The SPAC Week in Review

A newsletter recapping the previous week's SPAC activity (May 16, 2022)

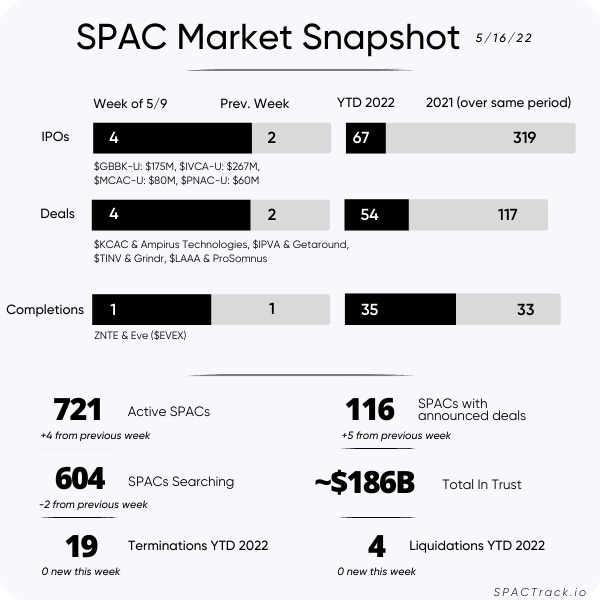

The Stats:

The Deals from Last Week (4):

1) InterPrivate II Acquisition Corp. (IPVA) & Getaround

Valuation: $1.2B Pro-forma Equity Value

2) Kensington Capital Acquisition Corp. IV (KCAC) & Amprius Technologies

Valuation: $939M Pro-forma Equity Value

3) Tiga Acquisition Corp. (TINV) & Grindr

Valuation: $2.09B Pro-forma Enterprise Value

4) Lakeshore Acquisition I Corp. (LAAA) & ProSomnus

Valuation: $168M Pro-forma Enterprise Value

SPAC Track Pro:

SPAC Track Pro subscribers get access to the premium SPAC dataset on spactrack.io and get the premium newsletter sent to their inbox each morning that recaps the daily SPAC activity.

Now until the end of May, sign up for 25% off the annual subscription with the promo code: ‘25MAY’. Expires at the end of May.

News from Last Week:

How a Digital Token Designed to be Stable Fueled a Crypto Crash (Barron’s) >> [references: Concord Acquisition Corp (CND) & Circle]

SmartRent’s (SMRT) losses widen as supply-chain crisis lingers (TheRealDeal)

WeWork (WE) narrows quarterly losses as workers make slow return

Lordstown Motors (RIDE) closes $230 million deal to sell its Ohio factory to Foxconn, injecting needed cash days before deadline (CNBC)

SPAC Retreat Shows Wall Street Awakens to Risk, Gensler Says (Bloomberg)

Chicken Soup for the Soul Entertainment (CSSE) to Acquire Redbox (RDBX)

Goldman Is Pulling Out of Most SPACs Over Threat of Liability (Bloomberg)

BofA Scales Back on SPAC Work as Bank Retreat Accelerates (Bloomberg)

Chelsea FC Agrees $5.2B Sale to Consortium Led by DraftKings Investor Todd Boehly (Casino.org)

Gett valuation plummets to $265 million as company faces uncertain future (Calcalist)

SEC Official Behind 1,000 Restatements Has Unusual Title: Acting (Bloomberg Tax)

CFA Institute calls for tougher disclosure rules for Spac sponsors (FT)

Updates from Last Week:

Terminations / Liquidations

No activity

Merger Votes/ Completions

OTR Acquisition Corp. (OTRA) shareholders approved the merger with Comera Life Sciences

10.3M shares were redeemed or an estimated ~97% of the public SPAC shares. Holders of 395k shares have since reversed their redemption election bringing the redemption figure to 9,994,363 shares

OTRA has extended the deadline for redemption withdrawal to 5/17 at 4pm EST. The merger is expected to close on 5/18

Zanite Acquisition Corp (ZNTE) completed its merger with Eve and the company started trading under the new ticker, EVEX

~21M shares were redeemed or an estimated ~91% of the public SPAC shares

Artisan Acquisition Corp. (ARTA) shareholders approved the merger with Prenetics

The merger is expected to be completed on 5/18 with the ticker change to PRE following the closing

Merger vote set:

Dynamics Special Purpose Corp. (DYNS) & Senti Bio (6/7)

Globis Acquisition Corp. (GLAQ) & Forafric (6/7)

RedBall Acquisition Corp. (RBAC) & SeatGeek (6/1/22)

Oaktree Acquisition Corp. II (OACB) & Alvotech (6/7/22)

SVF Investment Corp. 3 (SVFC) & Symbotic (6/3/22)

