SPAC Track Pro subscribers get the premium newsletter sent to their inbox each morning that recaps the daily SPAC activity. See today’s morning newsletter here:

The Stats:

The Deals from This Week (1):

1) American Acquisition Opportunity Inc. (AMAO) & Royalty Management Corporation

$111M Pro-forma Enterprise Value

SPAC Track Pro:

SPAC Track Pro subscribers get access to the premium SPAC dataset on spactrack.io and get the premium newsletter sent to their inbox each morning that recaps the daily SPAC activity.

Sign up using the code, ‘JulyNL22’, before the end of July to receive 30% off the annual subscription.

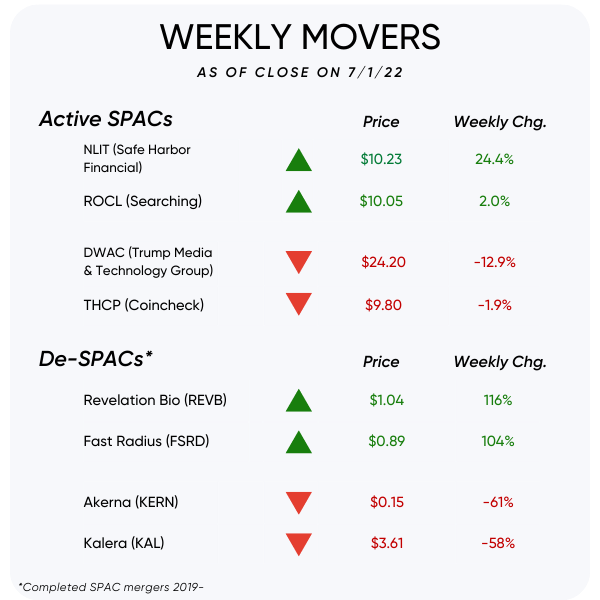

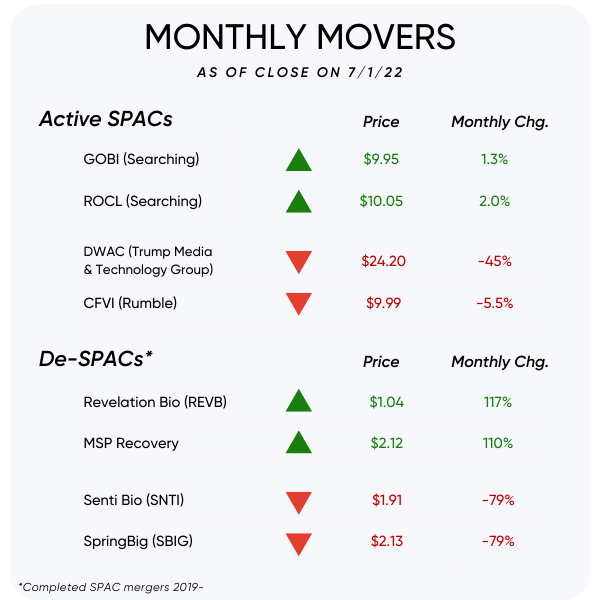

News from This Week:

Trump media company subpoenaed in federal criminal probe of SPAC deal (CNBC)

EToro to Abandon Deal to Go Public via SPAC Merger [with FinTech Acquisition Corp V (FTCV)] (The Information)

[De-]SPAC Led by Former Apple Executive [Enjoy Technology (ENJY)] Goes Bankrupt Less Than a Year After Going Public (Bloomberg)

Byju's says 500 employees laid off across the group, employees claim 1,100 retrenched at Toppr alone (The Hindu)

EV motorway charging network Gridserve in M&G funding talks (Sky News)

US Regulator to Review SPAC Audits After Restatement Wave (Bloomberg Tax)

Hyperfine (HYPR) CEO steps down after one year (Fierce Biotech)

Bird (BRDS) gets a warning from the NYSE because its stock price is too low (TechCrunch)

—> Also: CEO Travis VanderZanden steps down as president (TechCrunch)

4D pharma (LBPS), which has been placed into administration under English law after being unable to repay loans from its creditors, is set to be delisted from Nasdaq on 7/7

With SPAC merger [with Vickers Vantage Corp. I (VCKA)] looming, Scilex sues Apotex to block generic copy of key pain patch (Fierce Pharma)

India’s JetSynthesys Is Said in Talks to Merge With BurTech SPAC [BurTech Acquisition Corp. (BRKH)]

Updates from This Week:

Terminations / Liquidations

G3 VRM Acquisition Corp. (GGGV) announced that it will liquidate on 7/6 at a liquidation price of $10.15 per share

Isleworth Healthcare Acquisition Corporation (ISLE) and Cytovia Therapeutics terminated their merger agreement that was announced in April

North Atlantic Acquisition Corp. (NAAC) and TeleSign terminateD their merger agreement

