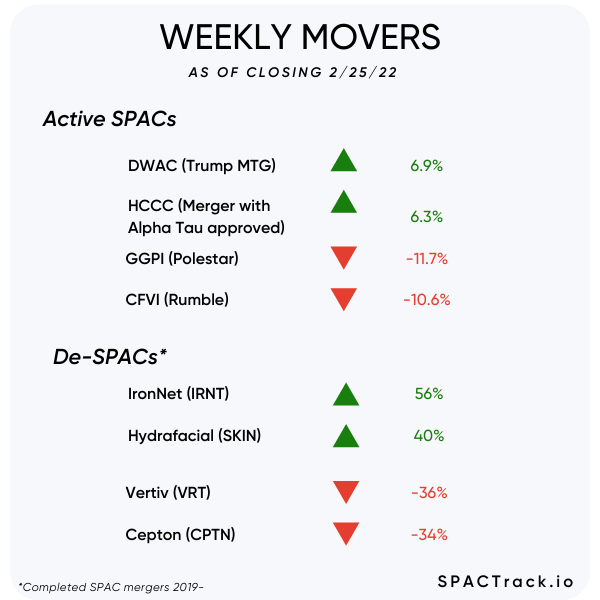

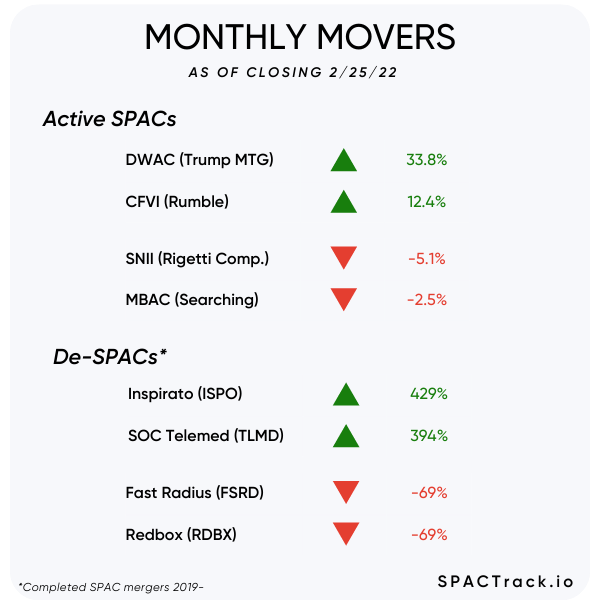

The Stats:

The Deals from the Past Week (2):

1) Delwinds Insurance Acquisition Corp. (DWIN) & FOXO Technologies

Merger Partner Description:

FOXO is a technology company aiming to make longevity science fundamental to life insurance. By applying epigenetic science and AI to commercialize saliva-based biomarkers, FOXO plans to simplify the consumer underwriting journey and enhance the consumer value proposition. FOXO’s platform will modernize the life industry with saliva-based underwriting technology and consumer engagement services. FOXO is the parent company of the FOXO Life Insurance Company.

Valuation: $369M EV

2) Brilliant Acquisition Corp (BRLI) & Nukkleus

Merger Partner Description:

Nukkleus, Inc. (OTC: NUKK) combines its world-class multi-asset technology with digital asset exchange execution and payment services, providing institutional clients with a full-service offering to operate effectively in the modern world. Nukkleus’s portfolio delivers institutional-grade custody and access to traditional and digital asset markets globally, along with a UK FCA registered EMD agent for the handling of professional and accredited client funds to conduct cryptocurrency conversion to and from fiat currencies.

Valuation: $140M pre-money EV

News:

Nasdaq is taking steps to remove SoftBank-backed View (VIEW) from its exchange after the glassmaker failed to meet another deadline to file missing financials (Business Insider)

Trump’s Truth Social tops downloads on Apple App Store, many users waitlisted (CNBC)

SoFi (SOFI) to Buy Banking-Infrastructure Firm Technisys for About $1.1 Billion (WSJ)

Merger Votes/ Completions & More Updates:

Supernova Partners Acquisition Company II, Ltd. (SNII) announces that it expects all closing conditions to be met for its merger with Rigetti Computing and expects the merger to close on March 2

ARYA Sciences Acquisition Corp IV (ARYD) and Amicus Therapeutics, Inc. Mutually Agree to Terminate Business Combination Agreement With Respect to the Acquisition of Amicus’ Gene Therapy Business Due to Market Conditions

FTAC Athena Acquisition (FTAA) and Pico’s business combination agreement was terminated “due to Pico’s failure to deliver financial information as required by the Business Combination Agreement”