Biotech Acquisition Company (BIOT) & Blade Therapeutics (6/1/22)

Extensions

Better World Acquisition Corp. (BWAC) shareholders approved the deadline extension from May 17 to August 17 with ~5.6M shares redeemed or an estimated ~45% of the public SPAC shares

Maquia Capital Acquisition Corporation (MAQC) announces it extended its deadline from 5/7/22 to 8/7/22 by depositing $0.10 per public SPAC share into the trust

Breeze Holdings Acquisition Corp. (BREZ) shareholders approved the deadline extension from 5/25/22 to 9/26/22

~6.7M shares were redeemed leaving $49.3M in the trust

Other Deal Updates

ShiftPixy, Inc. (PIXY) announced a special distribution to ShiftPixy shareholders in the form of shares of common stock of Industrial Human Capital, Inc. (AXH)

ArcLight Clean Transition Corp. II (ACTD), announced that investors comprising $110.8M in PIPE investments, or appx 89%, have entered into amendments extending the termination date for the PIPE subscriptions in connection with its merger with Opal Fuels

Lionheart Acquisition Corporation II (LCAP) announced a dividend in the form of 1.029B warrants pro-rata to non-redeeming shareholders in connection with its merger with MSP Recovery

LCAP also entered into Non-Binding Term Sheets for up to 3.5M share FPA and up to $1B Equity Facility with Cantor Fitzgerald

Duddell Street Acquisition Corp. (DSAC) and FiscalNote announced an upsized credit facility and bonus pool for non-redeeming shareholders

Biotech Acquisition Company (BIOT) and Blade Therapeutics announce the company has entered into a common stock purchase agreement with an affiliate of Cantor Fitzgerald, of up to $75M at Blade’s option

AGBA Acquisition Limited (AGBA) and TAG Holdings amended the merger agreement to, among other things, extend the outside date from 4/30/22 to 10/31/22

Far Peak Acquisition Corporation (FPAC) and Bullish amend the merger agreement to extend the outside date to 7/8/22

Kingswood Acquisition Corp. (KWAC) enters into a non-binding Letter of Intent with Wentworth Management Services, “a platform of RIAs/broker dealers which employ differentiated advisor business models with a shared support services backbone, providing optionality to their advisors and investors”

KWAC expects to announce additional details regarding the proposed business combination when a definitive agreement is executed, which is expected later in Q2'2022 and with a closing anticipated in Q3'2022.

Mount Rainier Acquisition Corp.’s (RNER) merger partner, HUB Cyber Security, announces a $5M PIPE at $1.76 per share, or a ~100% premium to the trading price (TASE: Tel Aviv Stock Exchange: HUB) as of the PR issuance, and 4.5M in warrant coverage. The TASE gave approval for the PIPE to proceed on May 10

De-SPAC S-1 Filings (including PIPE resale registrations*):

S-1 Filings:

NuScale Power (SMR))

S-1 Effective:

Cepton Technologies (CPTN)

Core Scientific (CORZ)

Satellogic (SATL)

Energy Vault (NRGV)

*When applicable

S-4 Activity:

S-4 filings:

Tiga Acquisition Corp. (TINV) & Grindr

AMCI Acquisition Corp. II (AMCI) & LanzaTech NZ

Vickers Vantage Corp. I (VCKA) & Scilex Holding Company, a Sorrento Therapeutics Inc. Subsidiary

Digital World Acquisition Corp. (DWAC) & Trump Media & Technology Group

Executive Network Partnering Corp. (ENPC) & Granite Ridge Resources (Grey Rock oil and gas assets)

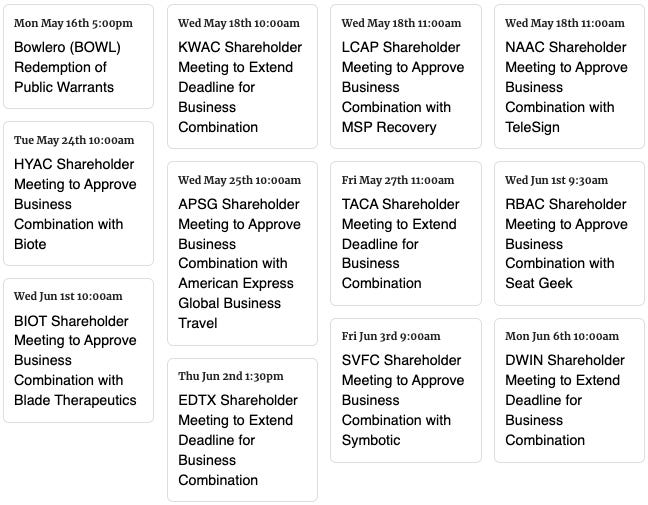

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

Thanks for reading,