USHG Acquisition Corp. (HUGS) and Panera Brands terminate their agreement that would have HUGS participate in the Panera Brands IPO, with HUGS continuing to look for a merger partner

Merger Votes/ Completions

Merger vote set:

Polestar (PSNY) released the official redemption number for its merger with Gores Guggenheim, Inc. (GGPI)

—> ~16.3M shares were redeemed or an estimated ~20.3% of the public SPAC shares

Agrico Acquisition Corporation (RICO) completed its merger with Kalera and started trading as KAL

—> ~14.3M shares were redeemed or an estimated ~98% of the public SPAC shares

Northern Lights Acquisition Corp. (NLIT) shareholders approved its merger with Safe Harbor Financial

—> NLIT also announced that it will accept redemption reversals, and that it is extending the outside date to 7/29 with the ability to extend to 8/31

Extensions

Model Performance Acquisition Corp. (MPAC) announced that it has deposited $0.10 per share into trust to extend its deadline from 7/12 to 10/12

Brookline Capital Acquisition Corp. (BCAC) deposited $0.033 per public share into the trust to extend its deadline by 1 month to 8/2

Tuscan Holdings Corp. II (THCA) shareholders approved the deadline extension from 6/30 to 12/31 with 39,400 shares redeemed

Northern Lights Acquisition Corp. (NLIT) announced that it had deposited $0.10 per public SPAC share into trust to extend its deadline from 6/28 to 9/28

Other Deal/ SPAC Updates

Digital World Acquisition Corp. (DWAC) files an 8-K noting that on 6/24 it received “a grand jury subpoena with substantially similar requests” to the earlier subpoenas from the SEC and a federal grand jury in the Southern District of NY

Benessere Capital Acquisition Corp. (BENE) files an 8-K noting that its directors (same sponsor as DWAC) have also received subpoenas by a federal grand jury in the Southern District of New York in connection with the DWAC investigation

Chavant Capital Acquisition Corp. (CLAY) signed a non-binding LOI with a “U.S. based technology company … developing advanced connectivity solutions with high bandwidth and low latency, targeting customers in the infrastructure, consumer electronics, satellite, automotive and other sectors”

Kismet Acquisition Two Corp. (KAII) announces its sponsor has transferred all the membership interest to a new sponsor: Quadro IH DMCC and Dimitri Elkin has taken over as the new CEO

Far Peak Acquisition Corporation (FPAC) & Bullish announce they have extended the outside date from 7/8 to 12/31 with Bullish having paid a $2.5M extension fee to FPAC to be used for working capital

—> FPAC also noted in its amended F-4 that the deal will move forward without the $300M PIPE as the PIPE subscription agreements expire on 7/8

26 Capital Acquisition Corp. (ADER) and Okada Manila amend the merger agreement to extend the outside date to 10/1

Global Consumer Acquisition Corp. (GACQ) amends its merger agreements with Luminex and with GP Global, to extend the outside dates to 8/15 and 9/11 respectively

Waldencast Acquisition Corp. (WALD) announces it has entered into a credit agreement for up to $225M

Silver Crest Acquisition Corporation (SLCR) and Tim Horton’s China amend their merger agreement, to extend the outside date to 8/30

De-SPAC Updates

Vivid Seats (SEAT) Announces Expiration and Results of Exchange Offer and Consent Solicitation Relating to its Public Warrants

De-SPAC S-1 Filings (including PIPE resale registrations*):

Filings:

MSP Recovery (MSPR)

Symbotic (SYM)

Senti Biosciences (SNTI)

SpringBig (SBIG)

Effective:

Global Business Travel Group (GBTG)

Comera Life Sciences (CMRA)

*When applicable

S-4 Filings:

KludeIn I Acquisition Corp. (INKA) & Near

Lakeshore Acquisition I Corp. (LAAA) & ProSomnus

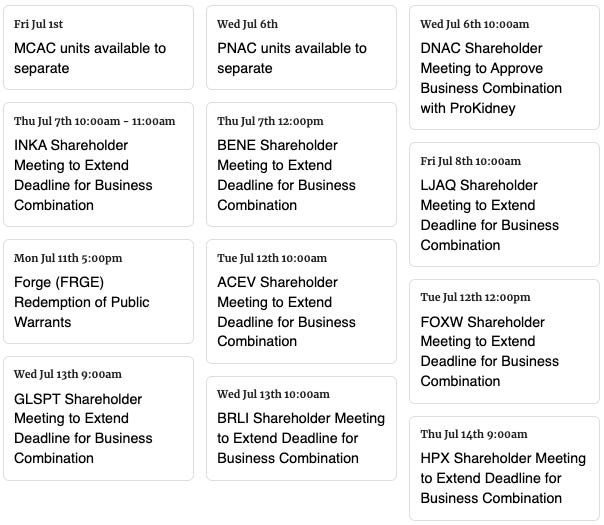

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

Thanks for reading,