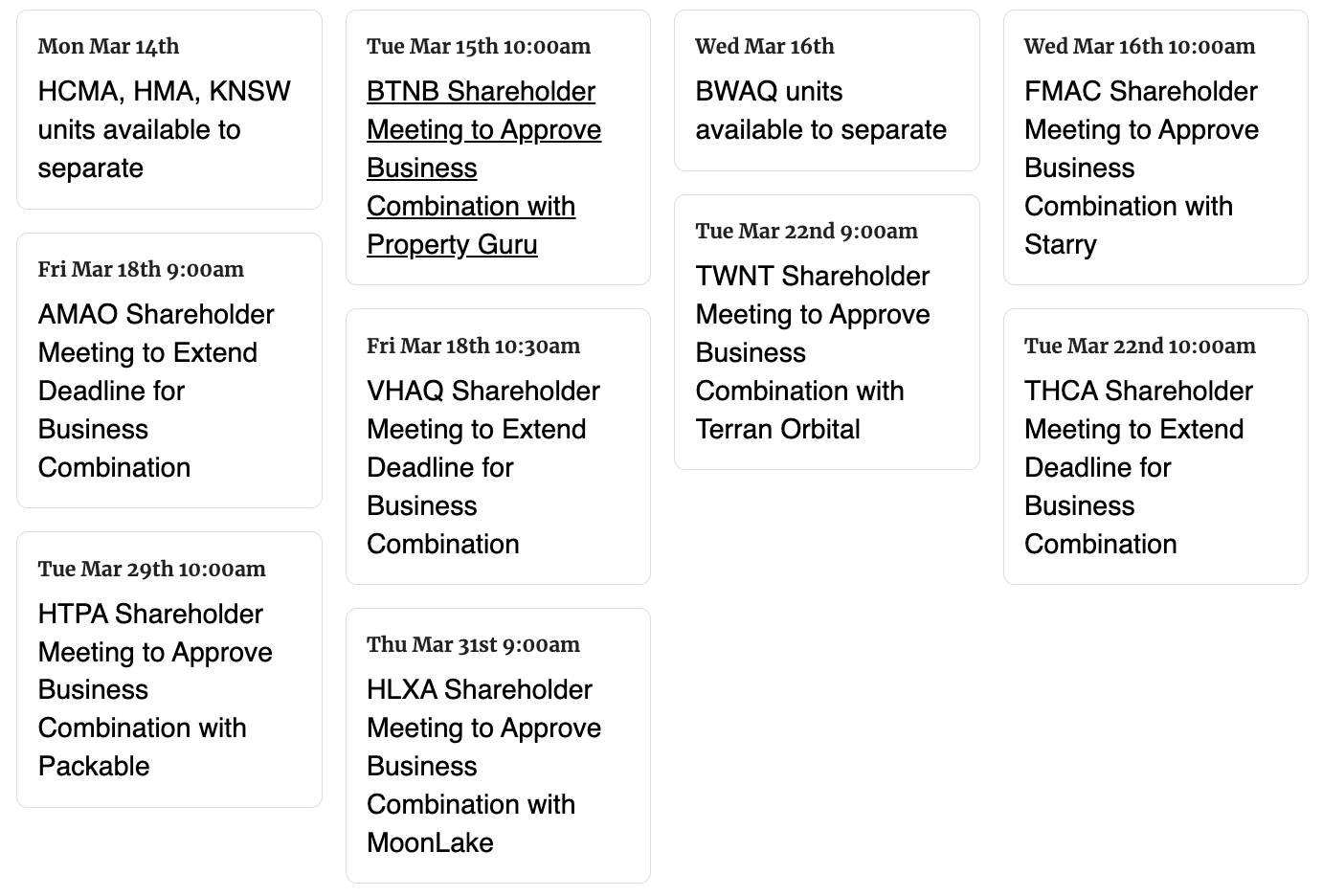

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

Thanks for reading,