Sign up for SPAC Track Pro and get 15% off of the first month or the first year of the annual subscription with the coupon: ‘15PRECAP2022’. View all of the data points available for SPAC Track Pro users here: spactrack.io/pro

If you only wish to subscribe to the premium daily newsletter (sent each morning before market open), you can do so here:

De-SPAC S-1 Activity (including PIPE resale registrations*):

S-1 filings:

Codere Online (CDRO)

*When applicable

S-4 Activity:

S-4 filings:

26 Capital Acquisition Corp. (ADER) & Okada Manila

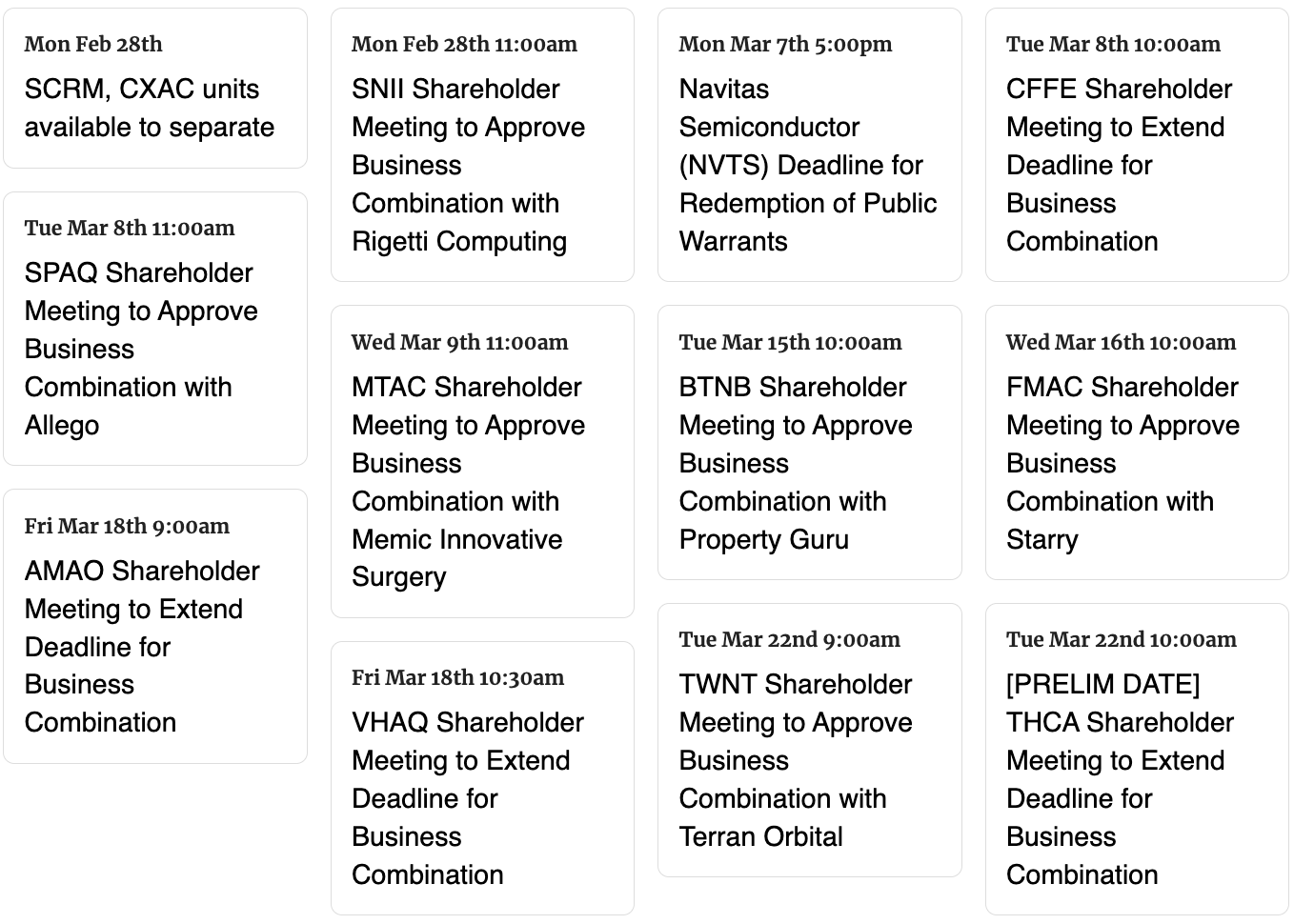

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

Thanks for reading,