Will another SPAC go to waste?

The Nightcap newsletter: SPAC Track’s nightly recap of the action in the SPAC world. (January 6, 2021)

Discover and track all of the SPACs at spactrack.io

If you haven’t subscribed to this Free nightly newsletter, you can do so below.

The Stats:

The Deals:

No deals today.

News:

Dubai Waste Firm Averda Said in Better World SPAC Merger Talks (Bloomberg)

Averda, a provider of waste-disposal services in India, the Middle East and Africa, is in talks to go public through a merger with Better World Acquisition Corp. (BWAC), a blank-check firm, according to people with knowledge of the matter.

The transaction’s size couldn’t immediately be learned. A deal, if reached, could be announced in coming weeks, one of the people said.

Averda representatives didn’t immediately respond to requests for comment outside of Dubai’s business hours. A Better World spokesperson declined to comment.

Dubai-based Averda, led by Chief Executive Officer Malek Sukkar, has more than 60,000 clients in sectors including oil and gas, automotive and hospitality, its website shows. Its services include street cleaning, bin collection and disposal of hazardous and household waste. Averda says its mission is to treat, recover and recycle more than 80% of the waste it processes through sustainable methods.

Trump SPAC Digital World Acquisition Corp. stock rises after social media app sets target launch date (CNBC)

Shares of the company connected to a planned social media app backed by former President Donald Trump rose sharply Thursday after news that the app has set a target launch date of Feb. 21.

Blank-check company Digital World Acquisition Corp.’s (DWAC +19.7%) stock jumped by nearly 20% by the close of the trading day Thursday, on significantly higher-than-average volume. The gains came after the Trump app Truth Social indicated on the Apple app store that it expects to go live next month.

Reuters first reported the target date posting on the app store, where Truth Social is available for pre-order. Feb. 21 is Presidents’ Day, a federal holiday.

Trump’s company is being marketed as an alternative to social media giants Twitter and Facebook, both of which banned him on the grounds of inciting the Jan. 6, 2021, riot at the U.S. Capitol. Thursday was the anniversary of that attack on Congress, which disrupted proceedings confirming the election of President Joe Biden over Trump.

Trump Financier in Last-Ditch Move to Salvage Hydrogen SPAC Deal (Bloomberg)

Patrick Orlando, the financier helping take Donald Trump’s digital venture public, is making a last-ditch effort to stave off the liquidation of one of his other blank-check companies.

Orlando’s Benessere Capital Acquisition Corp. (BENE) is asking investors for permission to extend the SPAC’s one-year lifespan, which is due to expire at the end of this week. A shareholder meeting will be held Friday to vote on Benessere’s request to extend the deadline for completing a deal until July 7, according to a statement.

An extension would give Benessere more time to close the $805 million acquisition of Miami-based hydrogen fuel developer eCombustible Energy LLC, which was announced in November. Investors holding at least 65% of Benessere’s common stock need to vote in favor of the extension. Otherwise, the special-purpose acquisition company will be liquidated and its cash returned to shareholders.

That’s happened to Orlando before. Another blank-check company he ran, Wuhan, China-based Yunhong International Co., dissolved in November after failing to find an acquisition target by its deadline. Yunhong had asked shareholders for another six months to do a deal, but didn’t get enough votes for the extension to be approved.

Highbridge Capital Management LLC, the hedge fund manager owned by JPMorgan Chase & Co., is Benessere’s largest shareholder with 9.2% of its common stock, according to data compiled by Bloomberg. Other major owners include investor Sander Gerber’s Hudson Bay Capital Management LP and former Deutsche Bank AG trader David Puritz’s Shaolin Capital Management LLC.

A virtual meeting of Benessere stockholders will be held at 10 a.m. New York time on Friday to approve the extension, and investors can cast their votes ahead of time online or by phone. The meeting has already been delayed once, giving Benessere more time to drum up support for the extension.

Tilman Fertitta Seeks a $250 Million Payday After Ditching SPAC Deal (Bloomberg)

Fertitta Entertainment is planning to pay out $250 million to its founder and sole owner, thanks to some $5.6 billion the company plans to borrow in bond and loan markets this month when it refinances debt, according to people with knowledge of the transaction. Money managers are eager to lend to companies like Fertitta’s that pay relatively high yields and are posting record profits after people resumed traveling and eating out last year.

The refinancing comes just a month after Fertitta ditched an $8.6 billion plan to sell a stake in his empire to Fast Acquisition Corp. (FST), a blank-check company. In a statement last month, he said, “the right decision for my company was to remain private at this time,” adding, “I look forward to continuing to grow our business.”

On a call with investors this week, he joked that he was looking to avoid the kind of public-company drama displayed in HBO’s series “Succession,” according to one of the people. The show depicts a power struggle between fictional media magnate Logan Roy and his children for control of their conglomerate.

Some debt investors on the call see Fertitta’s comments as signaling that the company’s profits are growing fast enough that the deal may have undervalued the owner of Golden Nugget casinos as well as restaurants such as Del Frisco’s steakhouse and Bubba Gump Shrimp Co. Fertitta grew his empire mainly through acquiring and selling properties at good prices, buying, for example, the Trump Marina Hotel Casino in Atlantic City, New Jersey a decade ago for $38 million.

Over the twelve months through September, Fertitta Entertainment LLC raked in $822 million in a key earnings measure on sales of $3.1 billion, according to documents that were shared with debt investors and seen by Bloomberg News, a record figure. For the full year, adjusted earnings before interest, taxes, depreciation and amortization are expected to top $900 million, a person with knowledge of the company’s performance said.

Merger Votes/ Completions:

Petra Acquisition, Inc. (PAIC) shareholders approved its merger with Revelation Biosciences

Merger Vote Set:

CITIC Capital Acquisition Corp. (CCAC) & Quanergy: 1/31

Quick News:

Model Performance Acquisition Corp. (MPAC) amends its merger agreement with MultiMetaVerse including, among other things, a covenant for the company to procure an additional $10M prior to merger closing

IPOs*:

1) C5 Acquisition Corporation Announces Pricing of $250 Million Initial Public Offering (CXAC-U)

*Priced as of this writing

If you find this newsletter useful, feel free to share it with a friend and suggest they subscribe:

S-4 Activity:

Pro subscriber content

Tracking De-SPAC S-1s (including PIPE resale registrations):

Pro subscriber content

New S-1s:

1) Murphy Canyon Acquisition Corp. (MURF)

2) Signal Hill Acquisition Corp (SGHL)

Upcoming Dates:

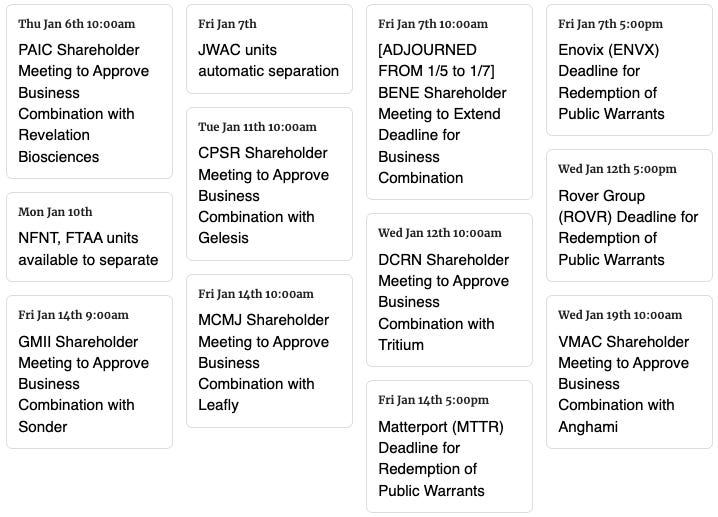

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions, Earnings, and Expected Ticker Changes

See the full calendar here.

The Pro edition of the Nightcap newsletter is sent to SPAC Track Pro subscribers and includes: deal details, S-1 registration details, S-4 merger filing updates, post-closing S-1 updates (incl. PIPE share registrations), and quick links to investor presentations, press releases, and relevant filings.

Sign up for SPAC Track Pro with 10% off of the first month or the first year of the annual subscription with the coupon: ‘10NIGHTCAP2022’.The Pro edition of the Nightcap newsletter is sent to SPAC Track Pro subscribers and includes: deal details, S-1 registration details, S-4 merger filing updates, post-closing S-1 updates (incl. PIPE share registrations), and quick links to investor presentations, press releases, and relevant filings.

Sign up for SPAC Track Pro with 10% off of the first month or the first year of the annual subscription with the coupon: ‘10NIGHTCAP2022’.

Thanks for reading,